The new car market will face huge challenges by year-end, according to Cox Automotive which is warning that pressures could be even worse that those caused by the 2008 financial crisis and the 2020 pandemic.

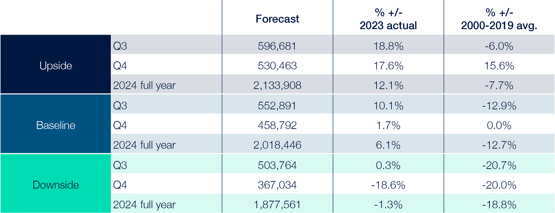

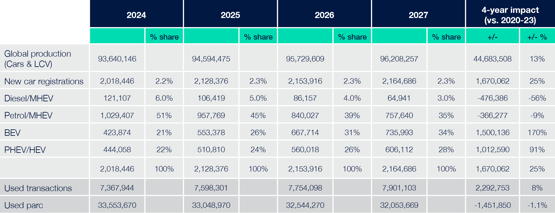

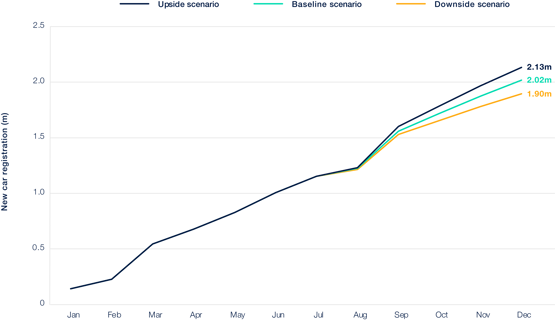

The warning follows the release of Cox Automotive’s revised 2024 new car forecast, now predicting 2,018,446 registrations for the year.

This represents a slight 2.07% decrease from the previous forecast, factoring in the performance recorded by the Society of Motor Manufacturers and Traders (SMMT) in the first two quarters and the expected volatility in Q4 as the Zero Emission Vehicle (ZEV) mandate influences manufacturer strategies.

The new car market will face huge challenges by year-end, according to Cox Automotive which is warning that pressures could be even worse that those caused by the 2008 financial crisis and the 2020 pandemic.

The warning follows the release of Cox Automotive’s revised 2024 new car forecast, now predicting 2,018,446 registrations for the year.

This represents a slight 2.07% decrease from the previous forecast, factoring in the performance recorded by the Society of Motor Manufacturers and Traders (SMMT) in the first two quarters and the expected volatility in Q4 as the Zero Emission Vehicle (ZEV) mandate influences manufacturer strategies.

The revised forecast includes 552,891 registrations in Q3 and 458,792 in Q4, leading to a 6.1% increase over 2023’s full-year volume. However, this remains 12.7% below the 2000-2019 average.

The full forecast, including alternative scenarios, is detailed in Cox Automotive’s latest Insight Quarterly report.

Philip Nothard, Cox Automotive’s insight director, cautions that while the overall numbers may seem positive, the methods to achieve these figures could have severe consequences across the industry.

“The first half of this year has been promising, with over one million registrations for the first time this decade and 24 consecutive months of growth,” said Nothard.

“Major OEMs like BMW, Mercedes, Renault, and Peugeot have shown strong volume performance. Registrations are currently ahead of our baseline forecast, and we believe that two million registrations for the full year is achievable.

“However, the means to reach this target are concerning.

"Many manufacturers have made it clear that non-compliance with the ZEV mandate is not an option, and with EV sales lagging, they are left with limited choices.

"They may either push EV stock aggressively into the market or restrict the availability of internal combustion engine (ICE) and plug-in hybrid electric vehicle (PHEV) models to drive EV sales—or potentially both.”

Nothard warns that such actions could create an unstable market, with long-term consequences for manufacturer and dealer profitability, consumer choice, and residual values.

“Manufacturers are under immense financial pressure, facing stiff competition, and are responsible for accelerating the transition to zero-emission vehicles. To make EVs attractive, they might resort to financial incentives or limit alternatives, putting additional pressure on dealers, fleets, and private buyers. This could lead to unpredictable residual values when these discounted EVs enter the used market in the next 12-36 months.

“As the year progresses, without any government concessions on the ZEV timeline or support mechanisms, the risk of significant challenges in Q4 is very real.”

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.