EV need vital boost as new car market records best monthly figures for two decades

Sales of new electric cars held their own during the traditionally slow month of February although the segment still needs a vital fiscal boost if the private buyer is to be convinced to make the switch.

Battery electric vehicle share actually grew during the low-volume month when sales fall in readiness for the new number plate month of March, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

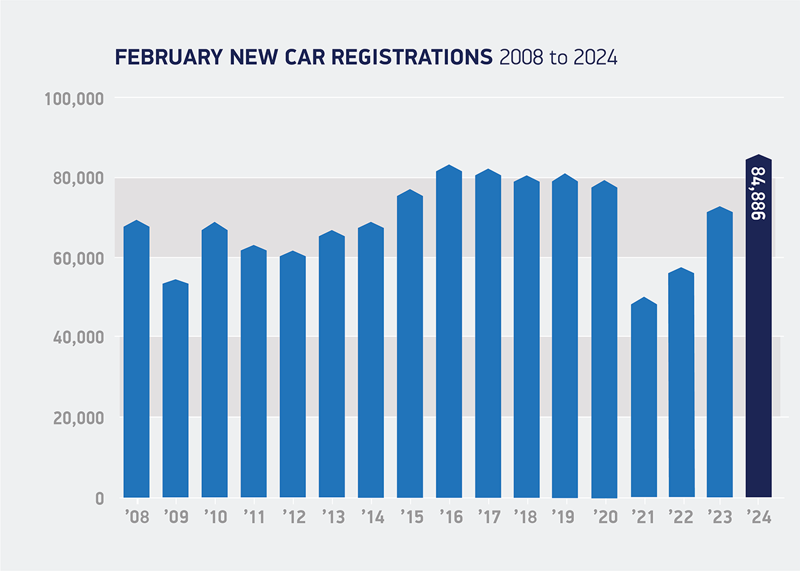

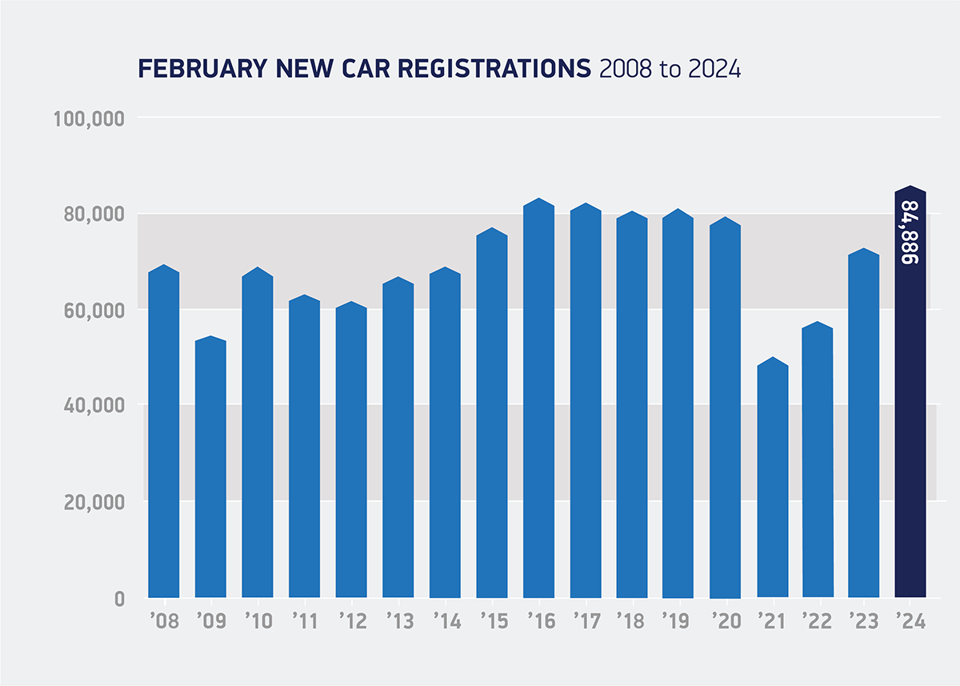

The uptick in electric sales was accompanied by the news that the new car market recorded its best February for 20 years, with new car registrations rising 14% to 84,886 units.

