By Richard Yarrow

With so much focus on the buoyant UK new car market and its wholesale migration to PCP transactions, who is the used car customer in 2015? What are the new trends in the pre-owned arena, and are there changing influences on the decision-making process?

Another question to consider is what are consumers actually buying? Andrew Ballard, strategy director at data company Experian Automotive, believes much of it is ‘premium’ because of that growth in PCP take-up.

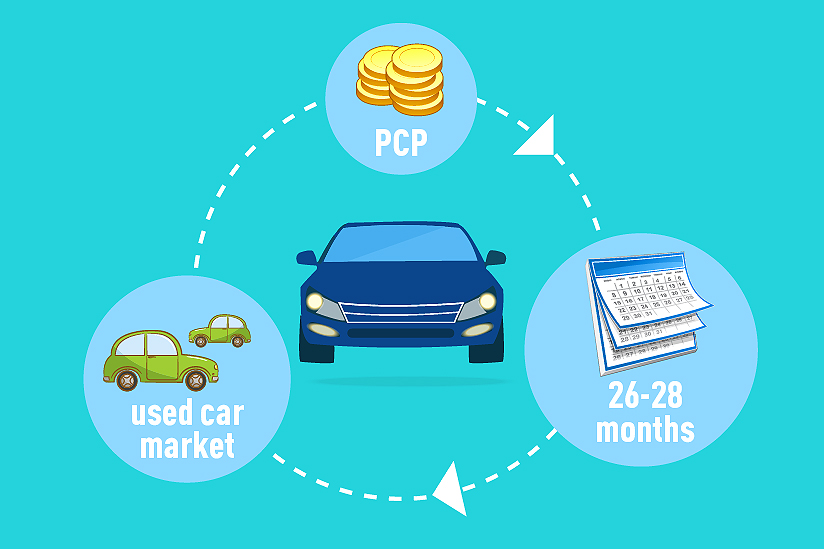

“It is cars recycled back into the market, many not running to term, so at 26-28 months, where there’s equity in the vehicle,” he said. “The subsidy from the manufacturer and attractive finance means it’s been worth it for the new car customer to change early.”

However, PCP popularity is also cascading into the used sector. Experian’s data shows that from a base of fewer than 50,000 transactions in 2011, the UK total hit 96,000 in 2013, then almost doubled to 187,000 last year.

Ballard said the PCP boom means both new and used buyers are entering the process thinking more about what they can afford, and that people are often surprised. He believes ultimately it could mean the end of the ‘Do you want to buy new or used?’ question as a starting point for searches on websites such as Auto Trader and Motors.co.uk.

“Customers might think they want a new car from a volume brand, but end up with a used car from a premium brand. If people aren’t wedded to the ‘it’s got to be new’ idea, then the sophistication in search criteria and peoples’ focus on affordability means that could happen.”

He believes a deal is even more likely to be sealed if the offer includes a warranty and service plan, so concerns about the vehicle not being new are reduced.

“It’s early days to say we’ve seen this, but the emotional attachment to a brand that’s more premium could actually be more of a pull than the car being brand new.”

Nick King, market research director at Auto Trader, agrees. “Porsche now offers a two-year warranty on all cars up to six years old. That’s not to be sniffed at; a 2009 Boxster could be £25,000, which is the same price as a new VW Eos. Which would people rather have? It changes the market completely.”

Both experts believe lifestyle-based online used car searching is aiding this move. Motors.co.uk’s Smart Search function is a good example; questions to the customer include asking what they want the car to do, what it needs to carry, how much road tax they want to pay and what luxury features they desire. Auto Trader’s site features Discovery Search, a basic functionality that helps the buyer choose the right vehicle. King said it is soon to be enhanced further.

Is the traditional used car buyer switching to new?

The flip side of the affordability coin is that buyers who have traditionally bought used could end up with a new vehicle. Andy Coulthurst, managing director of Motors.co.uk, said analysis of post-transaction data revealed this is happening more and more, with most of the final deals involving manufacturer-supported PCPs.

