Consumer demand, speed of sale and transactions in the used car market all rallied in February, according to the latest data from Auto Trader.

Despite such favourable market conditions and robust underlying market health, average retail prices were down -8.3% year-on-year (YoY), marking the sixth consecutive month of decline.

There are signs, however, of retail prices stabilising, with February recording the lowest rate of month-on-month (MoM) contraction (-0.6%) since October 2023.

Demonstrating the strength of the used car market, Auto Trader recorded circa 81.7 million cross platform visits to its marketplace in February, which is a 9.4% increase on the same period last year.

This increased engagement on site is being fuelled by the robust levels of consumer demand; Auto Trader’s data shows that demand was up 8% YoY in February, which is an uptick on the 6% recorded in January.

Reassuringly, Auto Trader’s consumer research points to sustained demand, with circa 80% of in-market car buyers surveyed claiming to be as confident in their ability to afford their next car as they were last year; nearly a third (31%) said they were ‘much more’ confident.

Current demand is further highlighted by the current speed at which used cars are selling. In fact, it took an average of just 27 days for a used car to sell in February, the fastest speed of sale in 12 months, and a significant acceleration on the 40 days recorded in January.

Highlighting the nuances of the retail market, cars sold even faster within certain segments; for example, the average 3-5-year-old car took just 26 days to sell, and volume brands took just 25. As a result of this strong demand, Auto Trader data has reported a similar uptick in transactions, with its retail sales tracker recording a YoY growth of around 3% in February.

As well as consumer demand, February saw an increase in the level of supply entering the used car market with the rate of growth rising 2.8% on the same period last year. It marks the largest year on year supply growth since October 2022 and is being fuelled by the 15.5% increase in cars aged over 5-years-old. Potential overall growth, however, is hampered by the ongoing squeeze on supply of 1-5-year-old stock (-13.7% YoY) as the circa 3 million ‘missed’ sales during the pandemic continues to flow through the market.

Despite the overall increase in February, supply growth remains well below growth in consumer demand, and as a result, Auto Trader’s Market Health metric, which assesses potential market profitability, rose 5.1% YoY in February, up from the 4.2% recorded in January.

Whilst Market Health was largely up across all market segments, as with speed of sale, there’s significant nuance, influenced by variances in supply and demand dynamics. For example, exceptionally strong demand for cars aged below 12 months, up circa 32% YoY, is almost equally matched by a 30% uplift in supply, and as a result Market Health increased just 1.4%.

Those aged 1-3, however, saw demand increase 15.8% YoY, far outpacing the -15.3% drop in supply, and as such, Market Health increased a confident 37%. Demand for used petrol cars (6.2%) was only just ahead of supply (5.6%), resulting in a conservative 0.6% increase in Market Health. But in contrast, demand for used electric vehicles surged a massive 81.5% YoY in February, which combined with a -1.1% fall in supply, drove a whopping 83.6% increase in Market Health.

Despite these favourable market conditions, Auto Trader is seeing under-pricing of high demand stock, which is likely in response to trends in wholesale values, which remain down circa -13.4% YoY. Auto Trader data shows circa 41,000 cars with a high Retail Rating score currently being advertised below their market average from the first day of being listed. This behaviour – basing prices on trade rather than retail – is not only unduly pulling average prices down, but also eroding retailers’ margins, potentially costing around £27m.

Commenting, Richard Walker, Auto Trader’s data & insight director, said: “February was another positive month for the used car market – demand was strong, stock sold quickly, and more cars were sold than last year. It’s disappointing therefore that retail prices were below where we would expect them to be given the otherwise very robust market health.

“Wholesale values are improving, and the number of vehicles being underpriced is falling, but still too many retailers are being guided by trade rather than retail, and the result is an unnecessary erosion of margin. To maximise the full potential currently available in the market, I’d strongly urge retailers to utilise our valuations data, which is based on the largest single view of the retail market and available to all our partners.”

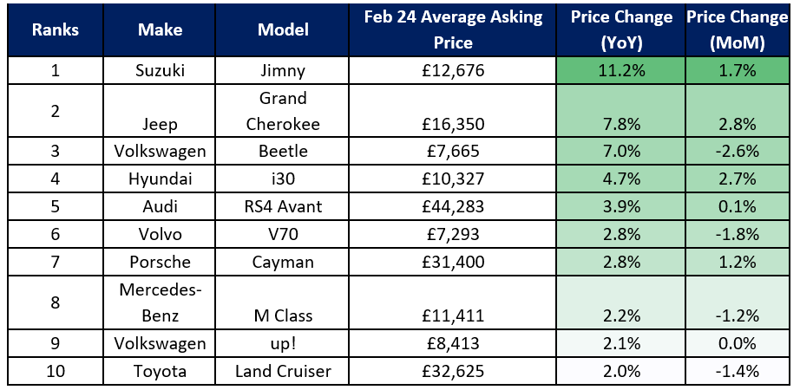

Top 10 used car price growth (all fuel types) | February 2024 vs February 2023 like-for-like

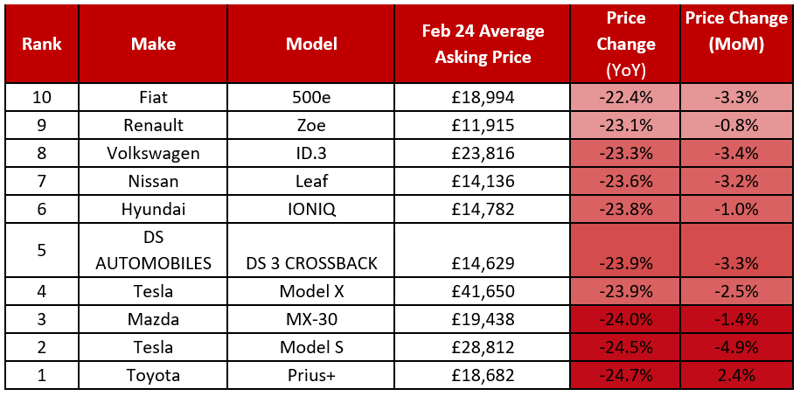

Top 10 used car price contraction (all fuel types) | February 2024 vs February 2023 like-for-like

Login to comment

Comments

No comments have been made yet.