The latest National Franchised Dealers Association (NFDA) Dealer Attitude Survey has delivered a wake-up call for Ford, as the manufacturer hit a record low while Citroën and Peugeot surged up the rankings.

The Winter 2025 edition of the survey, conducted in January and February gathered responses from 2,204 franchised sites across 31 networks - achieving a 61.3% response rate. Designed to gauge the health of dealer-manufacturer relationships, the biannual survey represents a comprehensive barometer of dealer sentiment.

Covering areas such as profit return, EV strategy, used car performance, and apprenticeship support, the survey provides vital insights into the health of dealer-manufacturer partnerships.

- Ford flounders Dealer satisfaction with Ford hits an all-time low

- Stellantis surges Citroën and Peugeot make stunning comebacks

- EV optimism grows Dealers report rising confidence in EV strategy

The latest National Franchised Dealers Association (NFDA) Dealer Attitude Survey has delivered a wake-up call for Ford, as the manufacturer hit a record low while Citroën and Peugeot surged up the rankings.

The Winter 2025 edition of the survey, conducted in January and February gathered responses from 2,204 franchised sites across 31 networks - achieving a 61.3% response rate. Designed to gauge the health of dealer-manufacturer relationships, the biannual survey represents a comprehensive barometer of dealer sentiment.

Covering areas such as profit return, EV strategy, used car performance, and apprenticeship support, the survey provides vital insights into the health of dealer-manufacturer partnerships.

Despite widespread improvements in survey questions - with every metric showing gains on the previous edition - Ford’s poor performance across profitability, EV preparedness, and training initiatives suggests growing discontent within its dealer network.

The brand's continued slide indicates the need for structural issues in its UK operations to be addressed, particularly as electrification and retail strategy grow more central to dealer satisfaction.

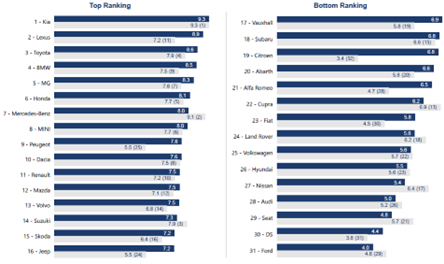

Ford posted the lowest overall manufacturer rating in this edition, scoring just 4.0 out of 10, a further blow for the marque already facing persistent criticism over profitability and electric vehicle (EV) support.

In the “current profit return” category, Ford recorded one of the lowest scores at 3.9, and it also failed to improve in projections for “future profit return,” again scoring 3.9 -significantly below the industry average of 6.5.

When it came to dealer confidence in EV strategy and the impact of the Zero Emission Vehicle (ZEV) Mandate, Ford also underperformed, receiving the lowest score (2.8) for the question on how the ZEV Mandate affects obtaining new vehicles for customers - a fall from 3.4 in the previous edition.

Even on apprenticeship support, Ford finished last with a score of 5.9, trailing peers in an area viewed as critical to the industry’s long-term skills development.

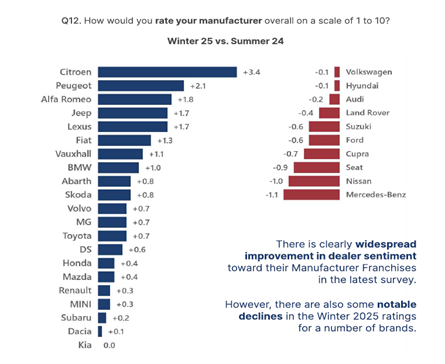

Kia held the top spot for the fifth consecutive year with a score of 8.7, an increase of 0.1 from their score of 8.6 in the previous survey. Mercedes-Benz and Mini rounded off the top three with scores of 8.3 and 7.7 respectively. Interestingly, while Mercedes saw the biggest drop in overall manufacturer, decreasing by -1.1 points, although maintained a high score overall.

In sharp contrast, Citroën and Peugeot emerged as the biggest movers in dealer satisfaction, reversing years of underperformance. Citroën, which held the lowest overall score in the previous edition, registered a 3.4-point increase - the largest improvement in the survey - as it significantly improved its dealer relationships.

Citroën’s current profit return score jumped from 2.4 to 5.2, while its total margin on new vehicles soared 122%, reflecting a renewed focus on dealer profitability. Its EV margin vs. ICE margin saw an extraordinary 211% improvement, suggesting stronger investment and product competitiveness in the electric space.

Peugeot similarly gained 2.1 points overall, cementing Stellantis’ presence as a leader in dealership relations improvements. Stellantis brands - Citroën, Peugeot, Fiat, Alfa Romeo, and Vauxhall - collectively made up the top five most improved manufacturers in this survey.

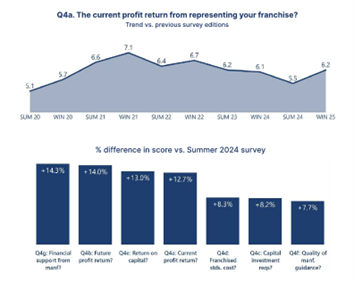

“This edition of the survey shows increases in all areas. Total New Vehicle Margin saw its first increase in rating over recent surveys, potentially signalling an improved optimism across the dealer network," said Sue Robinson, chief executive of the NFDA.

"Future EV/PHEV range also entered into the ‘top 5’ ratings, showing dealer confidence in new EV products beginning to improve. However, both Overall Profit and EV margin, while not decreasing, continued to score low, potentially showing wider concerns for overall Return on Capital ratings.

"There has clearly been significant progress with EVs, but challenges remain. The survey reveals a trend of how EV related questions improved the most, but the relative scoring remains stubbornly low compared to other areas.

"The total margin on new EV and hybrid sales compared with petrol or diesel new car sales saw a large improvement from a 5.2 to a 6.4, and while remaining one of the lowest scoring sections, there is a clear shift to more positivity around EVs.

"With the Government recently announcing changes to the ZEV Mandate, the future of EVs is looking better than ever. Nevertheless, against the backdrop of insecurity, global trade wars and tariffs, while positive, these ZEV Mandate changes are likely not going to be enough to support the industry in this transition.

"NFDA congratulates Kia, who has come top in the survey for what is now 5 editions in a row on the overall manufacturer rating with an impressive score of 9.3, the same score from the last edition.”

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.