Car manufacturers supported the UK’s electric vehicle (EV) market with £2.4 billion of tactical incentives last year, up by almost 150% year-on-year.

The latest data from ASI, a data consultancy that has tracked and analysed national promotions and tactical activity, has revealed these trends as part of its annual review report for 2024.

The £2.4bn spent on supporting the EV market almost matched the amount spent on the new petrol car market, which reached £2.6bn last year.

There was also a year-on-year increase in petrol incentive support, but the jump was nearly 50%, compared to the much larger spike for EV, as would be expected as brands look to boost retail demand.

ASI’s data shows that average support per vehicle increased from £3,200 per EV to £6,860 in 2024, which is by far the highest level since the company tracked this data back in 2016.

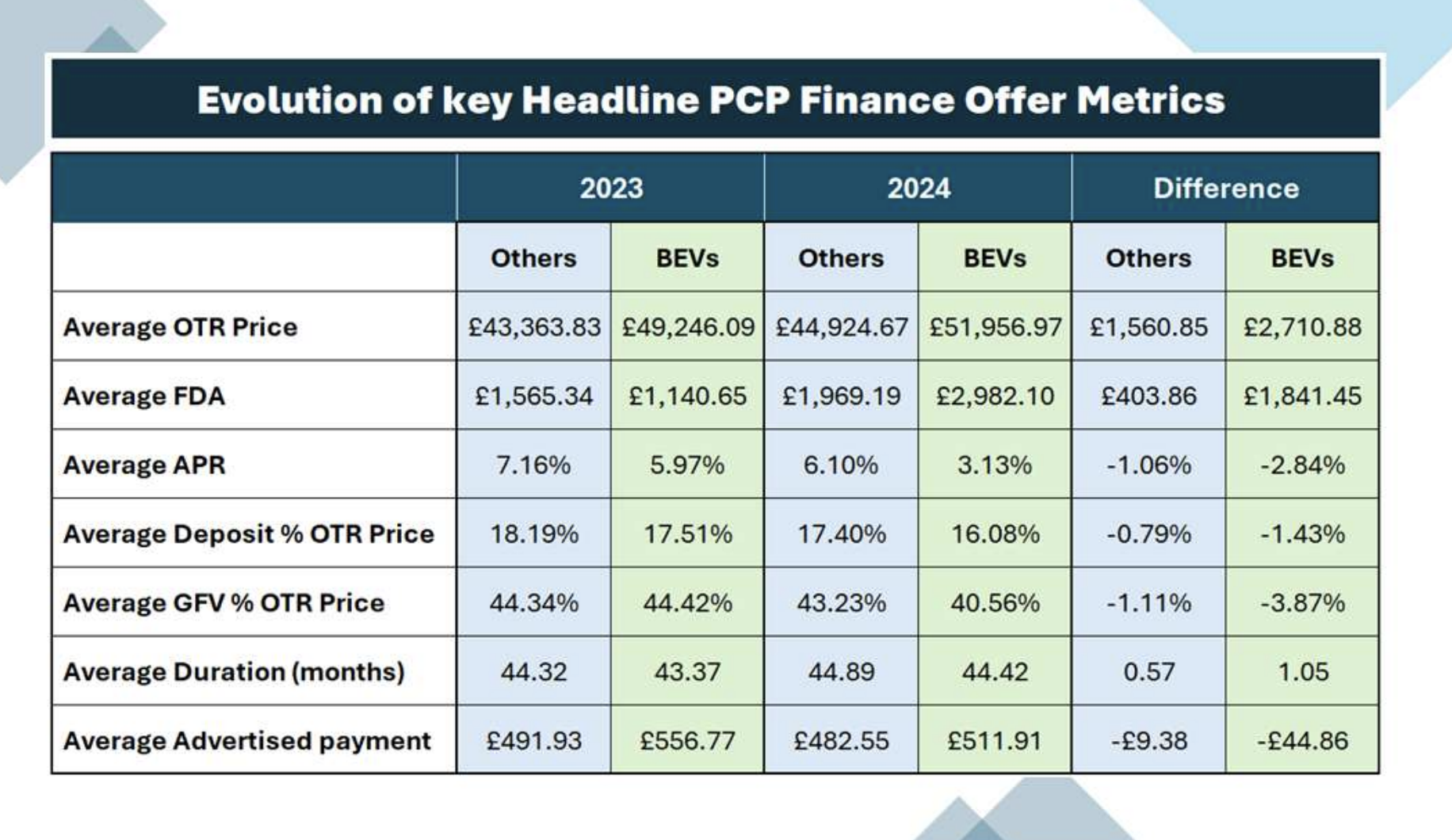

Headline PCP monthly payments for EVs hit a high of £595 in Q1 2023, but have been dropping fairly regularly down to an average of £512 as of Q4 last year.

