Dealers could help car owners save at least an extra £100 million in annual charges by paying for repairs using zero-interest monthly payments, according to automotive aftersales finance provider Bumper.

The latest credit card spending data released by trade body UK Finance shows half of all UK credit card balances incurred interest in March, based on 346.3 million transactions worth £19.9 billion.

Bumper’s own research further shows customers using its PayLater funding service have already saved £213m since launching in 2014, with the company forecasting a further £100m will be saved in this way by the end of the year.

“Even though average credit card APRs are riding at historically high levels, some car owners faced with the ongoing challenges of the cost-of-living crisis are racking up debt unnecessarily when it comes to paying for vehicle repairs, services and maintenance,” said James Jackson, CEO and co-founder of Bumper.

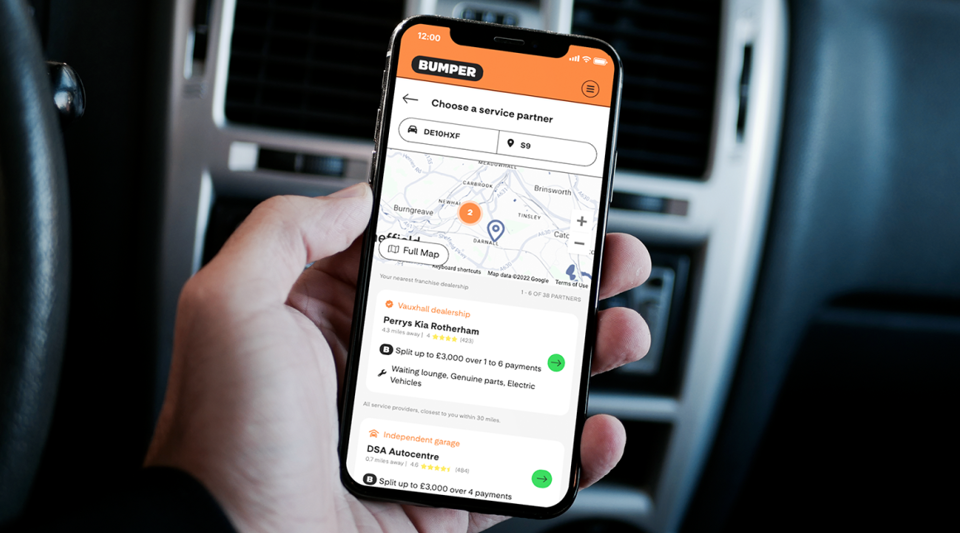

“However, as we sign up new dealer groups and integrate with more DMS platforms, we are seeing an exponential growth in demand for our PayLater service from owners choosing to spread their costs over monthly instalments that do not attract interest.

“We believe by the end of this year our dealer partners will have helped save their customers at least £100m while also boosting the amount of amber and red work carried out in their workshops,” said Jackson.

Across Europe, Bumper has worked with over 5,000 dealerships and garages who have used the service to help over 600,000 drivers pay their servicing and repair bills since 2020.

Login to comment

Comments

No comments have been made yet.