The Motor Ombudsman is reporting a significant rise in new car disputes for 2024, revealing an 18% increase in complaints compared to the previous year.

The Motor Ombudsman operates under two primary codes: the New Car Code, which focuses on manufacturers’ warranties ranging from three years to over seven and the Vehicle Sales Code, which addresses complaints related to both new and used vehicle sales from dealerships and garages.

In a recent webinar, chief ombudsman Bill Fennell noted that while new car complaints are rising, the bulk of disputes still stem from used vehicle sales.

Even so, last year, The Motor Ombudsman recorded approximately 3,400 new car disputes, a number that has now surged to around 4,000 so far in 2024.

Even so, last year, The Motor Ombudsman recorded approximately 3,400 new car disputes, a number that has now surged to around 4,000 so far in 2024.

“We saw an increase around 40% in the volume of cases coming into us in 2023, and we’ve seen a similar increase this year,” Fennell reported, noting that a significant factor contributing to the rise in complaints is consumers’ growing awareness of their rights.

Key drivers behind this trend include ongoing concerns over the cost of living driving consumers to seek resolution more aggressively. “Consumers are more inclined to pursue full refunds or vehicle rejections than they were pre-pandemic. This shift highlights a significant change in expectations following recent market challenges,” he added.

Fennell also noted the increasing amount of information consumers are giving to support their claims, saying, “it’s not unusual for us to have a case file from a consumer which can be more than 100 pages.”

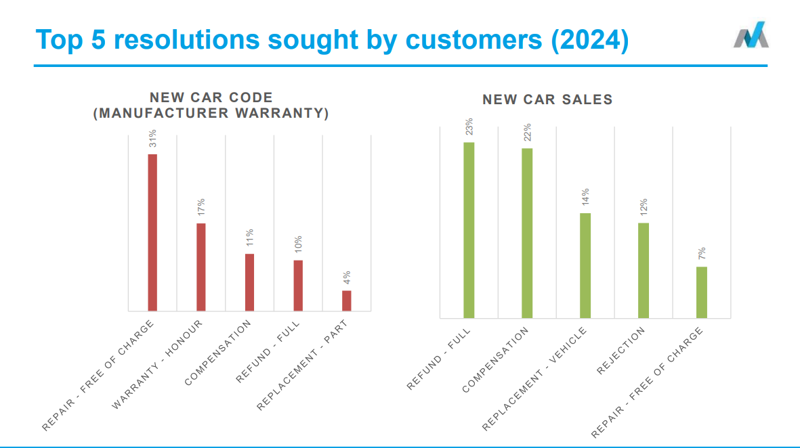

Delving into the specifics, Fennell pointed out that 70% of new car disputes under the New Car Code are tied to manufacturers' warranties, often concerning paint quality, leather issues, or electronic malfunctions.

Complaints regarding how manufacturers handle these issues account for 14%, while advertising discrepancies - especially concerning electric vehicles - constitute 11%.

“A lot of that will be related, certainly on the electric vehicles, about range. When we get into the colder months, we see a lot of complaints coming about the advertised mileage versus actual performance,” he noted.

Regarding the Vehicle Sales Code, common complaints include vehicle quality at the time of purchase, aftersales support, and the transparency of the sales process.

Fennell noted: “Most dealers and garages now have a documented sales process, and the key to making this go smoothly is getting the consumer to sign what you have taken them through.”

“A lot of the cases we get are hearsay, so the consumer is alleging one thing, the dealer is alleging another, and there is no evidence to support either side.”

When it comes to what consumers are seeking, 31% want the repair free of charge, while only 10% request full refunds.

Fennell said the total financial expectation of consumers approaching The Motor Ombudsman this year stands at approximately £15 million.

“Consumers will always go for what they think is fair and reasonable, but it tends to be on the high side,” he said, highlighting the discrepancy between consumer expectations and actual outcomes.

Despite these high expectations, Fennell cautioned that the average compensation awarded is about 20% of what consumers are initially seeking.

“We don’t pay compensation; what we’re looking to do is put the consumer back in the position as if the incident hadn’t happened,” he said, explaining the ombudsman's role in resolving disputes.

Login to comment

Comments

No comments have been made yet.