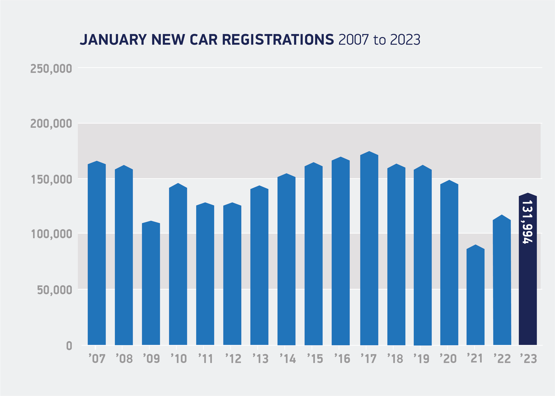

Society of Motor Manufacturers and Traders (SMMT) chief executive Mike Hawes has said the economic outlook, cost-of-living crisis and anxiety over new technology mean the new car market remains ‘fragile’, despite 14.7% January growth.

Hawes said that the SMMT were looking to Government’s Spring Budget for measures that will boost the automotive sector and electric vehicle (EV) sales after 131,994 new cars reached the roads in the first month of 2023.

The latest SMMT forecasts predict an 11.1% market uplift in 2023 to 1.79 million registrations – down 0.8% on October’s forecast – due to “a weak economic backdrop”.

The latest SMMT forecasts predict an 11.1% market uplift in 2023 to 1.79 million registrations – down 0.8% on October’s forecast – due to “a weak economic backdrop”.

It also warned that the delivery of Government’s “green goals” were in danger of delay without charge point mandates and action on VAT and VED.

Just one standard public charger was installed for every 53 new plug-in cars registered in Q4 2022, according to the SMMT – the UK’s weakest performance since 2020.

“The automotive industry is already delivering growth that bucks the national trend and is poised, with the right framework, to accelerate the decarbonisation of the UK economy,” said Hawes.

“The industry and market are in transition, but fragile due to a challenging economic outlook, rising living costs and consumer anxiety over new technology.

“We look to a Budget that will reaffirm the commitment to net zero and provide measures that drive green growth for the sector and the nation.”

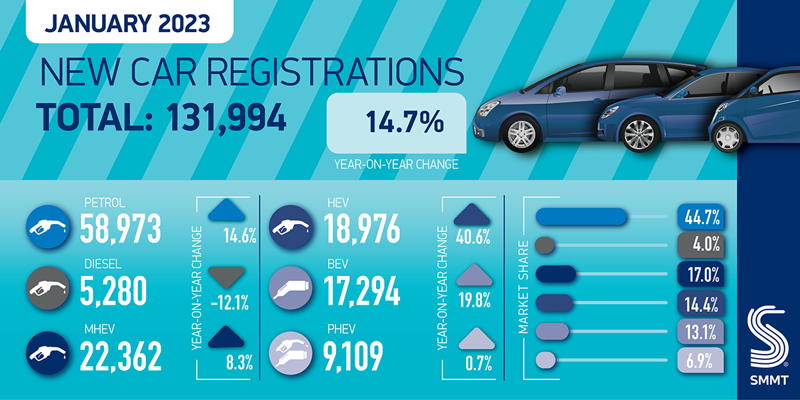

January was a strong month for large fleet registrations, which increased by 36.8% to 69,540 units, while registrations by private buyers fell by 4.3% to 59,639 units, the SMMT said.

Registrations by businesses, the smallest segment at 2,815 units, rose by 45.6%.

Hybrids accounted for 14.4% of new car registrations, increasing volumes by 40.6% as EV registrations rose 19.8% to reach 17,294 units – a 13.1% market share.

Hybrids accounted for 14.4% of new car registrations, increasing volumes by 40.6% as EV registrations rose 19.8% to reach 17,294 units – a 13.1% market share.

Plug-in hybrid vehicles (PHEVs) recorded a 0.7% rise, although their market share fell to 6.9%.

Auto Trader commercial director Ian Plummer said that January’s dip in EV registrations when compared to December’s record, demonstrated that Tesla’s huge quarterly delivery and the impact of annual manufacturer emissions targets had delivered a false representation of demand for zero emissions vehicles.

But he said that OEMs are expected to follow Tesla in price cuts as competition for EV sales hots-up amid faltering demand.

“On our marketplace, demand for new EVs is at a three-year low,” Plummer said.

“In the summer of last year, EVs accounted for nearly 30% of all new car enquiries being sent to retailers. By November, as electricity prices began to rocket, it had fallen to fewer than one-in-five, and today its fewer than one-in-10 as energy prices have risen and some negative commentary have dampened demand.”

Plummer added: “In the absence of government support, manufacturers will likely be forced to move on pricing to stimulate consumer demand, which we’re already beginning to see with the likes of Tesla announcing significant price reductions on key models. And it’s working. Following Tesla’s news, we saw an immediate 113% spike in Model 3 page views on our marketplace.

Plummer added: “In the absence of government support, manufacturers will likely be forced to move on pricing to stimulate consumer demand, which we’re already beginning to see with the likes of Tesla announcing significant price reductions on key models. And it’s working. Following Tesla’s news, we saw an immediate 113% spike in Model 3 page views on our marketplace.

“As the race to EV dominance accelerates, I have no doubt we’ll see other brands follow suit, albeit probably with customer offers rather than list price cuts.

“While the industry won’t welcome the pricing and profitability challenge, if EVs are to achieve mass market success, they’ll need to bridge the current price gap of around 35% between similar EVs and their petrol or diesel equivalents.”

The SMMT is hopeful of government support to bolster EV sales.

It has proposed a reduction of VAT on public charge point use from 20% to 5% - in line with home charging – and a review of proposals to make EVs liable to VED Road Tax in the upcoming Budget.

“Existing plans would unfairly penalise those making the switch, and risk disincentivising the market at the time when EV uptake should be encouraged,” it said.

Login to comment

Comments

No comments have been made yet.