Chinese-built cars have failed to maintain momentum in the European new car market this February, accounting for just 2.7% of all the cars registered in the continent.

It marks a modest decline from the 2.9% market share achieved by Chinese models in February 2022.

Felipe Munoz, global analyst at Jato Dynamics said: “The entrance of Chinese vehicles into Europe is not taking place as quickly as many expected. There is clearly more work to be done on the models, production and marketing plans before these brands can successfully expand into the region.”

Europe’s established car manufacturers could face an electric vehicle (EV) “price war” ahead of an influx of new Chinese brands in 2023 and beyond, however, Grant Thornton warns.

The accounting and consulting organisation’s head of downstream automotive, Owen Edwards, said that Chinese carmakers were already waging war on their rivals in a trend that was set to accelerate as they increasingly targeted Europe as a region ripe for expansion.

Cox Automotive recently highlighted that BYD – launching in the UK this year – was the strongest-performing Chinese OEM in 2022, with EV and hybrid sales up 132% at 1.62m units.

BYD is now the world’s third-largest automotive company by value after Tesla and Toyota.

Overall, new car registrations were 12% up in Europe last month - more than 900,000 were sold.

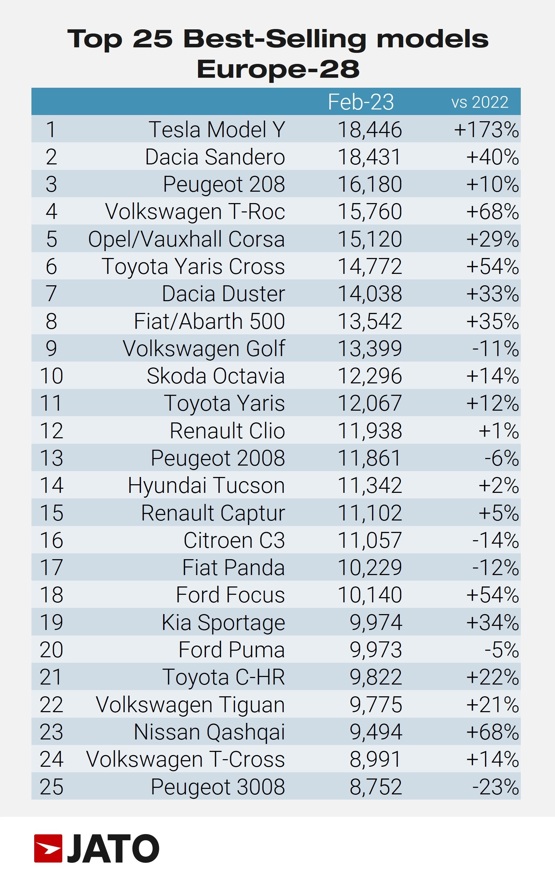

The best performing model was the Tesla Model Y, which achieved 18,446 registrations. It was followed by the Dacia Sandero and Peugeot 208.

Increasing demand for pure electric cars aided the overall positive results in February 2023. According to Jato data, 118,329 pure electric cars were registered last month – an increase of 33% from February 2022.

The accelerated adoption of electric vehicles (EVs) across Europe comes as a result of competitive deals and offers in the market, alongside declining consumer concern about battery range and charging anxiety. EV market share grew across 25 markets, including the UK which saw double-digit growth.

Registrations from January and February combined amounted to 1.81 million units - 11% higher than January and February last year.

Munoz added: “While big structural problems persist, results from 2023 so far indicate that consumers are responding positively to more competitive offers in the market. However, rising interest rates - due to hit the market in coming months – may make consumer access to loans more difficult, potentially impacting purchasing decisions.”

The UK’s new car market experienced a 26.2% year-on-year rise in registrations to register a seventh consecutive month of growth, The Society of Motor Manufacturers and Traders (SMMT) has reported.

Login to comment

Comments

No comments have been made yet.