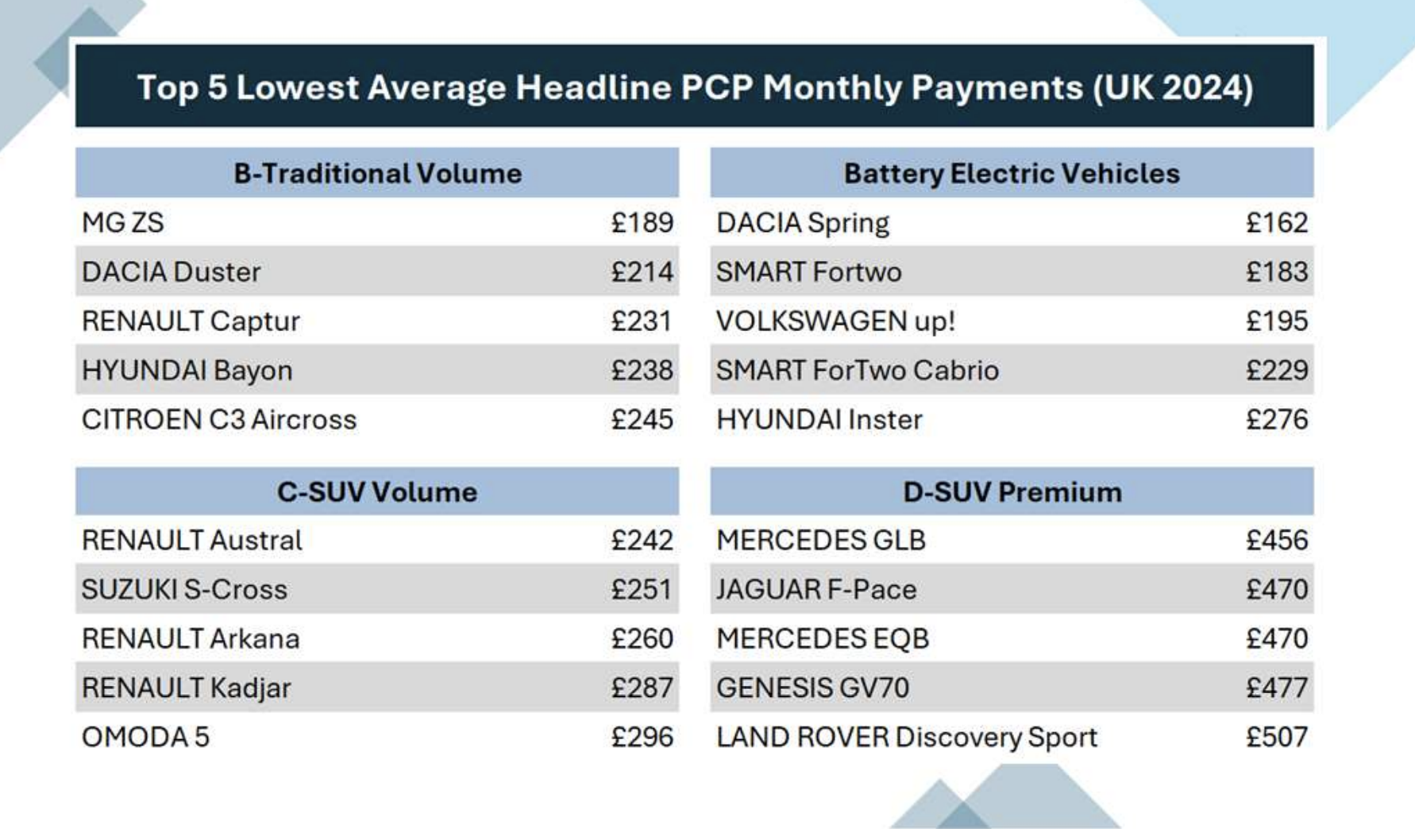

MG, Dacia and Renault topped the lowest average headline PCP monthly payment figures, while Mercedes offered the lowest monthly price for its GLB in the premium D-segment SUV sector.

Dacia topped the most affordable EV list on a monthly basis with its Spring at an average of £162.

Stewart Walker, ASI associate director, said: “In 2024, the UK new car market encountered significant challenges and shifts, driven by high car prices due to inflation, ongoing supply chain disruptions, and rising electric vehicle (EV) production costs.

“The introduction of the Zero Emission Vehicle (ZEV) mandate, requiring 22% of car sales to be EVs, added pressure on brands.

“With limited Government support for retail sales, manufacturers had to rely heavily on tactical incentives to encourage customers to transition from internal combustion engine (ICE) vehicles.”

Walker said Tesla’s bold price cuts in 2023 triggered a domino effect, leading other manufacturers to follow suit.

This resulted in downward revisions of residual values and, consequently, lower guaranteed future values (GFVs).

Walker said: “Amid these changes, high interest rates made it unexpected but notable to see an increase in zero percent finance offers, particularly for EVs.

“As the ZEV mandate is set to increase to 28% in 2025, strategic planning to stay competitive is crucial.”

Login to comment

Comments

No comments have been made yet.