How do dealers retain loyalty post-sale when the maintenance profile of an electric vehicle (EV) is so significantly different compared with an internal combustion engine (ICE) car?

The owner of an EV shouldn’t need to visit the dealership as often so the shift to EVs will demand a far more considered approach to maintaining effective touchpoints once the car has been driven off the forecourt.

Speaking at the AM Live event last November, Keith Jackman, head of marketing and CRM at Sandown Mercedes-Benz, summed it up with a precision borne of many years of hard-won experience.

How do dealers retain loyalty post-sale when the maintenance profile of an electric vehicle (EV) is so significantly different compared with an internal combustion engine (ICE) car?

The owner of an EV shouldn’t need to visit the dealership as often so the shift to EVs will demand a far more considered approach to maintaining effective touchpoints once the car has been driven off the forecourt.

Speaking at the AM Live event last November, Keith Jackman, head of marketing and CRM at Sandown Mercedes-Benz, summed it up with a precision borne of many years of hard-won experience.

“It takes me back to being a Land Rover technician many years ago, when the big services were six and a half hours long. When they suddenly became an hour and a half, we all panicked. But you have to adapt and change and EVs are no different.”

So, what should dealers do to retain a meaningful relationship post-sale and do increasing EV sales necessarily mean fewer aftersales opportunities?

EV-Specific

For Waylands chief executive John O’Hanlon the simple answer is to create effective service plans that address the key differences between EV and ICE products – primarily fewer moving parts and extended life of consumables.

“We know that damage or wear can occur on certain parts of the vehicle than previously experienced on an ICE vehicle (e.g. tyres) so undertaking a vehicle health check (VHC) will offer peace of mind to the driver of these cars.

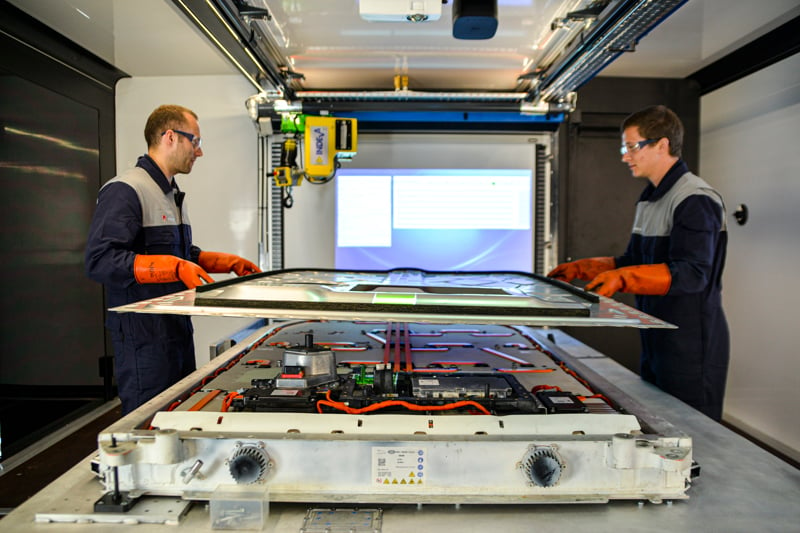

“If we can include a battery health check as part of the VHC this will increase the value of the visit to the dealership as concerns remain around battery health despite the evidence of the robustness of modern batteries.”

“If we can include a battery health check as part of the VHC this will increase the value of the visit to the dealership as concerns remain around battery health despite the evidence of the robustness of modern batteries.”

Jeremy Evans, chief executive at Marketing Delivery, who has supported Sandown in addressing the challenge posed by fewer service opportunities, says that an EV’s higher recall rate should be handled more proactively and sensitively to ensure customers ‘keep the faith’ in their new electrified purchase.

“Something that many customers may not have thought of is the importance of checking their EV’s tyres. Due to the higher levels of torque and weight associated with EVs, rates of wear with standard tyres can be higher – something that can be mitigated with EV-specific products.

“Something that many customers may not have thought of is the importance of checking their EV’s tyres. Due to the higher levels of torque and weight associated with EVs, rates of wear with standard tyres can be higher – something that can be mitigated with EV-specific products.

“Potholes can cause significant damage to the tyres too and affect the handling of the vehicle due to the wheel alignment being compromised.

“All of this provides further opportunities for retailers to communicate the importance of checking tyres and to come in for suitable replacements when appropriate.”

Another part of an EV that may need additional attention is its brakes. In a recent interview with AM, Bill Fennell, chief ombudsman at The Motor Ombudsman, said EV brakes could be liable to stick as a result of reduced usage – a consequence of regenerative systems taking the load.

“Again,” Evans says, “this affords an opportunity to explain, guide and reassure.”

O’Hanlon also flags the increasing complexity of EV software systems as another potential opportunity to develop a touchpoint with the customer.

“These cars are much more sophisticated in their driving and safety systems,” he points out, “and so the software behind these systems needs to be regularly updated. We should offer this at the dealership, complementing any over-the-air updates.”

