Global car manufacturers could well start to abandon the UK to focus on other more lucrative markets in response to highly challenging net zero targets, according to Cox Automotive.

That echoes the warning last week from Stellantis chief Carlos Tavares that the UK’s zero emission vehicle (ZEV) mandate could force carmakers such as itself to scale back their presence in Britain and even force them to cease offering some models in an effort to protect margins.

Although Cox Automotive’s latest Insight Quarterly paints a cautiously optimistic picture, the healthy start to 2024 is tempered by several caveats caused by uncertainty over what impact legislation to phase out ICE technology will have on the sector allied to future policy decisions issued by a new Government in office.

While still too early to call in terms of its ultimate impact this year, the launch in January of the ZEV mandate – the UK regulation requiring manufacturers to sell an increasing percentage of zero emission vehicles each year until an eventual ban in 2035 – will play a critical role in industrial fortunes.

Fewer first-quarter private registrations - at 40.4%, they are 8% lower than the figure year-on-year – is, Nothard said, ‘a bitter pill to swallow’ for OEMs and dealers as cars bought by private buyers generate healthier margins.

Consumer doubts about the transition to electric focussed on affordability and infrastructure are playing their part in lacklustre EV uptake, leaving the sector heavily reliant on fleet purchasing to drive a recovery of sales volumes.

Philip Nothard, insight director at Cox Automotive, said costly ZEV ‘allowances’ may be one way manufacturers can soften the impact of the mandate or they may simply reduce volume in the UK market in an effort to hit the 22% figure.

“With the UK’s ICE ban deadline U-turn, a palpable lack of help for the sector in the most recent budget, such as the government addressing the VAT discrepancy between domestic and public charging, it may well be that an unintended consequence of the ZEV mandate could be a drop in the supply of new vehicles.

“Manufacturers looking at the UK market may change tack and opt to put their cars into less stringent markets in other parts of the world. It’s still early days, but clarity on how the sector will react in the inaugural year of the mandate has yet to materialise.”

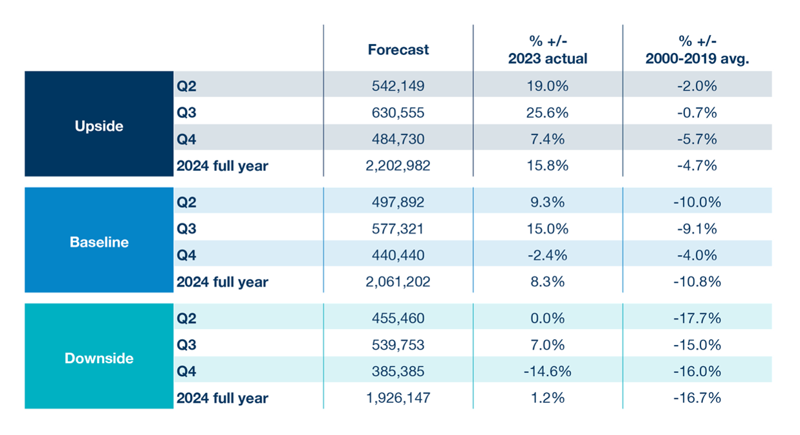

Still, new car registrations, are up 10.4% year-on-year in Q1 boding well for a return to pre-pandemic normality and encouraging Cox Automotive to peg registrations at over two million cars, with the most positive forecast extending that to beyond 2.2 million.

“That rethink is contingent upon a more robust performance in the second half of the year buoyed by signs of economic stabilisation alongside the imperative for manufacturers to gain market share while meeting ZEV mandate obligations,“ said Nothard, who warned that the Q1 performance this year still lags behind the pre-pandemic average.

Login to comment

Comments

No comments have been made yet.