Dealer Auction’s latest EV Performance Review reveals a thriving trade market for alternatively fuelled vehicles (AFVs), which in October were younger, lower mileage, and more profitable than in previous months.

The trade-to-trade platform saw a 10% increase in bids on electric and hybrid vehicles, with an average sale price rising to £15,706 - a 9.5% increase from September, underscoring the ongoing demand for electrified vehicles, especially as consumers show increasing interest in newer, lightly used models.

The average age of traded EVs and hybrids dropped to 3.5 years in October from 4.1 years in September, reflecting a trend toward younger vehicles moving quickly through the market. Average mileage also saw a marked decrease, down 15% to 32,456 miles.

Dealer Auction’s marketplace director Kieran TeeBoon noted that this trend suggests consumers might be more inclined to trade in lower-mileage EVs, which could further drive interest among hesitant buyers considering the switch to electric.

“Interest in EVs and hybrids on our platform continues to grow,” TeeBoon said. “Knowing there’s an active resale market may encourage owners to trade in sooner, and with fewer years and miles, it could motivate more drivers to make the jump to electric or hybrid.”

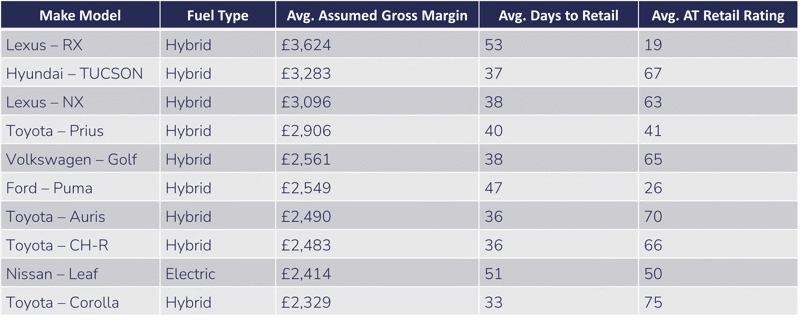

Hybrid models dominate the market, comprising all spots in the top 10 for volume sold, gross margin, and CAP performance. Toyota maintained its strong market position with six models in the top 10 by volume and three in the top 10 by gross margin.

The Mitsubishi Outlander stood out as the fastest seller, with an average turnover of 27 days. Other popular models included the Kia Niro, Toyota RAV4, and Hyundai Tucson, each selling within 30 to 32 days.

The Lexus RX achieved the highest average gross margin in October at £3,944, followed by the Lexus NX and Toyota RAV4. Renault’s fully electric Zoe was the only EV in the top 10 by CAP performance, with a score of 124.7%, while the Nissan Leaf, a consistent performer this year, dropped out of the top 10.

“October’s numbers are very positive,” TeeBoon concluded, “especially ahead of a traditionally challenging quarter. It’s interesting to see brands position themselves as the used market and consumer preferences continue to shift towards sustainable options.”

Login to comment

Comments

No comments have been made yet.