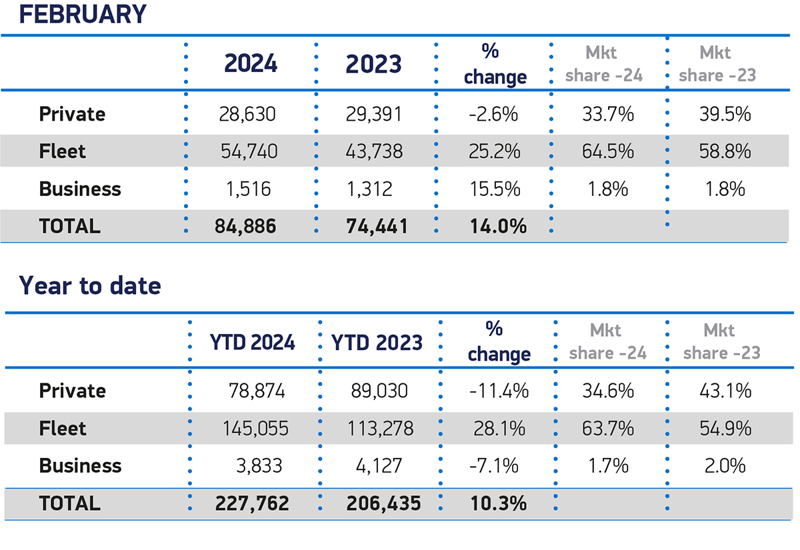

It was the 19th month of consecutive growth, driven exclusively by fleets investing in the latest vehicles. Indeed, fleets and businesses with registrations up 25.2% and 15.5% respectively.

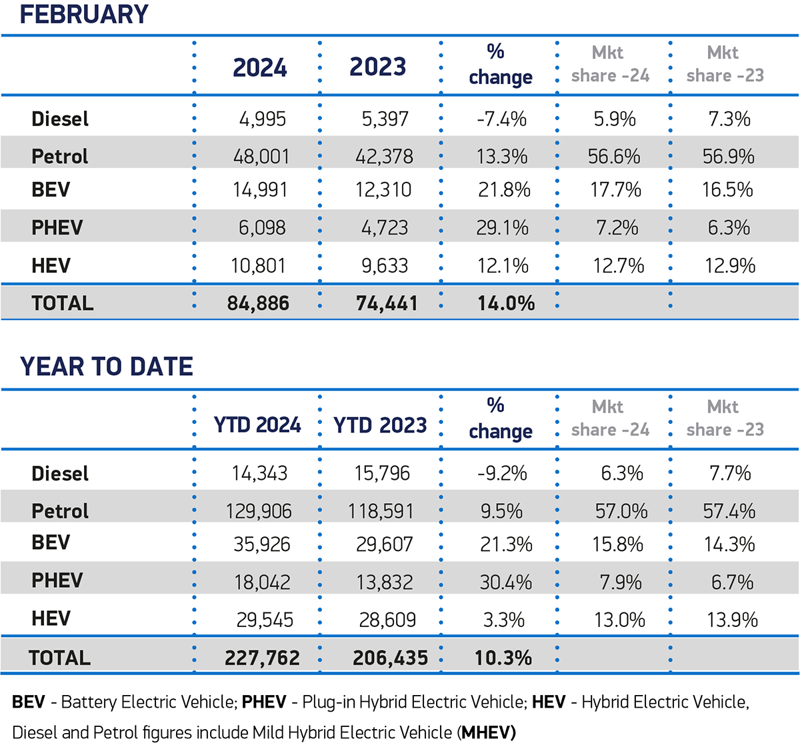

Electrified vehicles recorded robust growth, with hybrid electric vehicles (HEVs) rising 12.1%, but taking a marginally smaller year-on-year market share of 12.7%. Plug-in hybrids (PHEVs) recorded the largest proportional growth for the month, rising 29.1% to reach 7.2% of the market.

Battery electric vehicle uptake similarly outpaced the rest of the market, rising 21.8% to account for 17.7% of registrations, an improvement on last year’s 16.5%.

The SMMT said that while February’s growth is positive and demonstrates robust demand for the latest vehicles, the long-term picture will become clearer in March, the busiest market month.

