The quality of consumer data found within a car retailer's DMS can sometimes be questionable – but there is now a range of ways to guarantee it’s useful.

Thanks to the latest advances in technology, car dealerships and manufacturers can now get a far greater insight into what their customers want than ever before.

Among the biggest disruptors driving this evolution are connectivity and digitalisation, presenting a host of opportunities and risks for OEMS and retailers across the board.

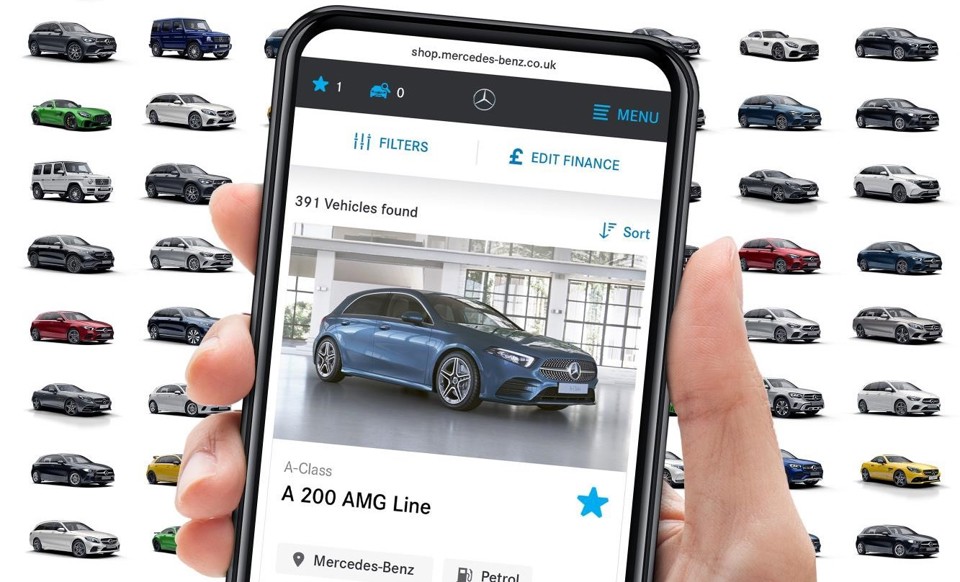

Dealer websites

One of the most useful tools to help a dealer understand their customer better is their own website.

Having a well-designed and highly-functional website enables them to capture a consumer’s personal information and identify what they are looking for.

Martin Dew, Autoweb Design’s digital solutions director, said dealers need to use analytics to determine the factors that make consumers enquire about a vehicle in the first place.

Martin Dew, Autoweb Design’s digital solutions director, said dealers need to use analytics to determine the factors that make consumers enquire about a vehicle in the first place.

The other challenge, he said, was to capture potential leads who have been directed to their website from another source, such as social media.

“Dealers want to understand the journey a consumer took to making a purchase to allow them to optimise their digital marketing activity for future sales,” said Dew. “They also need to capture these ‘unknown audiences’ coming to their website and market to them in an appropriate fashion.”

But Russell Borrie, Arnold Clark’s group franchise director, warned that dealers need to be careful about how they use a consumer’s data, in compliance with the General Data Protection Regulation. To ensure this, he said his company collects only the minimum personal details required, including for part exchange valuations.

Apps and telematics

The fastest growing area of customer engagement is dealer apps and aftermarket telematics to gather data – for example on how a customer uses their car, when their next service is due and if they have had a breakdown or been in a crash. But because of greater awareness of data privacy, many consumers are wary about using them.

Mark Rose, the managing director of Tracker, said his Tracker Connect device can be used by the dealer for a host of applications, foremost tracking mileage.

By being aware of the mileage a customer has done, he said that dealers can alert them if they are likely to exceed the terms of their warranty or personal contract purchase and offer them an alternative, or let them know when a service is due.

“It’s a complex area with considerations around who owns the data, access and sharing,” said Mike Walters, managing consultant at Elevenci. “But ultimately it offers massive opportunities including automatically identifying potential repairs and future servicing needs, routing drivers into preferred networks, sophisticated integration models in the event of breakdown or incidents, and sophisticated retention and renewal interactions.”

Cookies and widgets

The rise of social media, driven primarily by the millennial generation, has also enabled dealers to better understand the likelihood of a consumer buying a vehicle, and then retarget them. By using cookies and widgets such as the Facebook pixel, they can track the consumer’s activity and then promote offers on other platforms they visit through targeted marketing.

