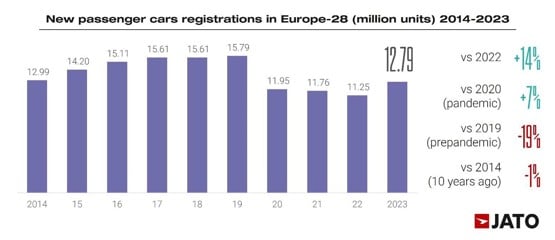

Sales of new cars across Europe last year reached 12.79 million units, precisely three million below the 2019 peak but the highest result since the COVID pandemic.

The result was almost the same as 2014's European market. The main markets driving the growth were the UK, France, Italy, Spain, Belgium, Portugal, Croatia and Cyprus.

“Europe’s automotive market appears to be normalising. Supply chain issues are now largely under control, and consumers have become accustomed to waiting longer to receive new vehicles. Despite this, it is unlikely we will see volumes surpass the 15 million units recorded in 2019. Purchasing a vehicle has become more expensive, and attitudes to ownership continue to change,” said Felipe Munoz, global analyst at JATO Dynamics.

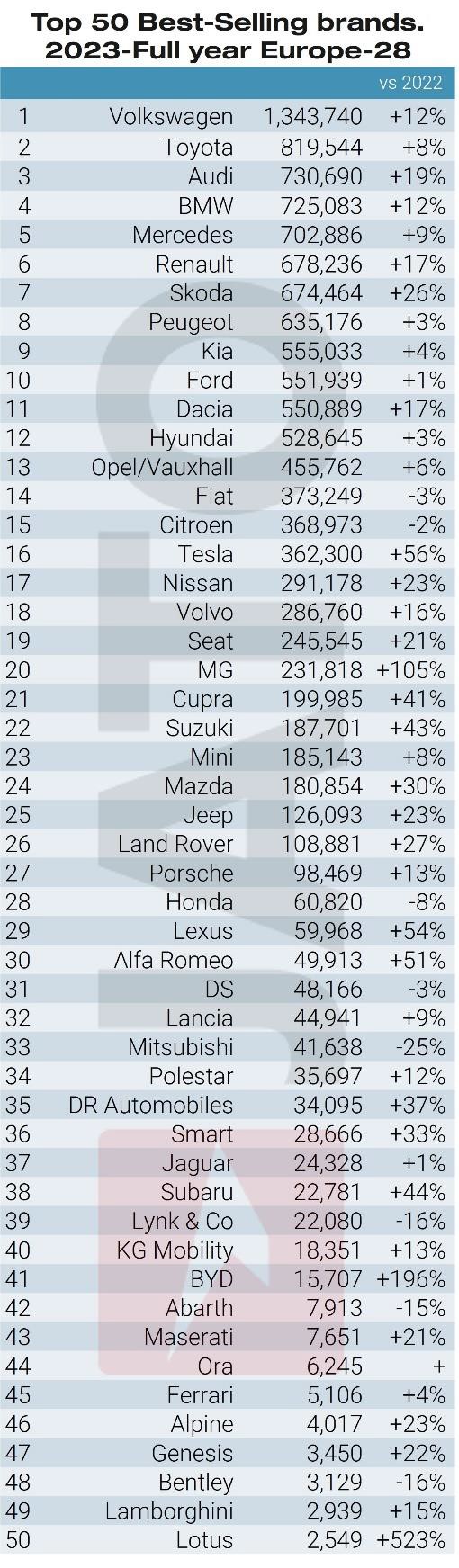

Germany’s Volkswagen Group held the largest market share in Europe in 2023, rising to 25.8% from 24.7% in 2022. Its Volkwagen, Audi, Skoda, Seat and Cupra brands all gained market share last year, which JATO said was a result of their strong EV line-ups and attractive deals for older models such as the Audi A4, A1, and Q2 and the Seat Ibiza.

The Tesla Model Y became Europe’s most-registered model in 2023 – both the first time a non-European model and an electric model have led the rankings – thanks to the Tesla Model Y's dominance of new car markets in Norway, Denmark, Sweden, Netherlands, Belgium, Switzerland, and Finland.

The Tesla Model Y became Europe’s most-registered model in 2023 – both the first time a non-European model and an electric model have led the rankings – thanks to the Tesla Model Y's dominance of new car markets in Norway, Denmark, Sweden, Netherlands, Belgium, Switzerland, and Finland.

JATO said much of the growth in Europe’s new car market in 2023 was driven by BEVs (battery electric vehicles), which accounted for 15.7% of total market share with 2,011,209 units registered. This marks a new high for the category, and cements Europe’s status as the world’s second largest market for BEVs, behind China (~5 million units) but ahead of the US (1.07 million units).

JATO said much of the growth in Europe’s new car market in 2023 was driven by BEVs (battery electric vehicles), which accounted for 15.7% of total market share with 2,011,209 units registered. This marks a new high for the category, and cements Europe’s status as the world’s second largest market for BEVs, behind China (~5 million units) but ahead of the US (1.07 million units).

But attracting more private buyers to spend their own money on a BEV is still an industry-wide challenge. Only 39% of overall BEV registrations were made by private buyers, down nine points from 2022

“Although growth stalled in November and then fell sharply in December, incentives are continuing to support BEV uptake across Europe. But when looking at the data by registration type, it becomes clear that incentives are only currently appealing to companies, fleets and rentals,” Munoz said.

“The lack of interest from private buyers is a major hurdle for the industry to overcome. Sales to private individuals tend to be the most profitable for carmakers, and so it’s imperative that they do more to attract this type of customer."

The number of Chinese brands now selling new cars in Europe increased from 23 to 30 during 2023, according to JATO, however only eight of these achieved more than 1,000 registrations and MG accounted for 72% of all Chinese brands' 321,918 new car sales in 2023.

“Although Chinese brands recorded a record market share of 2.6% in 2023, up from 1.7% in 2022, claims of an “invasion” have been overstated,” said Munoz.

He added: "MG is benefitting from offering competitive and appealing products made in China but making use of its status as a legacy British brand."

Login to comment

Comments

No comments have been made yet.