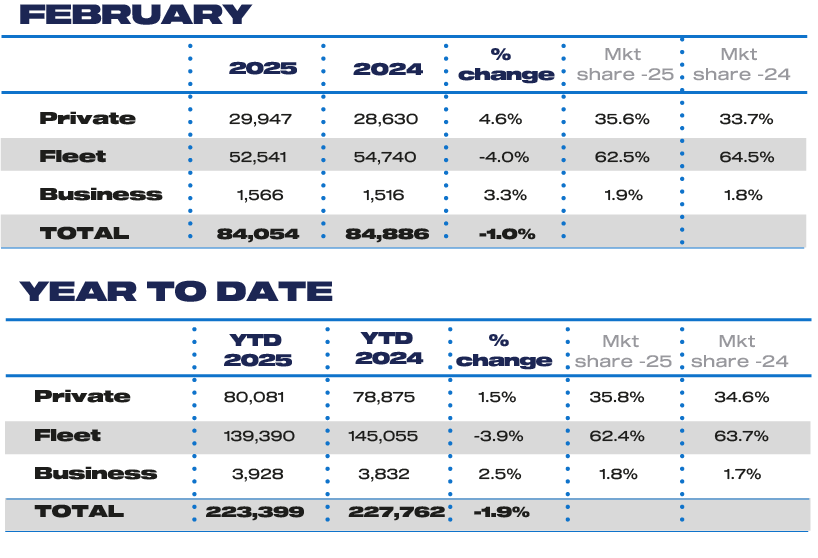

Retail demand for new cars increased by 4.6% in February to outperform the overall market that dipped by 1%.

Private demand in the UK is up slightly year-to-date by 1.5% to 80,081 units.

New data from the Society of Motor Manufacturers and Traders (SMMT) showed that electric vehicles accounted for a quarter of all new car registrations for February, securing a 25.3% market share.

The rise in private demand, in what is historically a small month for new car registrations anyway, offset the drop in fleet volumes, which fell by 4%.

The SMMT said the increase in EV registrations compared with the rest of the market was unsurprising considering the forthcoming tax changes in April, which will see many EV models subject to the vehicle excise duty expensive car supplement (ECS) for the first time.

The February performance maintains a positive trajectory for EVs but still falls short of the 28% target for 2025 and, given February comes ahead of the March numberplate change, the SMMT said “it is always one of the smallest and most volatile months”.

The SMMT is expecting next month to see a further surge in EV uptake, as buyers capitalise on the new '25 plate and take their last chance to avoid the ECS which, from April 1 will add £2,125 over six years to the cost of BEVs with a list price above £40,000.

The trade body said that relative to the rest of the market, EVs are disproportionately affected as higher production costs mean the average EV retails above the ECS threshold, a threshold which remains unchanged since its introduction in 2017.

The introduction of this measure also risks disincentivising the used market as well as the new, impeding a faster, fairer transition.

Mike Hawes, SMMT chief executive, said: “Although February’s figures show a subdued overall market, the good news is that electric car uptake is increasing, albeit at huge cost to manufacturers in terms of market support.

“It is always dangerous, however, to draw conclusions from a single month, especially one as small and volatile as February.

“With the all-important March number plate change now upon us, and tax changes taking effect in April that will, perversely, dissuade EV purchases, we expect significant demand for these new products next month - but, long term, EV consumers need carrots, not ever more sticks.”

