FCA

Third of drivers unaware they could be due compensation in commissions probe

A third (34%) of drivers are unaware they may be entitled to compensation due to historic discretionary commission arrangements (DCAs), according to a new survey by direct-to-consumer online lender Carmoola.

Executive View: Gaining ground with GAP insurance

It’s a year since the FCA’s investigation into GAP insurance, casting light on the character of the motor finance industry. But GAP is back on the table and motor retailers can make strides to re-build revenue, writes Duncan McClure Fisher, CEO at Intelligent Motoring.

Finance industry braces for Supreme Court ruling on commission disclosure

The Finance and Leasing Association admits it is bracing for all possible outcomes - both good and bad – in the imminent Supreme Court’s ruling on commission disclosure which will ultimately determine a lender’s fiduciary duty and whether it will be enshrined as a permanent legal standard.

Supreme Court rejects Chancellor’s bid to intervene in finance compensation case

The Supreme Court has rejected Chancellor Rachel Reeves’ attempt to intervene in a landmark case concerning hidden commissions in car finance, dealing a blow to lenders facing a compensation bill potentially running into billions.

Supreme Court grants appeal in car finance commission case, expedited hearing set

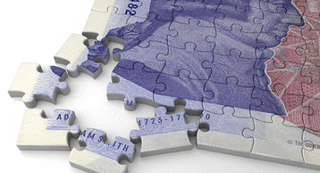

The Supreme Court has granted permission for two car lenders to appeal a landmark ruling on motor finance commission payments that has raised concerns over a potential £30 billion compensation bill.

Car loan crisis could rival £50bn PPI scandal, FCA chief warns

The financial crisis brewing in the UK’s motor finance sector could rival the infamous £50 billion Payment Protection Insurance (PPI) consumer scandal, the Financial Conduct Authority's (FCA) top legal chief has conceded.

Financial Conduct Authority to consult on extra extension for car loans complaints

The motor retail industry is being urged to have its say on a proposal from the Financial Conduct Authority to let dealerships and finance providers delay their responses to consumer complaints about motor finance commission.

Car loan providers must prioritise clear commission disclosure since court ruling, say experts

Clear, upfront disclosure of commission to ensure informed consent will be critical for providers of motor finance following last week’s shock Court of Appeal decision which saw several major industry names suspend lending in order to take stock of the implications of the ruling.

Close Brothers shares hit as car loans commissions ruling spooks investors

Shares in Close Brothers have taken a sharp hit in the wake of a landmark ruling by the Court of Appeal, which determined that motor finance brokers must provide full disclosure on commissions when arranging car loans.