Latest data from Dealer Auction’s EV Performance Review shows a steady and consistent performance from alternatively fuelled vehicles (AFVs) in February, with sold prices on the rise and several high-performing models, led by the hybrid Hyundai Tucson.

The online marketplace reported that the average sold price on AFVs increased by just under 5% to £17,766 – its highest level since Dealer Auction started monitoring the performance of AFVs from January 2024,which it believes bodes well for the sector in 2025.

The average age of AFVs fell from 4.4 to 4.2 years old, with mileage also dropping from 36,129 to 33,980. While age and mileage fluctuated throughout 2024, both figures have gradually been decreasing over the last few months, showing stronger signs of consistency.

Dealer Auction’s marketplace director, Kieran TeeBoon, commenting, said: “It’s encouraging to see February following the lead of a strong January. Last month, I said the key to long-term success for the used market will be seeing younger and lower mileage stock, and February certainly delivered on this. Vehicles that are younger and carry fewer miles might be what tips the scales in terms of attracting AFV-curious drivers.”

Despite the bid and retail margin figures being slightly down (2% for each) compared to last month, they remain robust. At 5,068 and £2,945 respectively, they come in above the 2024 averages.

Turning to the best-performing trade-to-trade AFV models in February 2025, the hybrid Hyundai Tucson was once again the top seller, having previously topped the overall 2024 chart and the January 2025 chart.

But, more notably, the family SUV more than doubled its January volume sold in February. It also clocked the third-highest profits, with an average retail margin of £3,378, and joined the CAP performance top 10 for the first time this year with 110.4%.

There was also success for Toyota. The Yaris hybrid ranked second in sales, while the Yaris, Prius and Auris hybrid models secured the top three places in the CAP performance table, posting 112.7%, 112.7% and 112.0% respectively.

Hybrid models continued to dominate, with only one electric car featuring in the three top 10 charts. But notably, this was a new EV entry – the Peugeot E-208 – which will be one to watch as the year progresses.

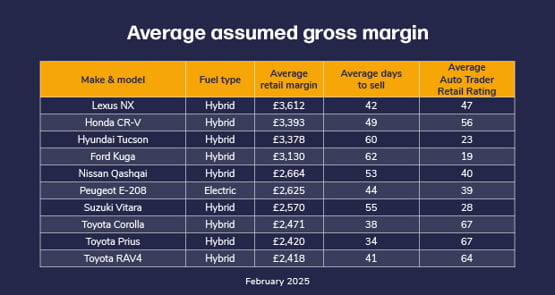

Lexus also continued to draw profits for dealers, this time with the hybrid NX topping the average gross margin table with £3,612 and also ranking in the top 10 for both sales and CAP performance.

Despite Lexus’ performance, mainstream vehicles dominated the rankings for February, taking 90% of the CAP performance top 10, 90% of the top 10 for average gross margin and 80% of the top 10 positions in sales. January had seen a 60:40 mainstream-premium split for top margins, but February saw premium brands like Mercedes-Benz being edged out.

TeeBoon concluded: “February was a strong month for preowned AFVs and it will be interesting to see if this is sustained in the coming months. Many dealers are pushing new EVs due to the change in VED rates from April, so it will be interesting to see if this results in an influx of younger, lower-mileage EVs or hybrids on the trade scene, as drivers look to upgrade before the deadline.”

Login to comment

Comments

No comments have been made yet.