The Society of Motor Manufacturers and Traders (SMMT) said there is an "overriding concern" over weaking retail and electric vehicle (EV) demand, despite two years of new car registration growth that continues to be driven by the fleet market.

The UK new car market rose by 2.5% in July and has increased by 5.5% over the first seven months of 2024, but fleets are continuing to boost the figures, according to the latest data from the SMMT.

The retail market dropped by 11.1% in July and is down by nearly 12% year-to-date year-on-year.

The Society of Motor Manufacturers and Traders (SMMT) said there is an "overriding concern" over weaking retail and electric vehicle (EV) demand, despite two years of new car registration growth that continues to be driven by the fleet market.

The UK new car market rose by 2.5% in July and has increased by 5.5% over the first seven months of 2024, but fleets are continuing to boost the figures, according to the latest data from the SMMT.

The retail market dropped by 11.1% in July and is down by nearly 12% year-to-date year-on-year.

Battery electric vehicle (BEV) sales were still below the 22% needed for the Zero Emission Vehicle mandate (ZEV), however the July BEV market is pushing in the right direction with a 18.5% share of new car registrations for the month.

However, the year-to-date market share average is still 16.8%.

Mike Hawes, SMMT chief executive, said: “Two years of new car market growth against a backdrop of a turbulent economy is testament to the sector’s resilience and the attractiveness of the deals on offer.

“Weakening private retail demand, however, particularly for EVs and despite generous manufacturer discounts, is the overriding concern.

“More people than ever are buying and driving EVs but we still need the pace of change to quicken, else the UK’s climate change ambitions are threatened and manufacturers’ ability to hit regulated EV targets are at risk.”

Hawes said achieving market transition to BEV at the pace demanded requires “greater support for consumers”.

The SMMT is calling for the Government to step in to help with BEV incentives and charging infrastructure, particularly in the lead up to the September plate-change.

With zero emission vehicles mandated to comprise a minimum 22% of each brand’s new car registrations over the full year, the pace of transition needs to increase.

The latest industry outlook, however, suggests that such a surge is looking increasingly unlikely given the current market conditions.

While the outlook anticipates overall market growth in 2024, expectations have been revised downwards since April, with 1.968 million new car registrations now forecast by the end of the year.

The anticipated BEV share of the market has also been revised downwards to 18.5% from the 19.8% expected in April. Last week’s interest rate cut was already ‘priced in’ to the latest outlook but further cuts would be welcome, helping reduce the costs of finance and making new car purchases more accessible to more consumers.

Fleet sector sustaining new car registration growth

As has been the pattern for the year, July’s growth was sustained entirely by the fleet sector, which recorded a 13.0% increase in registrations to achieve a 62.0% market share. Private demand continued to diminish, falling by -11.1% to account for 36.2% of deliveries in the month, although the growing popularity of salary sacrifice purchasing will contribute to this decline.

Electrified vehicle demand outpaced the overall market, accounting for four in 10 (42.0%) new cars registered in the month.

Hybrid electric vehicle (HEV) uptake increased by 31.4% to achieve a 14.5% market share, while plug-in hybrids (PHEV) grew 12.4% to take 8.9% of registrations.

While the private share of the BEV market continues to fall – 17.2% went to private buyers, compared with 20.3% last year – private BEV volumes did increase by a marginal 0.9%.

With zero emission vehicles mandated to comprise a minimum 22% of each brand’s new car registrations over the full year, the pace of transition needs to increase significantly.

Industry commentators beleive a surge in private BEV demand is looking increasingly unlikely given the current market conditions.

While the outlook anticipates overall market growth in 2024, expectations have been revised downwards since April, with 1.968 million new car registrations now forecast by the end of the year.

The anticipated BEV share of the market has also been revised downwards to 18.5% from the 19.8% expected in April.

Last week’s interest rate cut was already ‘priced in’ to the latest outlook but further cuts would be welcome, helping reduce the costs of finance and making new car purchases more accessible to more consumers.

Urgent need to restimulate private BEV market, says NFDA

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA) (pictured left), said private BEV demand highlights the "urgent need to restimulate the private electric market and an important consideration for the new Government".

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA) (pictured left), said private BEV demand highlights the "urgent need to restimulate the private electric market and an important consideration for the new Government".

Robinson said: "It is encouraging to witness another month of continuous growth in the BEV market.

"However, the overall market share of electric vehicles still falls short of the 22% required by the ZEV mandate.

"This is an important consideration for the new Government, particularly as they aim to reinstate the 2030 phase-out date of ICE vehicles."

Responding to SMMT new car registrations data for July:

Richard Peberdy, UK head of automotive for KPMG, said benefit-in-kind and salary sacrifice incentives for business have been the major driver of growth in BEV sales and market share for some time.

Peberdy said the evidence increasingly suggests that accelerating private EV sales may require similar incentivisation, particularly if the Government is going to reinstate the 2030 end to new petrol and diesel vehicle sales.

He said: "While choices in the new car market are improving, EV prices and the scale and rate of price depreciation when buying from new remain major barriers to convincing consumers to buy a new EV.

"Subsequently, many consumers that are looking to transition to an EV are deciding that the used EV market is a more attractive way to do that.

"Despite used EV sales growing, the higher rate of stock that is currently coming into the used market is still pushing the price of some models down even further.

“All of this context continues to pose big questions regarding how car makers will meet their ZEV mandate targets.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte said there are some signals that consumer sentiment is rising.

