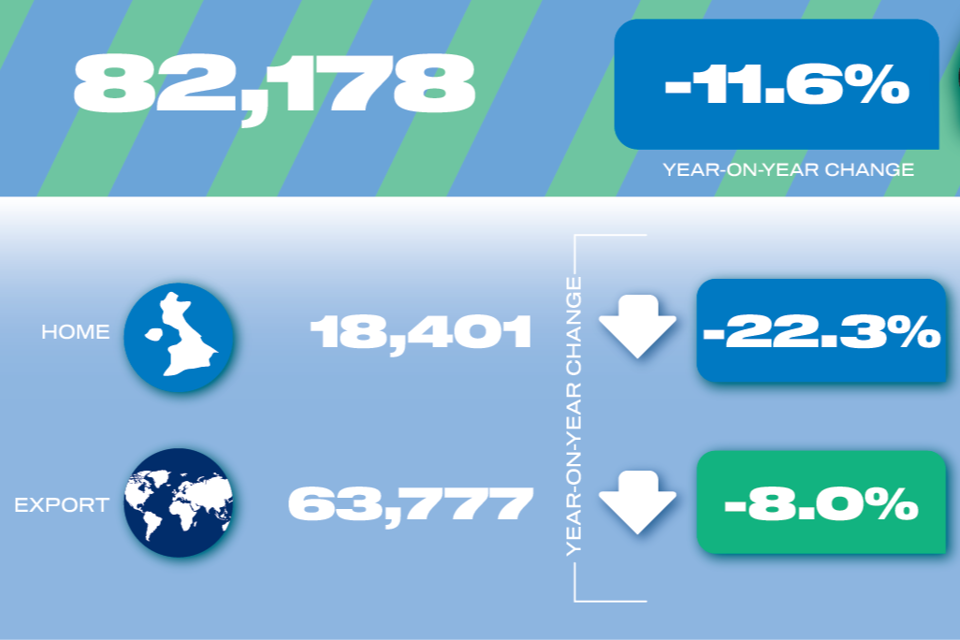

UK car and commercial vehicle production saw a significant decline of 11.6% in February 2025, with total output falling to 82,178 units, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The drop, amounting to 10,787 fewer vehicles produced compared to February 2024, is attributed to a combination of soft market demand, model transitions, and plant restructuring.

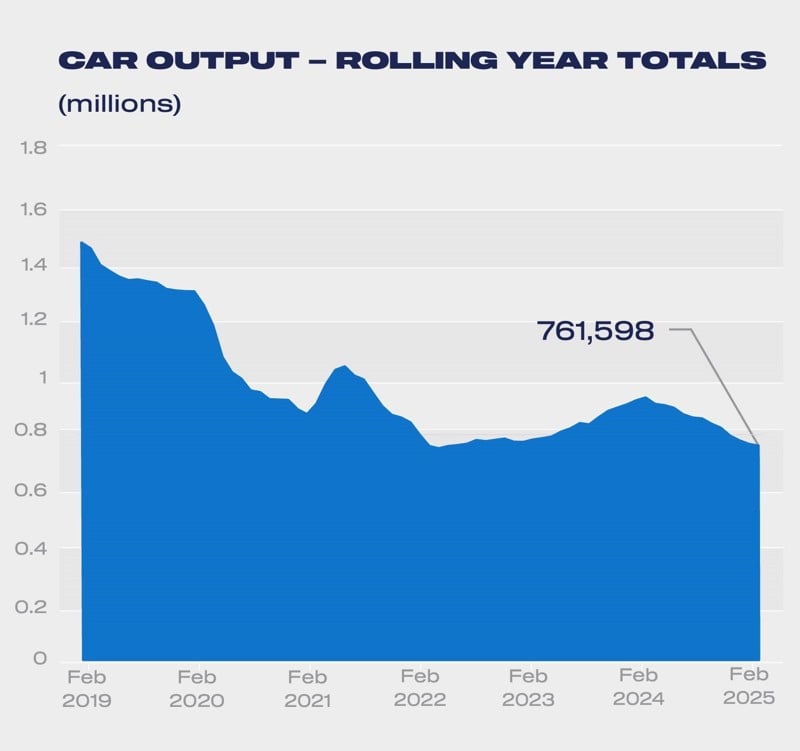

This marks the twelfth consecutive month of declining car production. The export market remained dominant, with more than 80% of output shipped abroad. While exports to the EU and China fell by 9.6% and 10.9%, shipments to the US saw a notable rise of 34.6%. Turkey and Japan also showed strong growth, with exports increasing by 75.5% and 119.2% respectively.

UK production of battery electric, plug-in hybrid, and hybrid cars dropped by 5.6% to 27,398 units. However, their market share increased to 37.1%, up from 36.3% in February 2024. Year-to-date, electrified cars accounted for 39.6% of total production.

Meanwhile, commercial vehicle production fell sharply by 35.9% to 8,364 units, largely due to reduced van production. This decline follows an exceptionally strong February 2024, which recorded the highest output since 2008. Domestic demand accounted for 55.2% of commercial vehicle output, rising by over 50% to 4,621 units, while exports plummeted by 62.7% to 3,743 units, with 93.8% of those vehicles destined for the EU.

The SMMT said the ongoing decline in production underscores the urgent need for government measures to enhance industrial competitiveness and stimulate consumer demand.

It noted that the Spring Statement, announced by the Chancellor, failed to offer support for the automotive sector, exacerbating industry concerns and urged the government to fast-track its industrial and trade strategies and immediately roll out the £2 billion Automotive Transformation Fund.

Key recommendations include scrapping the VED Expensive Car Supplement for EVs, reducing VAT on public charging and new battery electric vehicle sales, extending the Plug-in Grant for lorries, and implementing mandatory targets for charging infrastructure rollout. These steps would reinforce the automotive sector’s investment in new models, manufacturing facilities, and price reductions, encouraging businesses and consumers to transition to electric mobility.

SMMT chief executive Mike Hawes expressed deep concern over the current trajectory of UK manufacturing, stating that these are worrying times for UK vehicle makers, with car production falling for 12 months straight, escalating trade tensions, and weak demand.

“It was disappointing, therefore, to hear a Spring Statement that did nothing to alleviate the pressure on manufacturers and, moreover, confirms the introduction next month of additional fiscal measures which will actually dissuade consumers from investing. Without substantive regulatory easements our manufacturing viability remains at risk and the UK’s transition to zero emission mobility under threat.”

Login to comment

Comments

No comments have been made yet.