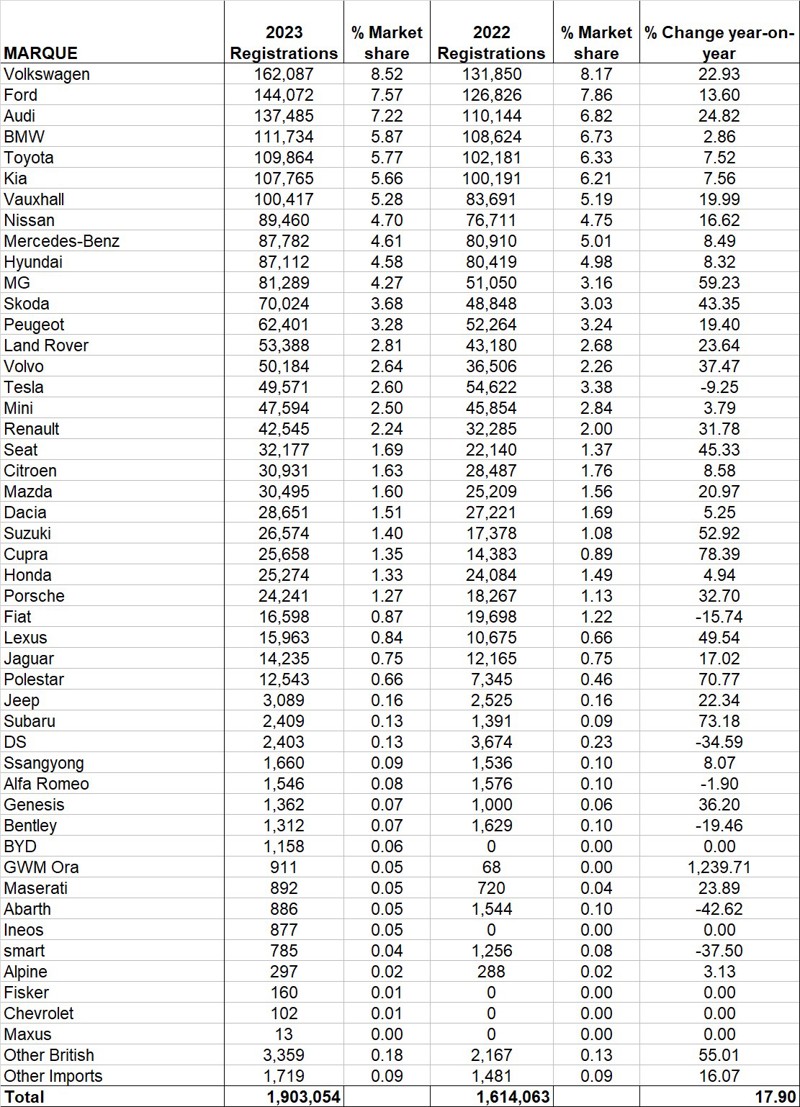

Volkswagen dominated the UK’s new car market in 2023, ending the year with 162,087 registrations and market share of 8.52%, almost a whole percentage point ahead of nearest rival Ford’s 7.57%.

Only seven car brands achieved market share above 5%: VW, Ford, Audi, BMW, Toyota, Kia and Vauxhall.

In contrast, there are now more than 20 new car brands that have less than 1% share of the UK market. This includes an influx of new brands such as Ineos, BYD and Fisker, together with some long-established carmakers that have declined, such as Fiat, Jaguar, Jeep and SsangYong.

More new entrants in the next few years will dilute the market further, if they do not force out some of the stragglers, making brand choice even more challenging for both franchised dealers and UK motorists.

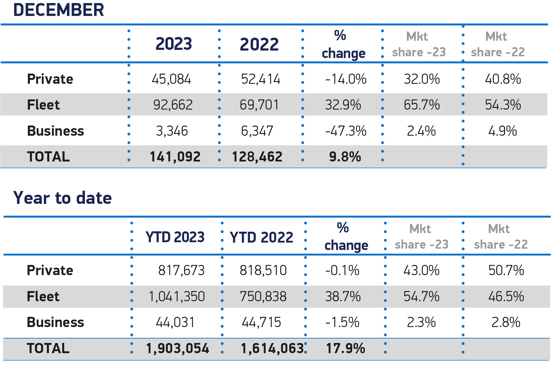

The Society of Motor Manufacturers and Traders celebrated that the UK’s new car market reached its highest level since the pandemic, with 1,903,054 new car registrations, a 17.9% year-on-year increase.

The Society of Motor Manufacturers and Traders celebrated that the UK’s new car market reached its highest level since the pandemic, with 1,903,054 new car registrations, a 17.9% year-on-year increase.

Private demand has stagnated, however, with 817,673 sales a 0.1% drop on 2022’s private sales. It was the fleet segment which recorded all the growth, as increased levels of new car supply drove OEMs to resupply the corporate, rental and own fleet customers that had been de-prioritised during the recent supply constraints.

