Society of Motor Manufacturers and Traders (SMMT) chief executive Mike Hawes has admitted that the UK car manufacturing sector needs a new "pitch” to remain competitive with global rivals.

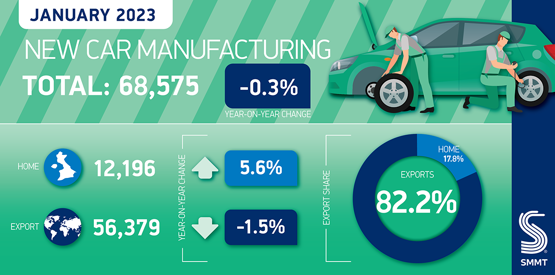

Hawes once again urged the Chancellor of the Exchequer Jeremy Hunt to deliver new policies that will boost the sector’s fortunes following a 0.3% year-on-year decline in production to 68,575 units in January.

The loss – equivalent to 215 cars – was attributed chiefly to structural changes, with Stellantis shifting to van production at Ellesmere Port and supply chain shortages still impacting some manufacturers.

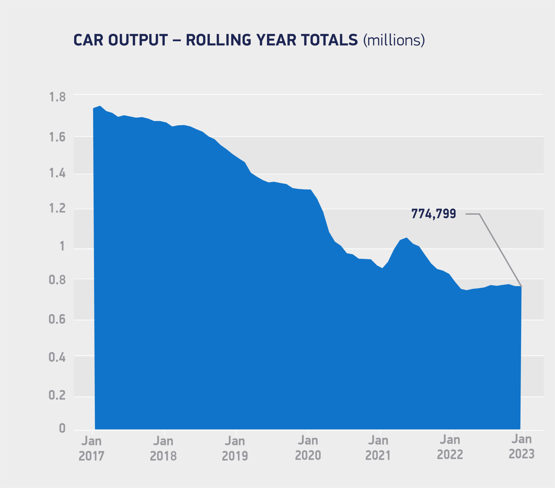

But it follows a 9.8% decline in 2022 as a whole, and prompted Hawes to renew his calls for Government action to secure the future of a sector which has failed to recover production volumes following the COVID-19 pandemic.

But it follows a 9.8% decline in 2022 as a whole, and prompted Hawes to renew his calls for Government action to secure the future of a sector which has failed to recover production volumes following the COVID-19 pandemic.

“Automotive manufacturing can drive long-term growth for the low carbon economy but the sector needs competitive conditions to attract investment,” said Hawes.

“Recent global developments, however, suggest increasing protectionism which, if not challenged or mitigated, could put the UK at a disadvantage.

“To deliver a wholesale industrial transformation we need a competitive framework and a pitch that promotes advanced vehicle manufacturing internationally.

“We now look to the forthcoming Budget for the necessary measures that will enable the automotive sector to deliver its undoubted potential.”

Richard Peberdy, KPMG’s UK head of automotive, said the UK was looking like an increasingly unattractive production base for carmakers.

He said: “Medium to longer-term questions remain unanswered for the industry, despite investing over £10 billion in electric vehicle capability since 2011.

“At present the UK is proving a less attractive proposition for new vehicle manufacturing facilities due to relatively high labour and energy costs, and access to raw materials and chemicals.

“Some countries, like the USA in the form of its Inflation Reduction Act, have developed bold policy moves to encourage inward investment in next generation manufacturing facilities for the electric vehicle supply chain and these are proving effective at securing big bet investments from car makers.

“Whilst the UK is a global leader in high value skills and research, in a globally competitive environment the government and the local industry need to do more to show that it can be a viable manufacturing base for battery and electric vehicle manufacturing at scale.”

Alastair Cassels, partner and head of automotive advisory at MHA, said the Chancellor's Spring Budget was "a real opportunity for the government to help EV manufacturers and current or prospective owners" ahead of the 2030 ban on new sales of petrol and diesel cars and the anticipated Zero-Emissions Vehicle (ZEV) Mandate.

He added: “To remain internationally competitive, the UK needs more domestic battery production. Investments in gigafactories, battery and recycling facilities will enable UK producers to create produce EV products that are more affordable for modest incomes and reduce our reliance on imported Chinese batteries.

“Ultimately, the UK remains in danger of falling behind the US and other European neighbours in terms of investment in EV technology. The government must use the Spring Budget to boost confidence in the sector and reinforce its pledge of decarbonising the transport sector.”

Evidence of UK car manufacturing’s shift to an electrified future was present in plug-in hybrid (PHEV) and hybrid volumes up 49.9% to 28,329 units during January, representing more than four-in-10 (41.3%) vehicles.

Evidence of UK car manufacturing’s shift to an electrified future was present in plug-in hybrid (PHEV) and hybrid volumes up 49.9% to 28,329 units during January, representing more than four-in-10 (41.3%) vehicles.

Total production for the UK market rose 5.6% to 12,196 units, but exports declined 1.5%.

The SMMT said this was largely due to the suspension of shipments to Russia, which accounted for 83.6% of the loss.

In total, some 56,379 cars – more than eight in 10 of all those produced – were destined for overseas markets, with over half of these (56.6%) for the EU, with next most important global destinations the US (9.3%), China (8.8%), Japan (4.4%) and Australia (3.3%).

Login to comment

Comments

No comments have been made yet.