Dealer attitudes suggest a level of uncertainty about a 2022 car retail market increasingly defined by vehicle availability, the transition to electric vehicles (EV) and moves from manufacturers towards an agency franchise model.

Respondents to AM’s 2022 Outlook survey indicate that many retailers remain pragmatic about their fortunes in the year ahead, with many expecting to hold station after a year that under-delivered in volume terms, but saw the vast majority enjoying record profitability.

Among the results, more than 52% of business leaders surveyed said they expected profitability to be the same or better than in 2021, while 31.9% planned to increase headcount to grow their business, despite the staffing headaches explored on these pages last month.

Among the results, more than 52% of business leaders surveyed said they expected profitability to be the same or better than in 2021, while 31.9% planned to increase headcount to grow their business, despite the staffing headaches explored on these pages last month.

The relationship between decreased volumes and stronger margins is laid bare in responses to suggestions that new car supply will negatively impact profits in 2022.

More than a third (38.3%) either disagreed or strongly disagreed, suggesting that many are not too downbeat about a continuation of the new car supply shortages.

A lesser proportion (31.9%) disagreed or strongly disagreed with a suggestion that used vehicle supply would negatively affect profitability, with 42.6% suggesting it would.

There is clearly a desire to gain a larger share of a used car sector offering peak profitability after value increases averaging close to 30% year-to-date.

MARGIN IN CONSTRAINED MARKET

Cap HPI head of valuations Derren Martin, Cox Automotive insight and strategy director Phillip Nothard, and Auto Trader commercial director Ian Plummer said there is little prospect of any sizeable influx of new cars or used car stock any time soon.

As a result, should retailers fear a “seismic” slump in used car values in 2022?

Martin said November’s end to eight months of rising wholesale values – with a decline of 1.2% at the three-year, 60k miles mark – was seasonal and that it was “highly unlikely” that next year would bring any significant decline in values.

Ongoing new car supply woes, resulting from shortages of semiconductors and other materials, are likely to continue the limited flow of cars into the UK until at least the second half of next year, he said.

“The first quarter of 2022 will be quite strong and in January and February you might see movements up,” said Martin.

“The first quarter of 2022 will be quite strong and in January and February you might see movements up,” said Martin.

“I think it will stay strong until at least the summer when we might see some easing of the semiconductor issues.”

Martin said his “biggest concern” was the end of next year, when supplies may come back on-line more widely and urged the sector to employ “cautious remarketing” to avoid a used car price drop if volumes do escalate quickly.

But he added: “The reality is that there have been 1.7 million registrations lost from the market. There will be vehicle shortages for quite a while to come and that will keep prices strong. When values do come down they are not going to come down by 30%. I don’t think there’s going to be a crash at any time. A loss of 30% would be like nothing we’ve ever soon before. It would be seismic.”

Nothard stated there would be “no tsunami of product” in 2022.

He said: “I think retailers will need to keep a keen eye on valuations in order to maximise their margin, but the outlook for the year is likely to be one of increased stability with a few gentle peaks and troughs.”

He said: “I think retailers will need to keep a keen eye on valuations in order to maximise their margin, but the outlook for the year is likely to be one of increased stability with a few gentle peaks and troughs.”

Plummer is relatively upbeat about 2022. He’s optimistic that the consumer confidence seen in recent months is set to continue, helping to maintain the kind of margins that will make up for any lost volume.

The average price of a used car advertised on Auto Trader has now increased by more than £3,400 – to £17,366 – since May, and it is forecasting a used car market of 7.75m to 7.9m in 2022.

Plummer said that will make for a good year for retailers.

Plummer said that will make for a good year for retailers.

“What we are seeing is very strong levels of consumer demand, with a 30% year-on-year increase in leads,” he said.

“We don’t believe the performance in the market is the result of a bubble. That would suggest there are trends that are unsustainable. That’s not the case here. There is no bubble to burst. The high values and high demand will continue into 2022.”

CONSUMER DEMAND

Respondents to AM’s Outlook 2022 survey were inclined to agree with Plummer, with 40.4% disagreeing or strongly disagreeing that a lack of consumer demand would negatively impact profitability next year.

While 29.8% were uncertain, 29.8% agreed or strongly agreed that it would, their reasoning perhaps influenced by customer reactions to ever longer lead times as vehicle supplies continue to be constrained.

