The used car market is set to close 2024 on a high note, with strong demand and stabilising prices, according to Auto Trader’s Retail Price Index.

Despite a -7.4% year-on-year dip, used car prices averaged £16,408 in October - marking the smallest annual decline since December 2023. Monthly prices rose 1%, showing market resilience even as they remain slightly below pre-pandemic averages of 1.9%.

Demand surged 9.9% year-on-year on Auto Trader’s platform, while supply fell -5.6%, driving cars to sell faster, averaging 29 days on the forecourt - three days quicker than last year.

The used car market is set to close 2024 on a high note, with strong demand and stabilising prices, according to Auto Trader’s Retail Price Index.

Despite a -7.4% year-on-year dip, used car prices averaged £16,408 in October - marking the smallest annual decline since December 2023. Monthly prices rose 1%, showing market resilience even as they remain slightly below pre-pandemic averages of 1.9%.

Demand surged 9.9% year-on-year on Auto Trader’s platform, while supply fell -5.6%, driving cars to sell faster, averaging 29 days on the forecourt - three days quicker than last year.

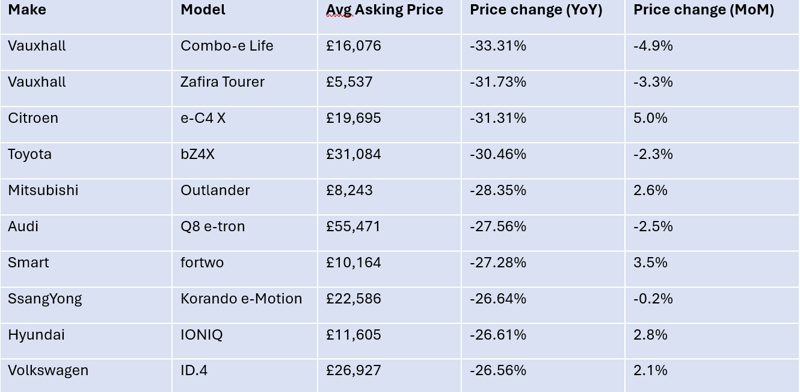

Petrol and diesel vehicles saw modest YoY price declines (-6.4% and -7.1%, respectively), while electric vehicle (EV) prices showed a modest MoM rise (2.1%), a first in two years.

Retailers are responding confidently to the demand, with BEVs in the 3–5-year segment selling in a brisk 19 days, the fastest of all segments.

The strong consumer interest and tight supply conditions are fostering a robust market, enabling retailers to avoid significant price cuts as they anticipate a solid year-end.

Commenting, Richard Walker, Auto Trader’s data & insights director, said: “It’s good to see retailers showing more confident pricing trends and following the supply and demand data, helping 2024 end on a far stronger note than 2023. Last year, many retailers were unnerved by largely unwarranted price cuts in the wholesale market but thankfully today’s levels of demand, combined with continuing tightness of supply, mean that we haven’t seen that pattern repeated this year.

“Solid market health indicators in the used electric market are a bright spot as we see overall BEV prices up month on month. The 3-5 year old EV segment continues to lead the overall market in selling faster than all others. We’re hopeful that as retailer confidence continues to grow in the second-hand electric segment, more and more will be ready to get involved and – as with all segments of the market - we’d urge all retailers to use data to make informed electric stocking decisions.”

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.