Despite severe political and economic headwinds, the UK car market will still have more than 10m sales during 2019, according to Philip Nothard, the customer insight and strategy director at Cox Automotive UK.

Cox predicts that annual transactions will be running at around 2.3m new registrations, of which roughly 7.9m are used car sales, writes Ian Halstead.

“The types of vehicles bought during the year may have changed, as might the ways in they were bought, but we still think that a final total of 10m touch-points for revenue is positive, given the conditions,” said Nothard.

His comments came at the latest Automotive Insight event featuring data and analysis from Cox Auto and Grant Thornton.

Owen Edwards, an associate director at the Grant Thornton London office, identified multiple strategic challenges for the automotive sector; from the OEMs through factory channels and the dealership network to the supply chains, Tier One providers and consumers.

He stressed that although the underlying UK market remained weak, it was important to take an international perspective, because sales were also continuing to decline significantly across Europe, the US and China.

“Autonomous vehicles are clearly one of the biggest structural challenges, for manufacturers, dealerships and everyone in the supply chains, because although they may still be some way off, they represent such a fundamental redesign of existing technology that new business models will be required,” said Edwards.

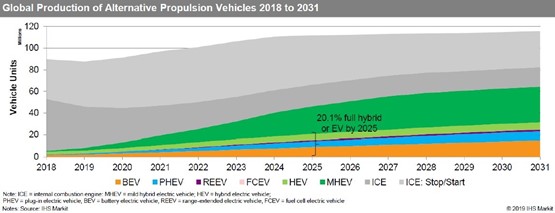

“Electric vehicles will also obviously have a future impact on how vehicles are made and serviced, because fewer parts mean that less labour is required at the manufacturing level. As just one instance, we calculate that the current need for castings will fall by 90% for electric vehicles.

“At the dealership level, we're also starting to see fewer parts used in the servicing of vehicles, and also a lot less labour. However, we mustn't forget that we still have 35m vehicles on the road in the UK, and 38 million if we include buses, trucks and lorries.

“Obviously, as with autonomous vehicles, the shift to electric can't happen overnight, but OEMs, suppliers and dealers should start thinking well in advance about their potential impact.

“As with the shift from ownership to usership, what is often called 'mobility as a service'. Yes, it's going to happen, and yes, it will have a major impact on the industry, but we certainly don't believe it will be here as a significant force in the short to medium-term.”

The Grant Thornton research also highlighted out the critical importance of considering cost reduction measures, alongside major investment decisions.

“As markets continue to weaken, cost reductions will impact all elements of the industry. Dealers will be looking to develop omni-channel sales platforms just as OEMs are trying to cut their own costs,” said Edwards.

“At the same time, manufacturers have to invest very significant amounts, not least in the development and adoption of new technology, and also they have to factor in climate change issues, so these are serious strategic challenges.

“Taken overall, it's right to say that the industry is going through a period of disruption, but we remain optimistic because it's certainly not the first time that OEMs, suppliers and dealers have faced the need to adapt their current ways of working and adopt innovative ones.”

Cox's Nothard then analysed the relationship between declining consumer confidence and the falls in new car registrations, and concluded that the two often moved in tandem, although they inevitably moved out of synch when new plate models were available.

He also suggested that the new corporate emission regulations which come into force in January 2020 were having - and would continue to have - a major impact on forecourt sales.

“Manufacturers have been holding back sales of their low-emission vehicles until the New Year, and really pushing their high-emission models now. In September, 40% of vehicles were registered in the last few days, and we expect that trend to continue.

“Incentives will be readily available for high-emission vehicles in the weeks until the year-end, as manufacturers pressure their dealers.”

Intriguingly, Nothard believes that although demand for used vehicles is running around the level which Cox forecast for 2019, that the headline figure is deceptive.

“Yes, stock is being moved, and looking at our data and the latest SMMT statistics, something around 8m remains very likely, but for me, these sales are not profitable. There is demand, but not from consumers, it's more about the way the businesses are being run.”

Nothard also identified consolidation of dealership networks as a major and ongoing challenge, driven by changes in regulations, technology and consumer preferences.

“Our latest 'State of the Market' survey shows that the looming impact of these influences is very widely understood. We saw 71% of dealers predict customers will move towards 'usage' rather than ownership, and 92% thought that servicing and after-sales would become more important to their profitability than currently.

”Dealer consolidation, market disruption and increased opportunities for online transactions would be my stand-out issues from our data and industry analysis.”

Login to comment

Comments

No comments have been made yet.