Reviewing data for one dealer group in January, he said Motors.co.uk generated 123 sales matches where the customer had searched and subsequently bought a vehicle. Of those, 26 had been converted from used to new, and the range of vehicles was wide – from a Nissan GT-R, Volkswagen Tiguan, Lexus NX and Toyota GT86 to volume models such as the Škoda Fabia, Toyota Yaris and VW Polo and Up. Even the most cost-conscious used car buyer could find it hard to argue with a brand new small hatchback for not much more than £100 a month.

Reviewing data for one dealer group in January, he said Motors.co.uk generated 123 sales matches where the customer had searched and subsequently bought a vehicle. Of those, 26 had been converted from used to new, and the range of vehicles was wide – from a Nissan GT-R, Volkswagen Tiguan, Lexus NX and Toyota GT86 to volume models such as the Škoda Fabia, Toyota Yaris and VW Polo and Up. Even the most cost-conscious used car buyer could find it hard to argue with a brand new small hatchback for not much more than £100 a month.

It’s a view supported by Simon Henstock, operations director at auction company BCA. Research carried out for its most recent Used Car Market Report suggested no/low interest deals could tempt used car buyers to go new.

“12% of owners said they would ‘certainly’ think about buying new instead of used next time, and a further 23% thought it was ‘quite likely’,” he said.

“We will soon deliver a ‘search by payment’ functionality on Motors.co.uk to cater for this unmet need in used car buying. In a world in which monthly payment drives everything, one would expect this dynamic to become the new norm.”

Ballard said the way finance is being offered on used car websites is also driving the switch away from searching for a specific make and model.

“We are having our customers ask us, in respect of the credit application capability, can we start introducing a likely ‘accept on finance’ and a likely monthly budget that a lender would feel is suitable for that consumer.”

He believes there are players in the market with the ability to change used car customer behaviour over time, and influence the way people start their buying journey.

“They’re making their sites attractive and useful, but there’s an appetite for them to own more of the customer journey. If you do a credit pre-application check upstream of the decision, you can only show cars that they’re likely to get accepted for finance on. We’re going to see more of this; we’ve seen it in credit cards and personal loans and it’s one where everyone seems to benefit.”

The trend towards making used cars more individual

John Leech, head of automotive at industrial analyst KPMG, acknowledged some buyers were being converted from used to new. But those who remain committed to secondhand models have more buying power than ever.

“That’s translating into them looking for more fully featured vehicles, and well specced cars are going for premium prices,” he said. “Customers are looking for more personality in their cars, so there’s a trend towards making used cars more individual. We’re seeing increased opportunity for dealers to retro-fit some optional extras, such as spec packs, to make a car more desirable and getting a better price for it. Customers are going for that.”

“That’s translating into them looking for more fully featured vehicles, and well specced cars are going for premium prices,” he said. “Customers are looking for more personality in their cars, so there’s a trend towards making used cars more individual. We’re seeing increased opportunity for dealers to retro-fit some optional extras, such as spec packs, to make a car more desirable and getting a better price for it. Customers are going for that.”

Linking back to the issue of affordability, vehicle purchase costs remain important to the pre-owned buyer. BCA’s Used Car Market Report bears that out. “When asked what influences the way they search for a used car, the majority of motorists said they were motivated most by ‘price range’, said Henstock.

Daren Wiseman, general manager of valuation services at remarketing company Manheim, agrees. However, he said having the right gadgets in a car was becoming a priority.

“People want Bluetooth and USB, not fancy wheels and big spoilers. They see technology on new cars and have an expectation it will be on used cars, too,” he said.

Wiseman believes consumers’ willingness to use digital devices, particularly tablets and smartphones, means virtually every manufacturer and some of the larger dealer groups are looking for the Holy Grail – an end-to-end online solution for used car buying. He reckons it’s not far away.

“No one has cracked it yet and the issue is around part-exchange valuation. It provides challenges because you have the customer describing his own car. Why would they know how to do that?”

Manheim is working with digital retailer Rockar, which launched an online new-car-buying website with Hyundai last November.