Close to a third (36.2%) of the responding retailers expect new car orders to remain unchanged, with the next largest group (23.4%) expecting orders to increase a little.

Steve Young, managing director of ICDP, believes that stymied vehicle supplies will test customers’ patience to the degree that brand loyalty goes out of the window in 2022, paving the way for some OEMs to make market share gains.

Young said: “The (2022 vehicle supply) recovery will be unequal, and some brands will be able to gain share at the expense of others who are still constrained as some customers lose patience with the long lead times being quoted.

Young said: “The (2022 vehicle supply) recovery will be unequal, and some brands will be able to gain share at the expense of others who are still constrained as some customers lose patience with the long lead times being quoted.

“Why wait over a year for a car that you may only be planning to keep for three years anyway?”

Uncertainty surrounds the potential impact of COVID-19 on 2022 trading. With the survey’s timing coinciding with the emergence of the Omicron variant in the UK, just more than 34% said they did know whether the virus would impact their businesses.*

Less than a third (31.92%) felt it would not have a negative impact, while just more than 34% feared it would.

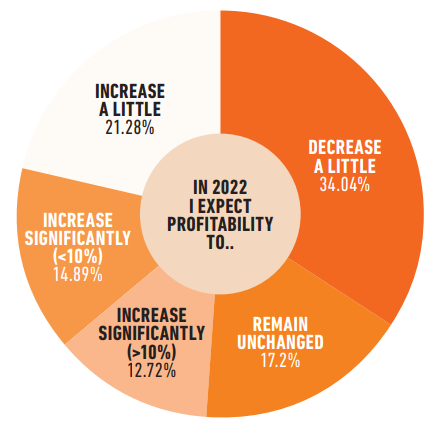

Taking all factors into account, 12.7% of responding business leaders said they expected a significant increase in profitability after the “tailwinds” that propelled many to record performance in 2021, with 21.3% expecting a “little” increase.

But 34% expect a “little” decrease in profitability, while 14.9% expected a significant decrease.

Neil Addley, founder and managing director of AM’s research partner JudgeService, suggested many of the survey answers could be dictated as much by attitude as hard evidence.

Neil Addley, founder and managing director of AM’s research partner JudgeService, suggested many of the survey answers could be dictated as much by attitude as hard evidence.

“The results reflect anecdotal evidence from the marketplace – some see a land of opportunity, others worry more about supply issues,” he said.

“I suspect it’s as much about attitude as anything. It is good to see that the electric dream is accompanied by a commitment to using technology and an, albeit modest, increase in employment.”

DIGITAL OFFERING

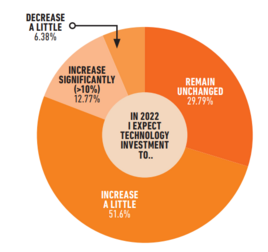

Despite a ramp-up in retailers’ online engagement, prompted by COVID-19 trading restrictions in 2020 and early 2021, technology will continue to attract investment from 63.8% of respondents to the survey.

AM found 68% of businesses now offer an end-to-end online car retail solution, 80.9% use live video to sell cars and 78.7% provide home delivery.

Young said 2022’s likelihood of delivering increased consolidation in the OEM and franchised retail space – along with the potential for the further formulation of agency model retail contracts after clarification of new Block Exemption Regulations in May – will increase the need for smaller retailers to increase their digital capabilities.

Young said 2022’s likelihood of delivering increased consolidation in the OEM and franchised retail space – along with the potential for the further formulation of agency model retail contracts after clarification of new Block Exemption Regulations in May – will increase the need for smaller retailers to increase their digital capabilities.

He said: “Smaller players may well be able to offer a more personal touch, but more and more interaction is in the digital space, or is dependent on tools that are more accessible at large scale. So, even the smaller players need to find ways to gain ‘virtual scale’ through collaboration or bought-in services.”

Young added: “We still see the physical dealership or used car outlet remaining a core part of the business.

“However, all players will need to develop and enhance their digital offer on a continuous basis – this is not a job you can just put a tick in the box for and leave for a few years.”

*Note: AM's Outlook 2022 survey pre-dated the Government introduction of Plan B.

Login to comment

Comments

No comments have been made yet.