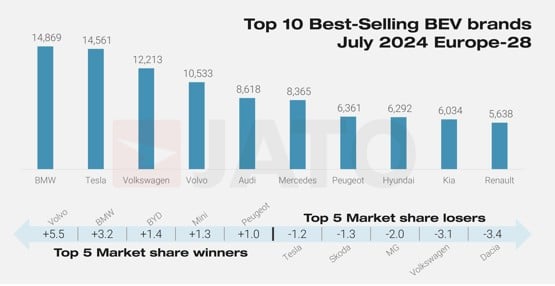

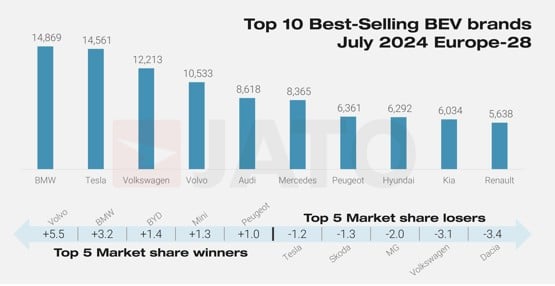

BMW led the battery electric vehicle (BEV) market for the first time in July, overtaking Tesla as overall EV registrations slowed.

According to JATO Dynamics’ data, BEV registrations fell by 6% compared to July 2023, with their market share dropping from 14.6% to 13.5%. This decline is attributed to uncertainties surrounding EV incentives and concerns about the residual value of electric vehicles.

BMW led the battery electric vehicle (BEV) market for the first time in July, overtaking Tesla as overall EV registrations slowed.

According to JATO Dynamics’ data, BEV registrations fell by 6% compared to July 2023, with their market share dropping from 14.6% to 13.5%. This decline is attributed to uncertainties surrounding EV incentives and concerns about the residual value of electric vehicles.

Despite the overall market slowdown, BMW saw a 35% year-on-year increase in BEV registrations, driven by the strong performance of models like the iX1, i4, and i5. Tesla, on the other hand, experienced a 16% decline in registrations, with the Model Y - formerly Europe’s best-selling vehicle - falling to ninth place in the overall rankings.

Meanwhile, the European car market as a whole saw a modest 2% increase in demand, with 1.03 million units registered in July 2024. Growth was particularly notable in Poland, Portugal, and Slovakia, while registrations decreased in key markets like Germany and France.

SUVs continue to dominate the European market, achieving a record 54% market share in July. A total of 554,000 new SUVs were registered, a 6% increase from July 2023.

Volkswagen Group led the SUV segment, accounting for 26% of all SUV registrations, followed by Hyundai-Kia and Stellantis. Compact SUVs (C-SUVs) saw the highest demand, while midsize SUVs (D-SUVs) experienced a 7% decline.

Among individual models, the Dacia Sandero was the top-selling vehicle in July, with 22,400 units registered - a 34% increase. Other strong performers included the Volkswagen T-Roc, BMW X1, and Peugeot 3008, while the Tesla Model Y, Ford Puma, and Fiat Panda were among those that saw declines.

The month also saw the rise of the Volvo EX30 as Europe’s second-most popular EV, registering nearly 6,600 units. Other notable performers in the EV segment included the MG3, Fiat 600, BMW i5, Renault Scenic, and Lexus LBX.

Read Tesla unveils new finance offer to significantly reduce starting price of leased Model Y SUV

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.