Evans agrees, saying this was borne out by his recent visit to the National Automobile Dealers Association (NADA) conference in Las Vegas where it was clear that the most common service concern was software issues. “Again,” he says, “this is an opportunity for the service department to be a fount of EV wisdom for customers in the event that they encounter any problems.”

On The Ramp

While retention is an important concern shared by every dealer, it should be viewed in two ways, according to O’Hanlon.

“First, there remains a large ICE parc that will continue to need to be serviced and maintained,” he says, adding “the change to an EV-dominated workshop will take time and we mustn’t simply ignore these (ICE) vehicles.

“Second, we know from other markets that EV vehicles remain in franchised workshops for longer. That does mean we can penetrate into older segments more effectively.

“Whether driven by the more sophisticated software or an anxiety about new technology, customers, EV customers seem to be returning to franchised dealers for longer. We should therefore encourage retention via service plans that go beyond the manufacturer’s warranty period.”

“Whether driven by the more sophisticated software or an anxiety about new technology, customers, EV customers seem to be returning to franchised dealers for longer. We should therefore encourage retention via service plans that go beyond the manufacturer’s warranty period.”

“If we can retain both ICE and EV vehicles for longer, we know that we will be able to sell more consumables.

“We need to improve how we offer additional services such as tyre and windscreens and cosmetic damage that the older segments will suffer more – services which are competitively priced and deliverable on a timely basis.”

This feature is from AM's 2024 Spotlight on Customer Experience and Retention report. Read the full report here.

Keyloop’s global OEM director Jacqui Barker (pictured) agrees that there is still a significant need to maintain the current car parc.

“However,” she notes, “we see a shift in the way some OEMs are working more closely with their retail partners to pivot to a new way of utilising ramp space for maintenance and repair work.

“However,” she notes, “we see a shift in the way some OEMs are working more closely with their retail partners to pivot to a new way of utilising ramp space for maintenance and repair work.

"By diversifying their offerings across various categories, dealerships can maximise customer lifetime value by providing a comprehensive range of products and services that cater to their customers' diverse needs and preferences. These can include specialist EV warranty and servicing plans, a greater choice of aftermarket accessories and customisation.”

Going Further

Barker, whose dealership clients are addressing these very issues, says that while EVHCs certainly create a regular start point of contact, it will be essential to go beyond servicing and that dealers must move beyond a binary transactional relationship to become more integral to their customer’s ownership journey.

She says seamless digital interactions are set to drive significant technological shifts across the automotive industry.

“With enhanced technology and data coming from EVs, there is an opportunity to improve a customer’s experience that can be initiated and delivered directly back to customers in the vehicle or via OEM-powered applications.”

“A timely warning on preventative maintenance will always be welcome, but also consider offering EV driving days to help customers get the most out of their new vehicle or offer loyalty discounts on the latest generation of home chargers or credits for supercharger networks,” she says.

Data Capture

None of these strategies will be effective, however, without tip-top data acting as the critical intelligence core around which a sophisticated contact strategy can be built.

Marketing Delivery’s Evans says that in his own experience it is obvious there are ample opportunities for retailers to maintain productive interaction and maximise loyalty for the benefit of both the sales and aftersales departments.

Fundamentally, he says, effective post-sale management of an EV customer depends on three key things: EV-specific pre-sale and post-sale contact plans; the means to communicate in a personalised, EV-specific and timely way, and do so at scale as the proportion of EV ownership rises.

Thirdly, and arguably most critically, retailers must ensure that customer data – and consequently back-office systems – know that the customer is an EV driver. Apparently, many retailers don’t yet routinely differentiate between EV and ICE customers in their DMS records.

For Evans, accurate data is critical. Along with vehicle make and model, retailers need to record the powertrain type in their DMS and ensure that other integrated systems recognise that too.

For Evans, accurate data is critical. Along with vehicle make and model, retailers need to record the powertrain type in their DMS and ensure that other integrated systems recognise that too.

Keyloop’s Barker applies the same caveats – that the journey must start with great data to be able to unlock a simple, yet intuitive, customer experience.

She further notes that the agency model will introduce additional complexity to customer data and permissions and that managing this throughout an ownership cycle will require timely customer and vehicle data to be instantly available to the agent and technician.

360-degree Data

"If automotive retail is to remain relevant to consumers, it has to step up to the challenge,” she says, “adding that technology platforms should aim to create a 360-degree view of the buyer, improving sales conversion and supporting customer lifetime value.”

She adds that Keyloop is currently working with a range of applications to ensure that real-time data can generate complex customer insight and interactions, from the first click through to collection and ownership.

“Retailers have a fundamental role in helping customers choose what’s right for them and helping them compare important areas of the total cost of ownership, but we know that brand experience happens when you live with your vehicle and you naturally turn to the retailer when it needs maintenance.”

Keyloop is, for example, working to develop platform capabilities so customers can book a vehicle health check through an application that connects directly to the retailer's workshop tool.

