The UK’s used car market is being held back by younger cars, with the average price of a car less than three years old (£29,699) contracting 3.5% year-on-year, according to the Auto Trader Retail Price Index.

Auto Trader said that rather than faltering demand, the price softening among younger vehicles was due to the recent easing of supply constraints in the market, pointing out that levels of consumer demand for such cars rose 15.1% year-on-year last month, matched by equally robust supply 14.4%. Supply of ‘nearly new’ cars - those aged below 12 months - was up a massive 51% over the same period.

Prices of younger used cars are also being impacted by the current surge in second-hand electric vehicles (EV) entering the market. The volume of EVs aged up to three-years-old advertised on Auto Trader increased 97.4% year-on-year last month.

With the average price of a used EV (£31,618) falling 22.6% yyear-on-year in August due to supply continuing to outpace the otherwise very strong levels of consumer demand for second-hand electric cars, up 68.6% year on year, not only are the average prices of younger age cohorts being suppressed, so too is the overall market.

Highting the influence of these factors on the headline figures, the average price of petrol and diesel cars aged over three-years-old increased 4.9% year on year last month.

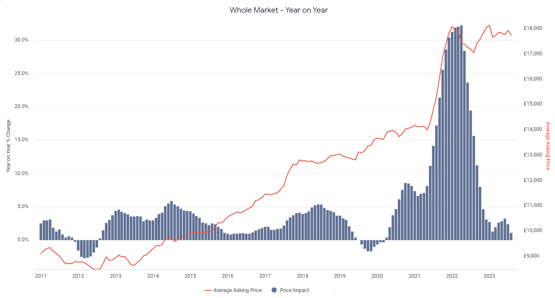

Auto Trader said that supply is slowly improving across most age cohorts, with overall levels on its platform increasing 1.2% compared to last year, marking the first positive total market growth since November 2022.

However, it noted that supply volumes remain constrained by the 3 million or so fewer new cars that weren’t built during COVID, and importantly for future retail values, continue to be outpaced by robust levels of consumer appetite for used cars.

In fact, based on Auto Trader’s Market Insight tool, which tracks levels of consumer engagement on its platform, demand was up 8.7% YoY last month across the market.

A further indicator of the solid levels of consumer demand in the market is the speed in which used cars are leaving retailers’ forecourts. The latest data shows that used cars took an average of just 29 days to sell in August: two days faster than in July, and a day faster than August last year.

Auto Trader’s director of data and insight, Richard Walker, said: “We’ve been seeing growing levels of volatility in the market over recent months as levels of COVID related new car supply gradually improves. However, headline figures can be deceiving, and as ever the devil is in the detail, because contrary to what it may suggest, the market remains full of pockets of profit potential. Our figures should serve as a clarion call for retailers: in such a nuanced market it’s vital to follow the data, and not the headlines to inform pricing and stocking strategies.

“As supply levels of younger stock improves, particularly of electric vehicles, it’s likely we’ll continue to see a softening in prices over the coming months. However, with no sign of a dramatic change in consumer appetites, there’s certainly no indication of prices falling off a figurative cliff edge. There’s still very strong pricing pockets available, including with used EVs – the demand is there, so if retailers use data to buy them and sell them at the right price, there’s plenty of profit potential available.”

Login to comment

Comments

No comments have been made yet.