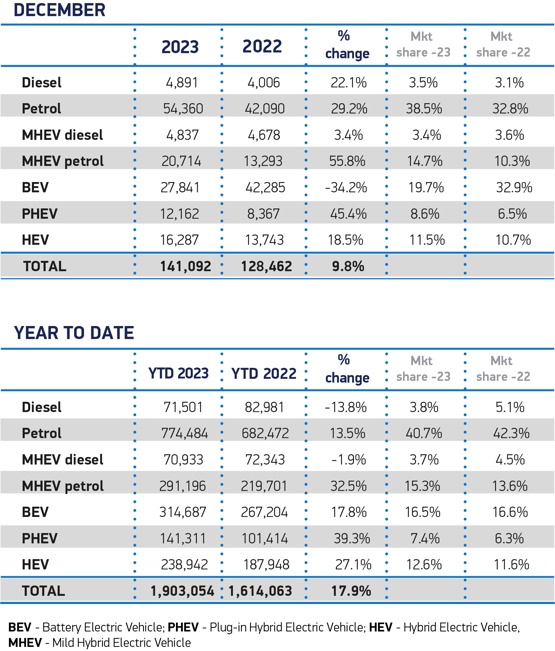

Registrations of battery electric vehicles (BEV), also known as pure electric cars, rose almost 50,000 units to 314,687 new registrations by the year-end. The BEV share of the market was flat, at 16.5%, which will concern some industry observers given the ZEV Mandate now introduced and a relatively short timespan to convince most new car customers that an EV should be their choice. Currently just one in 11 private buyers picks a pure electric car. Three quarters of BEV registrations are in the fleet market, where taxation benefits incentivise them.

The SMMT also warned that he next few months are also likely to be volatile due to the regulatory uncertainties that have beset the market over the past few months – most obviously the last-minute deal on UK-EU Rules of Origin, which avoids tariffs on EVs but which has made planning difficult.

Mike Hawes, SMMT chief executive, said: “With vehicle supply challenges fading, the new car market is building back with the best year since the pandemic. Energised by fleet investment, particularly in the latest EVs, the challenge for 2024 is to deliver a green recovery.

“Government has challenged the UK automotive sector with the world’s boldest transition timeline and is investing to ensure we are a major maker of electric vehicles. It must now help all drivers buy into this future, with consumer incentives that will make the UK the leading European market for ZEVs.”

The SMMT currently forecasts the 2024 new car market to reach 1.97 million units, of which 439,000 will be BEVs to achieve a 22.3% market share.

Rod McLeod, director of Volkswagen UK, said: “I am once again pleased that Volkswagen has secured top spot in the UK for new-car sales. This tremendous result speaks volumes for the quality and attractiveness of our cars, and for the fantastic work of our network partners, who continue to give customers outstanding service before, during and after delivering their new cars.

“This year we will continue to expand our award-winning ID. range of electric cars, and of course we have the 50th anniversary of the Golf as well as many more exciting new products to look forward to.”

John Veichmanis, chief executive of Carwow, said its recent data revealed that 80% of drivers are considering an EV as their next car this year, in efforts towards a greener 2024. While this is encouraging, he said, to ensure those who are considering switching actually make the change, there is clearly more to be done through financial incentives, clear communication from government and confidence in the charging network.

David Borland, EY UK & Ireland automotive leader, said the disparity between the timing of the ZEV Mandate and the UK Government's delay to the Internal Combustion Engine (ICE) vehicle sales ban until 2035 will "continue to represent one of the most marked challenges to the UK’s EV transition going forward", as OEMs attempt to provide a more compelling proposition to consumers to make the switch.

"And with question marks remaining around the residual values of EVs, while the current profitability of EV sales appears stretched, the road ahead will certainly be a complex one," he added.

“As auto companies in the UK look to build on a significant year of growth in 2023, striking the right balance between their ICE and EV priorities will be critical. The ZEV Mandate will prompt OEMs to place an increasing focus on EVs and how they manage the complexities of product planning, but the full portfolio of powertrain technologies must continue to be considered. With Plug in Hybrid Electric Vehicles (PHEVs) having the highest growth of all powertrain types at nearly 40% for the year, it is clear that they are part of the solution to provide consumers with comfort amid any hesitancy they may have to go all electric in the near term.”

At the National Franchised Dealers Association, chief executive Sue Robinson said the lack of clarity from the Government on EVs, such as the pushing back of the ICE ban from 2030 to 2035, appears to have impacted consumer confidence on electric.

At the National Franchised Dealers Association, chief executive Sue Robinson said the lack of clarity from the Government on EVs, such as the pushing back of the ICE ban from 2030 to 2035, appears to have impacted consumer confidence on electric.

“2024 is set to be an important year for the UK automotive sector particularly with the continued shift towards electric. With the ZEV mandate becoming law on Wednesday, electric vehicles look set to gradually increase their market share and gain ground on petrol vehicles which currently hold the largest market share in the UK.

“However, these figures outline that there remains important issues which the Government will need to tackle for the year ahead such as the availability of EV charging infrastructure across the country. The UK also remains the only major market in Europe without incentives for private buyers with France recently introducing measures and Italy also looking set to offer incentives for EVs. It will also be interesting to view the progress of new Chinese manufacturers which will enter the UK market this year.

“With the Spring Budget announced for March and a General Election expected in Autumn, it is a politically and fiscally important time for the sector and the NFDA will continue to to highlight the issues affecting the auto retail sector and ensure positive progress is made to benefit the industry, consumer and environment .”

Login to comment

Comments

No comments have been made yet.