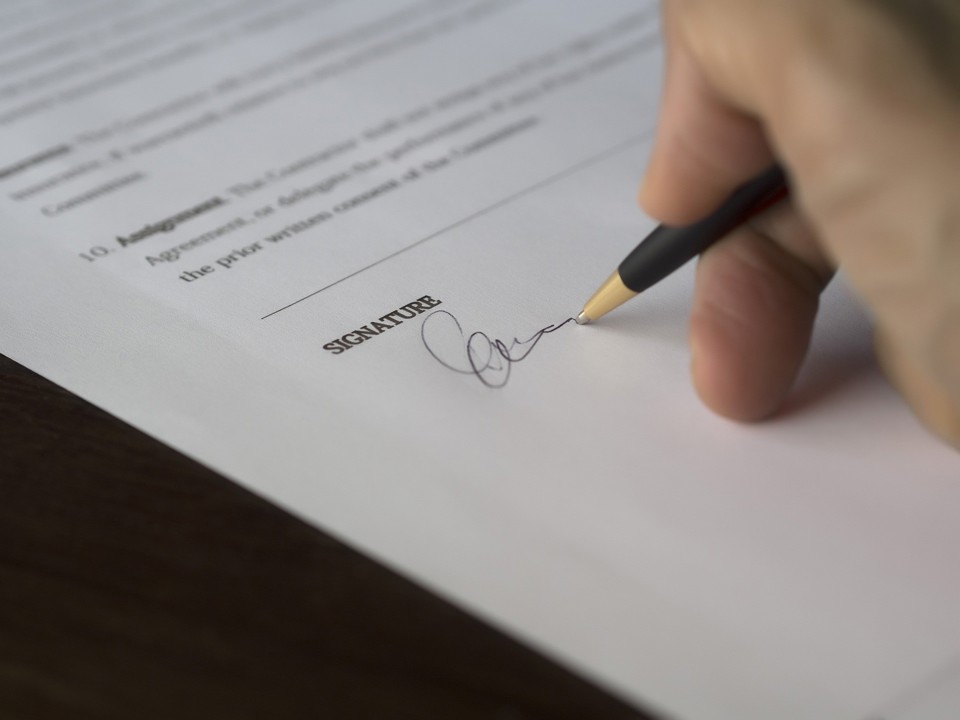

The rise of contactless bank cards and chip and pin transactions have resulted in over half of UK adults “rarely” using an actual signature, according to new research.

A survey of 1,000 UK adults by UK cyber security consultancy, Online Spy Shop, has highlighted the trend which has seen car dealers invest in the latest digital commerce technology as consumer behaviour changes.

Of those surveyed under 24, 15% can’t remember the last time they signed their name.

In contrast, over-55s say they still have a consistent signature, but even among a demographic that grew up with written signatures as the standard, 7% can’t remember the last time they used theirs.

Regular signature use is 20% lower among under-55s compared to over-55s.

The trend around signatures is linked to the increased use of contactless and chip and pin for payment.

Debit card payments overtook cash for the first time last month, according to the latest statistics from trade body UK Finance.

A total of 13.2 billion debit card payments were made last year, a rise of 14% on the previous year. This compared with 13.1 billion cash payments, as a result of a 15% drop in the use of notes and coins.

A new independent review commissioned by ATM network Link has recently been set up looking at the impact of a totally cashless society in the UK.

The Access to Cash Review will look at the impact of new technology, including contactless cards, over the next five to 15 years and examine future needs.

It will be chaired by the former head of the Financial Ombudsman Service, Natalie Ceeney.

The final report will be published in the first half of next year.

Ceeney said: "Many people in the UK have already made a shift to paying for most things digitally, but at the same time, there are between two and three million people across the UK who are entirely reliant on cash."

Link said consumer groups, community representatives, small businesses, industry and the general public would all be able to contribute their views.

Login to comment

Comments

No comments have been made yet.