“What Rockar has found is that the customer is being quite honest about their part-ex in most cases,” said Wiseman. “I think before the end of this year there will be a few manufacturers offering end-to-end sales on new cars – because standards are guaranteed – and from there it will move into used car retailing.”

Buyers’ desire to enquire 24/7 is another trend that’s not going away.

The ‘Night Owl’ tool on Motors.co.uk allows people to alert a dealer that they wish to reserve a car as soon as the business opens the following morning. The company says a year ago that happened 20-25 times a day across its portfolio of advertising dealers, but the current average is just under 50.

“Dealers have twigged that a lot of buying takes place in the Coronation Street ad break and that they can’t respond the next morning,” said Leech. “The sale is lost if they do. People are engaged at that time and so they have to respond.”

Gavin Amos, head of valuation services at MyCarCheck Trade, said he was seeing evidence of more people willing to travel further to buy a used car because of perceived regional price advantages. Demand for crossovers was particularly strong, and people were happier than ever to shop at franchised dealerships.

“The used car programmes offered by manufacturers provide a lot of support and, most importantly, consumers trust them because they give that vital peace of mind. They have also increased standards, which has put a gap between them and the vast majority of independents. Main dealers are doing a lot of distance-selling because the standards on schemes are so high.”

He said buyers can also expect more honesty and transparency, because what used to be considered tricks of the trade are now all over the internet for the world to see.

What way is the used car customer heading?

The factors that influence the used car decision-making process remain firmly entrenched, with personal experience and the opinion of family/friends still overwhelmingly top of the list, according to BCA.

“The test drive remains important and the influence of online shopping and consumer advice sites can be seen,” said Henstock. “Interestingly, motoring magazines, TV shows and social media rank very low when it comes to influencing the choice of a used car.”

“The test drive remains important and the influence of online shopping and consumer advice sites can be seen,” said Henstock. “Interestingly, motoring magazines, TV shows and social media rank very low when it comes to influencing the choice of a used car.”

Another emerging trend is that potential customers don’t bother to call or email the dealership any more if they spot a car they’re interested in – they just turn up.

“It’s because we trust the internet more than ever,” said King. “In January 2014, our research revealed that 50% of customers made no contact before going to the dealership. By June, that had grown to 56% and in January this year it was 61%. In America it’s 70% and we’ve heard tales from US dealers of 90%.”

The change means dealers have to keep their website up to date, because customers have an expectation that if a car is on the website then it’s still for sale.

Also following the US model, King believes video is going to be more important than ever in selling used cars.

“I was looking at a Toyota dealer in Orlando recently. They’ve got 700 cars for sale and there’s little films for every one, right down to the $5,000 Corolla with 160,000 miles on it,” he said.

One final emerging trend is that fewer younger drivers are buying older used cars, and that it’s now common to see newly qualified motorists in a new small hatchback.

“It’s probably courtesy of their parents, and has been an easy decision for them based on a low monthly outlay and peace of mind. This is sure to shape the used car market of the future, with many buyers unwilling to ever step backwards and so will never buy secondhand,” said King.

Online searches may end Sunday opening

Stephen Brighton is managing director of Hepworth Honda, with dealerships in Huddersfield and Halifax. He also has a SsangYong dealership in Horsforth, which is a Peugeot specialist and traditional used car operation. His three sites sell about 1,000 used cars a year.

Brighton said the Honda used car market had been flat, in part because of the brand’s recent problems which culminated in a three-car range. “The challenge we face is generating used car stock. We don’t have a massive number of customers coming out of PCP cars at three years, but the signs are good for the future,” he said.

Brighton said the Honda used car market had been flat, in part because of the brand’s recent problems which culminated in a three-car range. “The challenge we face is generating used car stock. We don’t have a massive number of customers coming out of PCP cars at three years, but the signs are good for the future,” he said.

Interestingly, Brighton is considering closing on Sunday as more and more customers do their research online. “I believe we would attract sales executives who value their work/life balance and my belief is that a happy sales team will probably sell more units in six days. I also believe customers value their free time highly and therefore this trend will continue for franchised dealers at least. I know a number of MDs who are considering closing on Sundays.”

Login to comment

Comments

No comments have been made yet.