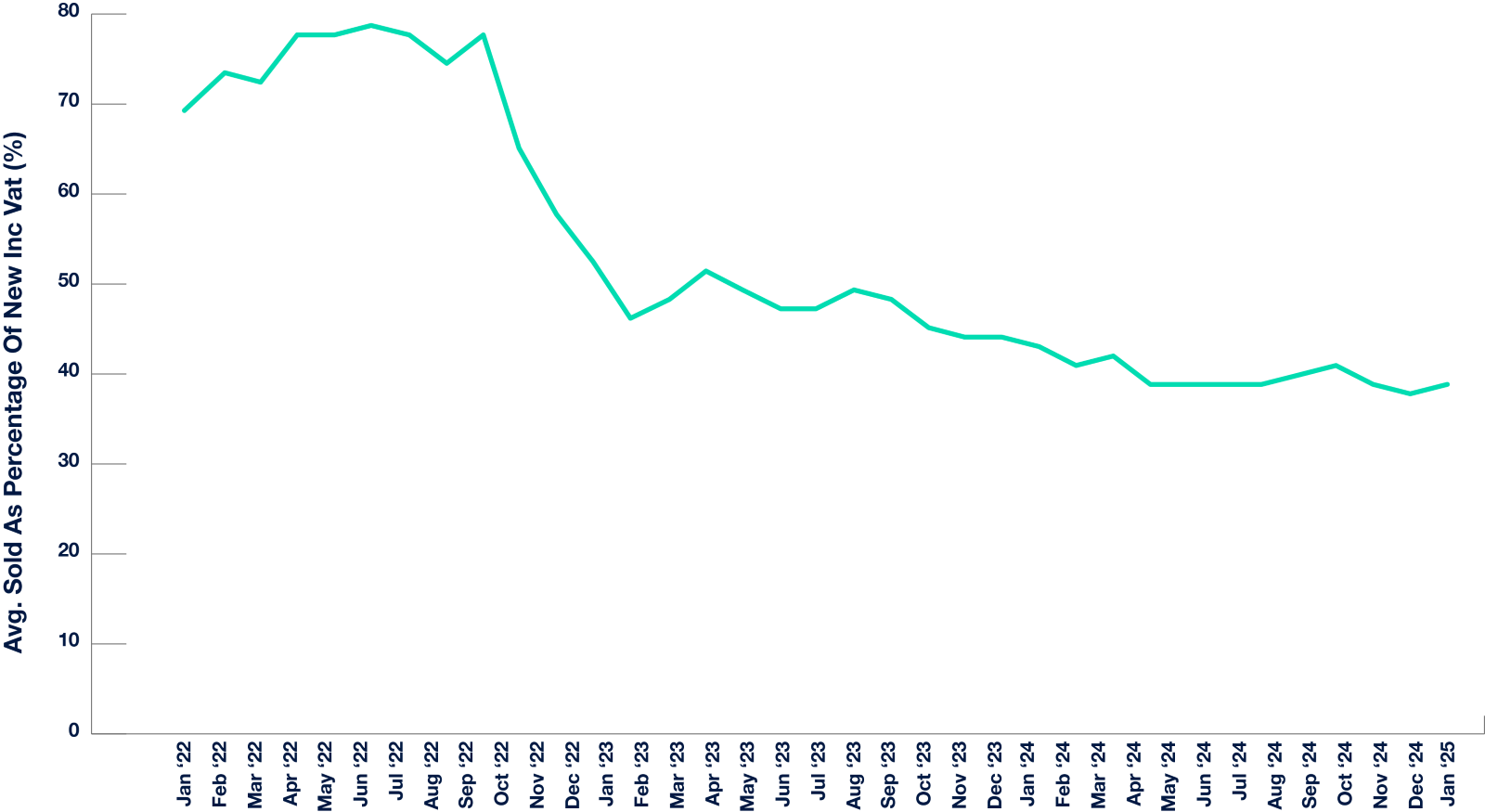

Used electric vehicle prices are expected to stabilise throughout 2025 against a flat year for the total market, according to new predictions from Cox Automotive.

Early signs of levelling are notable across EV prices as retailers begin to acknowledge customer value and shorter days to sell.

Following a sluggish start to the year, trade values and first-time conversion rates are firming and overall performance against CAP Clean is increasing, especially in the lower price bandings.

As recent Cox Automotive and Regit data revealed, 69% of drivers wouldn’t be willing to pay more for an EV over a petrol or diesel alternative, the prospect of lower priced used EVs could help drive adoption in 2025.

EV supply gap will keep prices strong in 2025

Values are predicted to stay strong due to a supply gap from recent years of low registrations in the first half of 2025.

They will likely continue until prices return to standard depreciation patterns in the third quarter.

As interest rates and inflation hopefully stabilise further this year, consumer demand is likely to increase in line, a positive development for those in the used market.

Philip Nothard, insight director at Cox Automotive, said: “In a market shaped by constant competition, forecasting valuations and their impact on residual values is vital for the modern-day dealer.

Philip Nothard, insight director at Cox Automotive, said: “In a market shaped by constant competition, forecasting valuations and their impact on residual values is vital for the modern-day dealer.

“With accurate insights into the direction of the market, retailers can define a competitive pricing strategy.”

EV market share expected to increase substantially

EVs and hybrids are expected to see substantial growth in their share of the car parc by 2028.

Both plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs) are projected to increase their share by 87.37% while EVs will increase by 177.45%.

Meanwhile, petrol cars will see a minor decrease in the same time period by approximately 5.97%.

Although petrol ownership is projected to remain relatively stable, the same cannot be said for diesel.

The share of diesel in the car parc is projected to decrease significantly by 2028, driven largely by stricter emissions regulations, changes in production volumes, supply chain efficiencies and shifting consumer preferences.

Looking back at 2024, as little as 123,000 new diesel vehicles were registered compared to 1,065,879 in 2017.

This trend will filter through into the used market, limiting the supply of newer diesel models but also declining consumer interest in this vehicle type.

Remaining challenges for EV market

Despite progress in building the UK’s EV car parc, challenges remain.

The used market for EVs is expected to remain fragmented as they are generally priced lower than their internal combustion engine (ICE) counterparts, posing challenges when it comes to retaining their value.

This combined with regulatory pressures, including VAT charges on charging, the changes to company car tax rules for PHEVs (which could drive up the rate for certain models from 8% to 24%), vehicle excise duty and the prospect of road pricing means that an air of uncertainty lingers around the used electric market.

Nothard added: “Supply and demand are central to the dynamics of the used car market, but successful retailers must go deeper.

“Stock profiling – ensuring the right mix of vehicles aligns with market needs – and strategic stock sourcing are now more crucial than ever.

“Retailers must adapt to these shifting dynamics and ensure that they can meet the diverse needs of consumers, all while navigating the challenges of a transforming automotive landscape.

“Leveraging data effectively to anticipate trends and consumer preferences can give retailers a competitive edge.”

Login to comment

Comments

No comments have been made yet.