INDICATA has highlight the effects of the COVID-19 coronavirus on Europe's used car market with the publication of its new Market Watch data report.

The used car inventory management system specialist – part of the Autorola Group – said that it has has created the free report o help UK companies manage the impact of Covid-19 on their used car assets.

The two-tier information source for remarketing professionals keen to achieve a competitive edge when making used vehicle decisions in the challenging current climate.

Among the data included in the new asset is used market volumes and pricing data for the UK and 12 other countries across Europe.

Market Watch is available as a PDF report on the INDICATA UK website, while access to a more comprehensive web-based market reporting tool is available to senior decision makers in the leasing, rental, OEM and dealer group sectors.

Andy Shields, INDICATA’s global business unit director, said: “Market Watch gives further support to the used car industry to help make sense of how to manage the impact of Covid-19.

“Our PDF and web portal provide used car decision makers with the best real time data to build both a short term and long-term strategy to efficiently manage used car supply and demand.”

In a 'guest opinion' published on AM yesterday (April 6) Derren Martin, head of valuations UK at Cap HPI once again stated that it had resolved to pause its used car valuations.

He also urged retailers not to reduce the value of stock during the coronavirus lockdown, stating: "'Reducing prices will not stimulate the market."

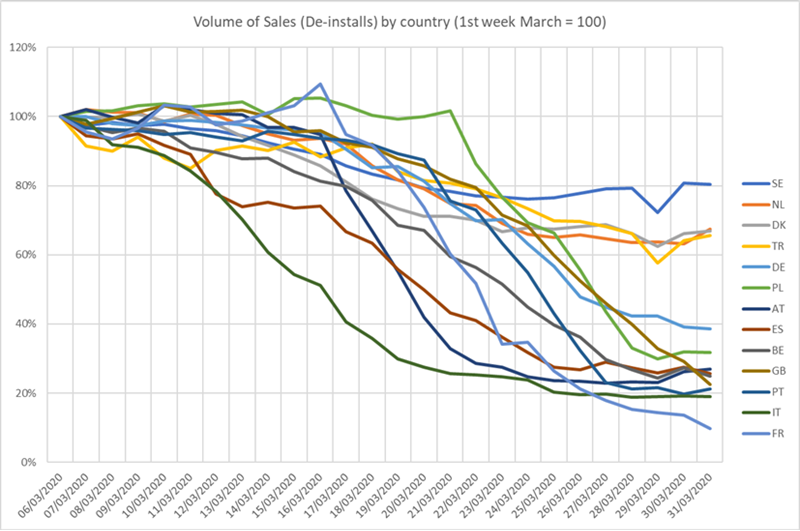

Focusing on the impact on used car sales across 13 European markets during March, and impact on used prices during March and April, the latest market analysis featured in INDICATA's Market Watch report showed the stark difference between the markets in full lockdown and those with some residual used car trading.

Indexing from week one in March, the resilience of Sweden retaining 80% of its used car volumes and Turkey, Netherlands and Denmark (retaining two thirds of its volumes) contrasts with the lockdown countries such as the UK where sales have dramatically fallen towards zero.

Another diagram shows how prices have changed based on INDICATA’s Market Watch benchmark cars basket between February 1 and April 3, with a marked lack of overall price movement in some countries among initial observations.

Another diagram shows how prices have changed based on INDICATA’s Market Watch benchmark cars basket between February 1 and April 3, with a marked lack of overall price movement in some countries among initial observations.

Analysis provided by INDICATA noted: “Looking at the UK, Spain, Austria, Italy and France, where they went into lockdown with the hardest or fastest measures, dealers had minimal time to react before closure and experienced the fewest number of price changes.

“Conversely, Denmark, Belgium, Netherlands and Sweden progressed more slowly into social distancing and their fall in volumes were either slower or less pronounced than other countries. As a result, their dealers had time to react by dropping prices.

“Analysis of individual countries such as the Netherlands showed small cars sustained values initially better than larger vehicles, both from a value and a percentage, typical of a market slide.”

Login to comment

Comments

No comments have been made yet.