"As EVs change how the customer experience looks and feels,” she says, “it’s an opportunity to think differently about how you build a lasting relationship. This can range from connecting data from vehicle telematics to tactical engagement by providing free or discounted super-charging to community engagement through ownership events and online communities.”

Customer Communications

Despite the diverse digital tools that are emerging, O’Hanlon says dealerships should still not overlook the basics.

“An effective post-sale communication strategy is key,” he says. “This strategy must be based around information that is valuable to the customers. Whether it’s technical, educational or offer-based, if relevant, we know that customers will open and will engage around it.”

Post-sale, O’Hanlon believes the first few days and weeks following delivery are crucial for the driver of a new EV.

Post-sale, O’Hanlon believes the first few days and weeks following delivery are crucial for the driver of a new EV.

“Whether charging, chargers or even parking advice we have bespoke solutions working with partners such as ZoomEV and Ohme to make sure that simple questions and concerns can be addressed by specialists quickly and efficiently.”

For Waylands, that also means providing general information around the brand in addition to about itself as a dealership business in the form of digital magazines which focus on education rather than just about offers, with product information and customer reviews providing valuable guidance and insights.

Here, Marketing Delivery’s Evans believes that communications can be tailored to reflect an EV’s specific maintenance schedule, and to provide the guidance and reassurance that many EV owners might need, certainly in the early stages of ownership.

“We recommend that our retailer customers offer a second handover to their customers, and potentially drop-in clinics too, to allow customers to ask questions that they may not have even thought of at the point of handover.

“Once the EV is in the customer’s possession, there may well be a knowledge gap around the aftersales requirements. Customers will appreciate the aftersales department contacting them proactively about the ‘normal’ appointments such as servicing, but we’ve also seen very positive response rates when workshops engage with EV customers about software upgrades and optional vehicle health checks.”

Jacqui Barker at Keyloop agrees: “Dealerships are placing a greater emphasis on providing exceptional customer experiences to retain loyalty and attract new customers. This may involve offering personalised service recommendations, convenient scheduling options, and responsive support for EV-related enquiries.”

Physical Presence

In spite of the emerging direct-to-consumer model, the importance of a physical presence offering a go-to site allowing an EV customer to tap into the dealership knowledge base cannot be understated.

AM100 dealer Arnold Clark invested more than £5m in its Glasgow innovation centre in 2021 – its first-ever non-retail showroom designed to educate and inform visitors about alternative fuel vehicles, charging and grant support.

That knowledge hub together with its resident fleet of £2.5m-worth of test drive vehicles has led to 13% of visitors going on to buy and the opening of a second centre in Stafford in early 2022.

Charging capability provides a compelling reason to travel to the dealer site on a regular basis. Here, Arnold Clark has recently announced plans to install more than 500 electric vehicle chargers across the UK in an investment worth £23m allowing its EV customers to book access on a 24/7 basis.

That commitment has been enabled by the acquisition of Scottish-based EV charge point installers Bumblebee which will install eight rapid chargers at larger Arnold Clark branches, and four to six rapid chargers at smaller sites.

Chinese newcomer brand GWM ORA has been vocal about the value of a physical network and a critical aspect of its launch strategy was to seek dealer partnerships to help consumers understand the benefits of its ORA 03 model range.

In its first year, it has developed a strong network of trusted retail partners with 30 points of representation across the UK, with more being added every month.

“We believe it is absolutely key to encourage potential customers to experience our products first hand and in their own time,” says Toby Marshall, managing director at GWM ORA. “Many of our retail partners are offering 24-hour test drives and extended test drives, so customers can really understand how an electric car can work for them in a no-pressure environment.

“Our teams of GWM ORA experts are also fully equipped to offer insight on how to navigate public charging infrastructure, home charging, electric vehicle energy tariffs, insurance, aftersales and everything you need to take your first step into the world of electrification.

“Ultimately, we want GWM ORA customers to feel confident and comfortable in their decision to buy an EV and make the most of the amazing benefits on offer and our fantastic retail partners play a key role in helping us achieve this.”

“Ultimately, we want GWM ORA customers to feel confident and comfortable in their decision to buy an EV and make the most of the amazing benefits on offer and our fantastic retail partners play a key role in helping us achieve this.”

O’Hanlon believes each and every visit to an EV dealer should be easy, efficient and compelling whether that’s in terms of welcoming facilities or the reassurance of professional staff who are trained, resourced and comfortable about everything electric.

Waylands is therefore scheduling a series of launch events to showcase new models which will provide the opportunity to talk to customers about upgrading their vehicle to the very latest technology featuring improved battery tech, more efficient charging or improved safety features.

“With the rise of ZEV mandate, we know that competition for EV customers will increase and more compelling offers will be available,” he notes.

Changing market dynamics and the continued growth of EV sales mean dealerships would be wise to act quickly to address all elements of the EV purchasing journey – as well as consider how new flexible ownership options could also provide useful additional touchpoints with dealers well positioned to be the local hub for all things mobility.

“Providing the right solution at the right time is powerful and will help drive customer lifetime value,” says Barker.

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.