The pressure on UK motor retailers to identify vulnerable customers ahead of the motor finance sales process has increased since the arrival of the latest regulatory regime, and Jonathan Barrett, chief executive of Comentis, shares his thoughts on what this means for regulated firms.

It’s been a few months since Consumer Duty came into force, and given this timeframe, vulnerability identification should now be a fundamental focus for all motor dealers and manufacturers in the UK who offer finance. But how well is the automotive and leasing industry faring with this process? Who’s ahead and who is falling behind? And most importantly, what is the regulator expecting to see next?

Whilst we are starting to see some real traction in the financial services and wealth space when it comes to vulnerability assessments under the Duty, there still seems some way to go for the automotive and leasing industry. We appreciate this process is no easy feat - this is a relatively new working practice for many in the industry and fundamental changes like this can take time.

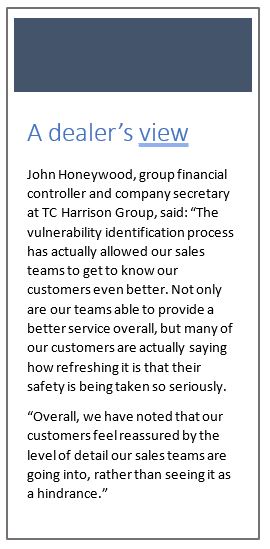

Certainly, one of the key misconceptions we have witnessed from the automotive industry so far is that customer vulnerability identification is time-consuming and will negatively impact the sales journey. Many dealerships have admitted to us that they are concerned that customers will not want to engage with the process for fear that the ‘extra questions’ may well lose them sales.

But this is far from true. Even though it’s early days, what we are actually hearing from our clients is that the vulnerability identification process is actually quick, simple, and most importantly doesn’t impact the sales journey in the slightest as long you have the right technology in place.

In its recent update, the FCA applauded those firms who have made a shift in their working practices and culture. And certainly, there are a few key organisations and industry bodies in the automotive space who should be congratulated too. That being said, the regulator has also given a pretty stark warning that the Consumer Duty is not a “once and done” exercise, reminding us all that firms will need to make sure they are learning and improving continuously.

In its recent update, the FCA applauded those firms who have made a shift in their working practices and culture. And certainly, there are a few key organisations and industry bodies in the automotive space who should be congratulated too. That being said, the regulator has also given a pretty stark warning that the Consumer Duty is not a “once and done” exercise, reminding us all that firms will need to make sure they are learning and improving continuously.

We believe data is central to this. Those that are starting to make traction, have started to build up their hard data on vulnerability. And three months in, we believe that there’s a real opportunity for these firms to assess what they’ve gathered so far, take stock, and see if their target market assumptions are playing out as expected.

We believe data is central to this. Those that are starting to make traction, have started to build up their hard data on vulnerability. And three months in, we believe that there’s a real opportunity for these firms to assess what they’ve gathered so far, take stock, and see if their target market assumptions are playing out as expected.

They could also look - if vulnerability has been identified – at how well that individual customer has actually been supported. With this knowledge, they can then determine whether their preparations were fit for purpose or if there are changes required and then develop from there.

Of course, the regulator is not expecting a transformation overnight, but it is expecting dealerships and manufacturers to build their banks of vulnerability data and learn and adapt based on this.

There may be some dealers and manufactures who may feel that they don’t need to change their ways of working in line with their Consumer Duty obligations just yet. Perhaps they think that being smaller means they’re safe from the Duty, but this is a dangerous misconception. While it may be true that the FCA will focus most of its attention on the largest automotive players, the regulator has been very clear that there will be no exceptions made.

While we have yet to hear of the FCA hauling anyone over the coals (across any industry), it’s sure to be only a matter of time before someone trips up and an example is made of them. The question on everyone’s lips, though, is who…

Author: Jonathan Barrett, chief executive of Comentis

Login to comment

Comments

No comments have been made yet.