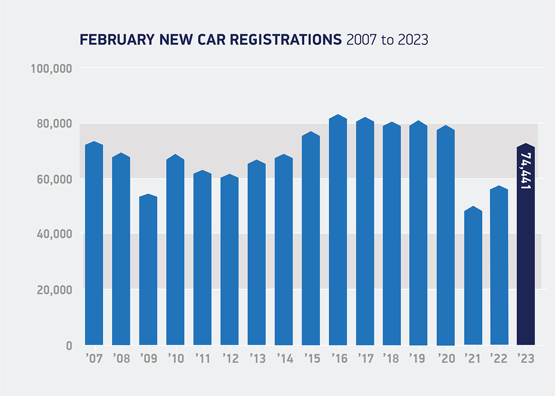

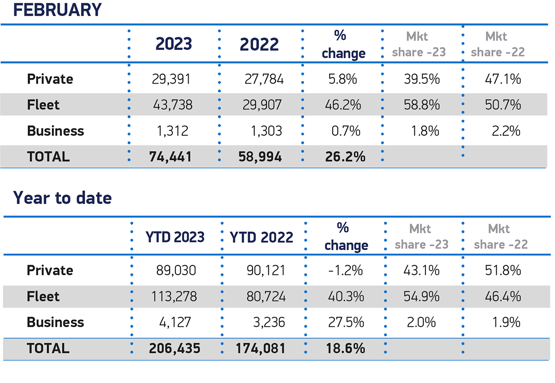

The UK’s new car market experienced a 26.2% year-on-year rise in registrations to register a seventh consecutive month of growth, The Society of Motor Manufacturers and Traders (SMMT) has reported.

SMMT chief executive Mike Hawes said that UK automotive was “facing the future with growing confidence” after 74,441 new cars joined the nation’s roads last month, with freer new cars supplies boosting fleet registrations to a market share up 8.1ppts YoY to 58.8%.

The result was down just 6.5% on the same month in pre-pandemic 2020.

Hawes reiterated calls for Chancellor of the Exchequer Jeremy Hunt to boost the sector in next week’s Spring Budget made following last January’s 0.3% decline in UK car production, however.

Hawes reiterated calls for Chancellor of the Exchequer Jeremy Hunt to boost the sector in next week’s Spring Budget made following last January’s 0.3% decline in UK car production, however.

“After seven months of growth, it is no surprise that the UK automotive sector is facing the future with growing confidence,” said Hawes.

“It is vital, however, that government takes every opportunity to back the market, which plays a significant role in Britain’s economy and net zero ambition.

“As we move into ‘new plate month’ in March, with more of the latest high-tech cars available, the upcoming Budget must deliver measures that drive this transition, increasing affordability and ease of charging for all.”

Last week car retailers from across the UK told AM how they were working to deliver strong March trading, despite continued new car supply issues.

February’s registrations data from the SMMT showed that fleet deliveries are starting to free up after carmaker’s prioritisation of high margin retail registrations in recent times.

February’s registrations data from the SMMT showed that fleet deliveries are starting to free up after carmaker’s prioritisation of high margin retail registrations in recent times.

Deliveries to large fleets rose 46.2% as those to private buyers were up 5.8% during February.

Business registrations, which account for a fraction of the market, increased by 0.7%.

Executive and luxury saloons were the only two new car segments to decline during February, falling 15.4% and 6.3% as minis rose 66.1%, multipurpose vehicles were up 41.9% and superminis climbed 37.7%.

Superminis remained the most popular segment, however, accounting for a third (33.1%) of all deliveries.

Hybrids grew most of all the sector’s fuel types, delivering growth of 40.0%, with petrol up 35.8% to a 56.9% market share as diesel registrations fell 7.0%.

Plug-in hybrid (PHEVs) registrations rose 1.0% and electric vehicles (EVs) were up 18.2% to account for one-in-six new UK car registrations.

In total, plug-ins accounted for almost a quarter (22.8%) of all deliveries during February, with nearly half a million (488,000) now expected to join Britain’s roads in 2023 as more than 40 new models enter the market.

Commenting on the continued growth of the new car market, Auto Trader commercial director Ian Plummer said: “Another month of solid year-on-year growth is a further indicator of growing consumer confidence, and the gradual improvement in supply.

Commenting on the continued growth of the new car market, Auto Trader commercial director Ian Plummer said: “Another month of solid year-on-year growth is a further indicator of growing consumer confidence, and the gradual improvement in supply.

Heavy constraints remain, but the taps are slowly reopening, with levels of new car stock on our marketplace up over 30% on this time last year.

“The growth in fleet sales indicates a buoyant business side of the market.

“The upward trajectory is even more noteworthy given the rising costs faced by car buyers, driven by the industry shift towards more expensive vehicles like EVs and SUVs. Average prices have climbed 43% to an average of £39,000 in just five years.”

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), said she expects a "steady improvement in both new and used vehicles throughout the year".

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), said she expects a "steady improvement in both new and used vehicles throughout the year".

Robinson added: “Steady macro-economic conditions should allow the new vehicle market to deliver a solid year. Franchised dealers continue to assist customers with choosing the right vehicle for their needs, finding appropriate financing schemes and the service plan.”

Jim Holder, editorial director, What Car?, said: “The latest new car sales figures are an encouraging boost for the UK automotive industry, but the ongoing cost of living crisis and high energy prices must be carefully managed for electric vehicle uptake to continue to accelerate as it needs to do in order to meet targets.

"After two years of demand outstripping supply, manufacturers need to be alert to stimulating the market again.”

Login to comment

Comments

No comments have been made yet.