Auto Trader’s latest market health figures reveal pockets of profitability with 1–3-year-old cars enjoying a huge 35% rise due to a 16.1% increase in demand far outpacing December’s 14.3% fall in supply.

Cars aged between 3–5-year-old came in second in terms of performance up 19.3% although older 5-10 year-old categories softened 0.4% while 10-15 year old vehicles fell 7.4% as supply exceeded otherwise positive demand.

By fuel type, all vehicles showed growth although electric vehicles stood out in December as a massive 103.2% rise in demand far exceeded a 7.2% rise in supply, propelled by the recent fall in prices.

Auto Trader said December's performance meant that the used car market had entered 2024 on a firm footing, with consumer demand, speed of sale, and transactions in a robust position. Going forwards, it predicts robust used car demand will continue throughout the year and deliver a small market uplift with forecast transactions increasing to around 7.24 million sales.

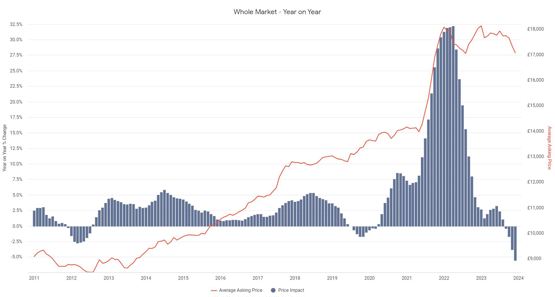

Even so, Auto Trader’s Retail Price Index indicates retail values contracted -5.6% on a year-on-year and like-for-like basis last month to £17,064, suggesting recent trends in trade prices are now flowing through into the retail market.

Consumer demand remained robust throughout December, increasing 11.7% YoY - up from 8.6% in November, the strongest pace of growth since July. Combined with a slight softening in the rate of supply to just 1% YoY growth, Auto Trader’s Market Health metric - which assesses market profitability based on supply and demand dynamics – increased from 6% in November to 10.6% in December, also the highest since July. This translated into sales too; Auto Trader’s proxy data point to circa 4% increase in used car transactions last month.

Buoyant consumer appetite was also reflected in the traffic to Auto Trader’s marketplace, which in December saw a total of over 67 million cross platform visits, which is a 10.2% YoY increase. Momentum continued into the New Year with visits up nearly 4% during the first week of January, whilst the number of daily unique users rose by nearly 1.5% YoY to circa 1.4 million. Furthermore, used cars continue to sell quickly; in December it took an average of just 36 days for a car to sell, which is the same as in 2022.

With promising signs of pressure beginning to ease on consumers, not least the much-improved GfK Consumer Confidence Barometer in December as well as the 14% YoY increase in visits to its marketplace in 2023, Auto Trader is predicting that robust used car demand will continue in 2024 and result in a small market uplift. It forecasts transactions will increase to an estimated 7.24 million sales.

With promising signs of pressure beginning to ease on consumers, not least the much-improved GfK Consumer Confidence Barometer in December as well as the 14% YoY increase in visits to its marketplace in 2023, Auto Trader is predicting that robust used car demand will continue in 2024 and result in a small market uplift. It forecasts transactions will increase to an estimated 7.24 million sales.

It said that these signs of strong consumer demand further underline the need for retailers to follow the retail market. According to Auto Trader estimates, some 51,633 cars are currently being priced below their market value by 8,100 retailers. With robust consumer demand in the market, this repricing activity is potentially costing retailers £35.8 million in lost profits - nearly £4,500 per retailer.

December marked the fourth consecutive month of YoY decline for retail prices although as in previous months there was considerable nuance in the data as the trend of fleet destocking pushed down 1–3-year-old prices 10.1% year on year to £24,806. Used cars more than 10 years old demonstrated positive price growth, with 10–15-year-old vehicles up 5.3% YoY to £6,532 and 15 year+ vehicles rising 2.5% to £5,516. Cars aged 3-5 years old slid 6.1% to £19,639.

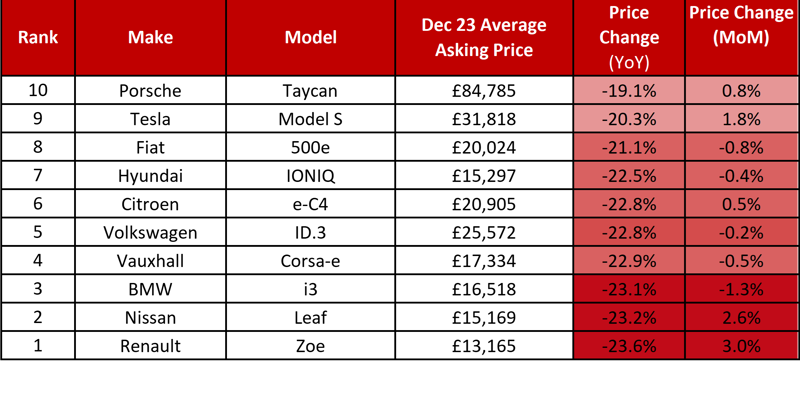

Among fuel types, the average cost of a used EV was down 22.7% to £29,718 – continuing the trend of much larger falls than petrol down 3.8% to £15,482 YoY and diesel which fell 2.2% to £15,371.

Commenting, Auto Trader’s director of data and insights Richard Walker said: “Our data clearly shows that the fundamentals of the used car market remain solid; consumer demand is robust, and cars are selling quickly, which combined with the slow return in supply, means retail prices continue to show more resilience than their trade counterparts.

Commenting, Auto Trader’s director of data and insights Richard Walker said: “Our data clearly shows that the fundamentals of the used car market remain solid; consumer demand is robust, and cars are selling quickly, which combined with the slow return in supply, means retail prices continue to show more resilience than their trade counterparts.

“Worryingly, it appears some pricing strategies are being guided by wholesale trends, placing unnecessary pressure on retail values, and risking profits in the process. Rather than just a cause for concern, the retail and wholesale markets being out of sync also presents a profit opportunity for retailers who analyse the data on a car-by-car basis and price stock relative to retail valuations. This year more than ever, it is crucial retailers adopt a forensic-like approach to their pricing strategies.”

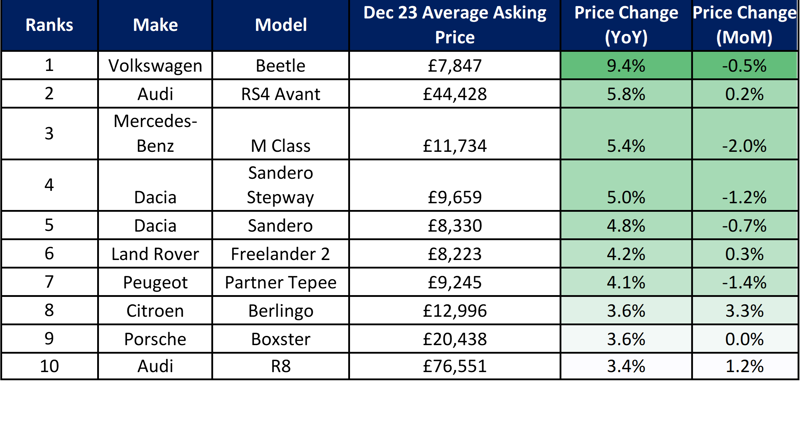

Top 10 used car price growth (all fuel types) | December 2023 vs December 2022 like-for-like Top 10 used car price contraction (all fuel types) | December 2023 vs December 2022 like-for-like

Top 10 used car price contraction (all fuel types) | December 2023 vs December 2022 like-for-like

Login to comment

Comments

No comments have been made yet.