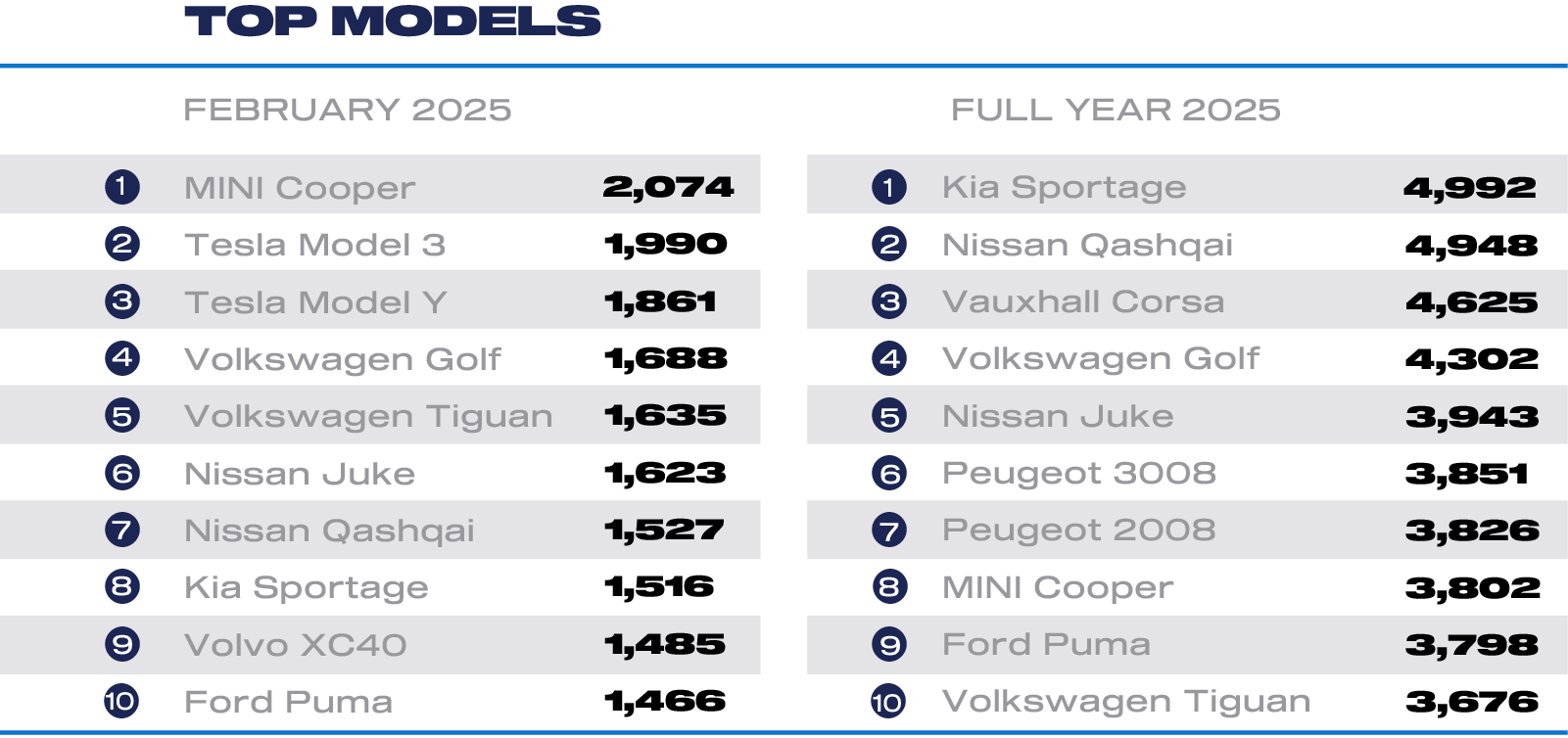

Mini and Tesla top the new car registrations in February

Industry reaction

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), said: "Last month, NFDA submitted its response to the Government consultation on proposals to support the UK's transition to zero-emission vehicles.

"A key focus of NFDA’s response is the urgent need for incentives, emphasising that stimulating consumer demand is crucial for driving market growth.

“Looking ahead, next month’s figures will see the added impetus of March being a plate change month, which should provide a boost to the market.

“Dealerships are well-prepared for this rapidly changing landscape, and it is important to note that next month will bring several changes, including EVs becoming subject to Vehicle Excise Duty.”

Ian Plummer, commercial director at Auto Trader, said February's performance is a positive sign for private demand heading into March, despite the slight drop in the overall market.

He said: "The jump in electric sales is also encouraging but we’re still well behind the growth we need to see at this stage in the transition, as well as hit to the government’s 28% target on EV sales.

“The industry is working hard to bridge the price gap between new EVs and traditional cars, but when new electric cars are 24% dearer it is still a challenge for many buyers.

"We need more support to boost demand."

Economic pressures continue to influence consumer decisions

James Hosking, managing director of AA Cars, said economic pressures continue to influence consumer decisions.

While the Bank of England’s recent interest rate cut may ease car financing costs, he said stubborn inflation and the cost-of-living crisis are keeping some buyers on the sidelines.

Hosking said: "The used car market is thriving, driven by demand for more affordable alternatives. The growing availability of second-hand EVs and hybrids is giving budget-conscious buyers more options, further shifting demand away from new vehicles.

"March could bring a much-needed sales boost to new car sales, with the new 25-plate registration change. This biannual update often stimulates demand, particularly for fleet and company car buyers looking to upgrade before tax rule changes take effect.

"The UK car market remains in flux, with new car sales under pressure while used car demand surges. A combination of government incentives, improved EV infrastructure, and greater affordability will be key to sustaining momentum in the transition to electric vehicles while reviving confidence in new car purchases."

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, said pent up demand for the ’25 plate and ongoing incentives should provide a boost to new car registrations in March, but wider economic pressures could temper expectations.

He added: "There is hope that the government's recent consultation on the Zero Emission Vehicle Mandate will deliver clarity for the industry.

"However, successfully navigating the next phase of the mandate and beyond will require a coordinated approach - manufacturers, charging point operators, finance providers, and government bodies must be enabled to work together in addressing the remaining barriers to EV adoption.

"This will ensure a smooth transition to a cleaner, more sustainable future for the UK automotive sector."

February boost to EV market doesn't provide the full picture

Philipp Sayler von Amende, chief commercial officer - Get Your Car, at Carwow, said the February boost to EVs doesn't reflect the true pictre of the UK market or demand.

He said EV sales continue to be dominated by fleets and consumer uptake remains "worryingly low", despite growing volumes of enquiries.

In February, EV enquiries on Carwow were up 87% compared to February 2024, indicating that an increasing number of consumers are considering making the switch.

However, Sayler von Amende said if this increased interest is to be converted into actual sales, the government must step in to provide motorists with more incentives to buy.

He said: "Car manufacturers are also in need of clarity.

"The recent decision by BMW to pause a £600m electric upgrade to ‘Plant Oxford’ highlights the general sense of unease surrounding the Government’s approach to electrification.

"A clear, consistent policy framework – whether that’s working to 2030 or 2035 – will help car makers commit to long-term investment in UK manufacturing."

Login to comment

Comments

No comments have been made yet.