Hamilton is predicting a rise in private demand for new cars in the second half of the year, supporting by the Bank of England's first rate cut since 2020.

He added: "Despite the BEV sector outperforming the rest of the market, the industry requires continued clarity on the ban of new petrol and diesel car sales so that it can plan investments accordingly.

“If the ban on new petrol and diesel car sales is to be maintained or moved forward, we can expect further calls from within the industry for financial incentives on electric vehicles to support demand.

"In the meantime, for consumers seeking more affordable options, there are cheaper electric vehicle models becoming available, including a number of new brands entering the market.”

Forward look for the UK’s EV transition

Edwin Kemp, director, EY-Parthenon Strategy, said there has been "conflicting news and sentiment" around the BEV market in recent weeks, with reports that one major manufacturer is intending to place most of its bets on EVs going forward, while another household name pared back its EV-related targets amid a fall in demand.

This juxtaposition is a clear example of the dilemmas and tough decisions facing manufacturers at present given the complex combination of challenges they continue to navigate.

Kemp said: "Given the 2030 ban, it is imperative that regulators and manufacturers work collaboratively towards this target.

"For example, providing adequate incentives for consumers to make the switch will likely remain a critical facet to the UK’s EV transition, particularly if OEMs are to meet ZEV mandate targets and avoid significant penalties.

“Now that inflation has fallen quite significantly in recent months, improving consumer sentiment could help boost private retail sales in the near future.

"However, given the growing limitations around new ICE options as automakers manage down their petrol and diesel sales, enhancing the public’s perceptions around the overall EV experience is likely to be pivotal to a recovery in retail demand and a resulting increase in profit margins.”

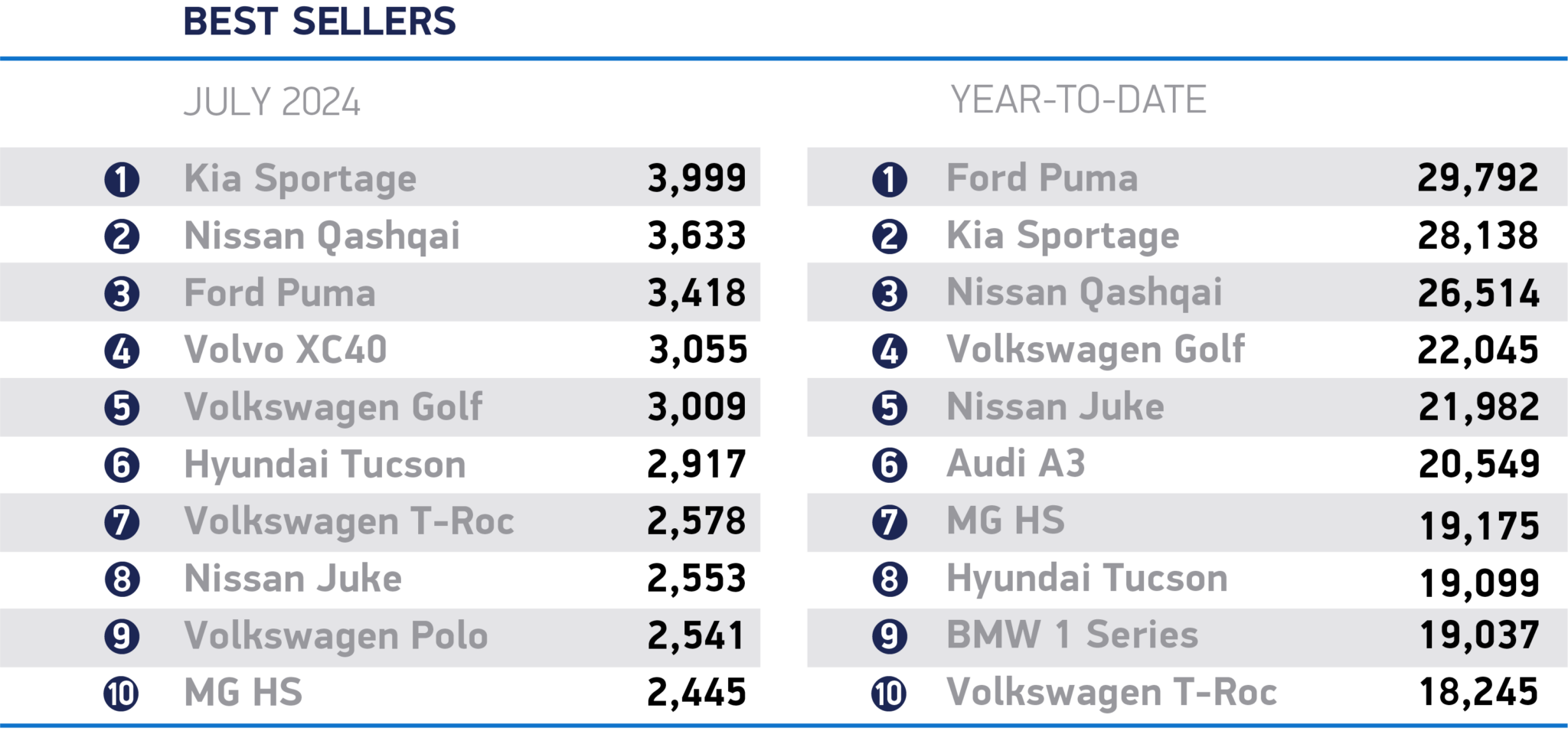

Kia, Ford and Nissan driving UK new car market

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.