Jeremy Evans, Marketing Delivery’s managing director, said the Facebook pixel allows dealers to retarget consumers who have already been to their website but haven’t yet made an enquiry. Once they have been persuaded to do so, he said they then have their details and can contact them directly via email.

Jeremy Evans, Marketing Delivery’s managing director, said the Facebook pixel allows dealers to retarget consumers who have already been to their website but haven’t yet made an enquiry. Once they have been persuaded to do so, he said they then have their details and can contact them directly via email.

“We know the people who have gone onto the website and made an enquiry, but there’s a far bigger audience that have been on there and haven’t,” said Evans.

“The Facebook pixel enables dealers to see where those consumers are on the website and then appropriately remarket to them through Facebook advertising, whether for used or new cars, or servicing.”

Events and pop-ups

But despite declining showroom footfall, perhaps the most overlooked method of customer interaction is face-to-face at events and pop-up stores in shopping centres or supermarkets. Buying a car is still a personal process and the best chance for dealers to learn more about the consumer, particularly those with a limited number of dealerships, such as Tesla.

Mobile technology, such as the Contact Advantage Central Lead app and iPad-based customer relationship management software, also makes it easier for dealers to collect a consumer’s details securely, said Steven Torrance, national sales manager at Reynolds and Reynolds. But he added he was sceptical about the quality of data and leads. despite the relatively low cost.

Julia Saini, associate partner, mobility, at Frost & Sullivan, said that the personal information gathered in this fashion needs to be used as part of an omni-channel approach to build a better consumer profile for the next time they go online or walk into a dealership.

That can include, for example, social media use, asking questions in a forum, browsing car magazines or using an online configurator, she said.

In many ways, however, the manufacturer has greater access to consumer data than the dealer. One such channel is the online configurator, which enables the carmaker to capture the consumer’s personal details to stay in touch and see what options they want.

Online vehicle configurators

Having an online configurator will also improve supply chain efficiency and lead times, according to Torrance.

Another key benefit, he said, is bringing marketing and sales and factory systems closer together.

“Many vehicle manufacturers offer pre-configurations to help less car-savvy customers online, and we increasingly see the use of customer data, gained among others from social media insights, to personalise the online configuration experience,” said Saini.

“Manufacturers can understand customer preferences and habits and adapt model line-ups accordingly, and dealers can avoid the current online-offline anti-climax, where the online customer journey is often lost.”

Connected cars

Connected cars are also set to transform the quality of data by monitoring closely how the customer uses their vehicle. For example, electric vehicles such as Nissan Leaf can track mileage of average journeys, when and how often they are charged, and how frequently they are serviced.

The MercedesMe connect system includes three connectivity services which allow the driver to call for 24-hour roadside assistance in the event of a breakdown, emergency services call-out in case of an accident, and artificial intelligence-based support, for example, for routes and locations. The second feature is mandatory for all cars and vans sold in the EU, and tracks a vehicle’s whereabouts.

The MercedesMe connect system includes three connectivity services which allow the driver to call for 24-hour roadside assistance in the event of a breakdown, emergency services call-out in case of an accident, and artificial intelligence-based support, for example, for routes and locations. The second feature is mandatory for all cars and vans sold in the EU, and tracks a vehicle’s whereabouts.

Lexus has also undertaken a new project which enables customers to see the saving and fuel efficiency of driving a self-charging hybrid Lexus UX.

Each test drive is monitored with telematics showing how much of the journey was completed using only electric driving, which on average is 53%.

“OEMs will want to monitor how batteries are performing as they assess their potential risk under warranty,” said Torrance. “Having your car connected to the OEM for data gathering and from a servicing perspective is hugely appealing.”

OEM lifestyle apps

Another rich source for data collection is owner platforms such as My Volkswagen, which enable car owners to register in order to receive offers, rewards and benefits, such as checking fuel levels and tyre pressures, and locking/unlocking the vehicle with a smartphone, in return for the manufacturer keeping in contact with them. Kia is rolling out its MyKia app, which provides customers with a host of benefits including service bookings, updates, information and advice.

The development of apps linked to the car that can control features such as charging, audio and pre-programming of navigation, has also enabled them to better understand customer behaviour. An example of this is uploading a destination from the app to the vehicle which can then schedule recommended charging locations along the route.

By Alex Wright

Login to comment

Comments

No comments have been made yet.