It noted that while the BEV market share and volumes continue are set to grow during the first year of mandated targets for manufacturers, future growth is uncertain as the increase in uptake is currently being sustained by fleets, due to the tax breaks on offer.

Indeed, private uptake continued to struggle with a -2.6% decline to record a 33.7% market share with buyers accounting for fewer than one in five (18.2%) new BEVs registered in 2024 so far.

This fall-off has prompted industry to call for fairer EV taxation to reverse the decline in private EV uptake.

“A faster, fairer market transition depends on more private buyers switching but the lack of significant incentives is holding back many,” said the SMMT.

“Tomorrow’s Budget is an opportunity for the Chancellor to stimulate demand by halving VAT on new EVs for three years, amending proposed Vehicle Excise Duty (VED) changes, and reducing VAT on public charging in line with home charging.”

It pointed out that while consumers do not pay VAT on other emission reduction technologies such as heat pumps and solar panels, private EV buyers pay the full 20% levied on all cars, whether they be electric, petrol or diesel. Halving VAT on new EV purchases would save the average buyer around £4,000 off the upfront purchase price – yet cost the Treasury less than the Plug-in Car Grant that was scrapped in 2022.

Similarly, upcoming changes to Vehicle Excise Duty next year would see the majority of BEV buyers effectively penalised £1,950 for going electric due to the ‘expensive car’ supplement. Furthermore, those unable to charge a BEV at home currently pay a ‘pavement penalty’ of 20% VAT on public charging – quadruple the rate paid by those with the opportunity to charge at home.

Mike Hawes, SMMT chief executive, said: “This week’s Budget is an opportunity to ensure that growth is greener. Tackling the triple tax barrier as the market embarks on its busiest month of the year would boost EV demand, cutting carbon emissions and energising the economy. It will deliver a faster and fairer zero emission transition, putting Britain’s EV ambition back in the fast lane.”

“February’s figures reinforce the robust performance of the UK automotive sector, maintaining a strong start to 2024 and signalling a nineteenth month of consecutive growth,” said Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK.

“It is promising to see that electric sales continue to grow after a bounce back last month, particularly as OEMs seek to meet the targets set by the ZEV mandate for this year. In spite of encouraging progress, it is crucial that the Government continues to work with dealers to attain the best outcomes for consumers.”

Ian Plummer, commercial director of Auto Trader commented: “As we’ve highlighted since last summer, we’re seeing very clear signs of the new car market fully pivoting and returning to a ‘push’ model. Manufacturers facing a challenging combination of new regulatory targets, softening retail sales, and increased pressure from new brands, have little choice but to turn to substantial offers to stimulate flat retail demand and entice buyers.

"This is already playing through on our marketplace; new car advert views were up 38% YoY to 6.6m in February. By the end of the month, we saw an especially strong uplift in EV enquiries, doubling to 20% with some manufacturers offering significant discounts to tempt buyers.

“This includes the Honda e:Ny1, with headline offers that fell below £200pcm, helping it to take around 12.5% of all new EV enquiries in February. Clearly, such a strong message of affordability is turning many car buyers’ heads. Average EV discounts remain around 10%, but as the pressure to achieve the strict ZEV Mandate target begins to tighten, this sort of extreme discounting risks becoming more common.

Lisa Watson, director of sales at Close Brothers Motor Finance, noted that its research indicated that only 12% of buyers are planning to purchase an electric car - down from 14% last year although aggressive pricing by Chinese electric vehicle (EV) brands could make EVs more appealing to private buyers.

Responding to the February new car sales figures, Richard Peberdy, UK head of automotive for KPMG, said: “Ongoing pressure on household budgets and a higher cost of car finance mean that it’s still a difficult economic period for many people wanting to buy a new car, and a challenge for those trying to sell them. Overall, the UK market continues to hold up relatively well to this challenge, boosted by flowing supply of new vehicles, discounting on many forecourts, and export demand.

“While the used EV market is growing, sales growth of new EVs to consumers has plateaued. Many in the car industry are looking to this week’s Budget and hoping that demand can be stimulated by the likes of cutting VAT on EV purchasing and at public charge points. Increasing EV sales is now all the more important after the Zero Emission Vehicle Mandate began this year.”

Login to comment

Comments

No comments have been made yet.