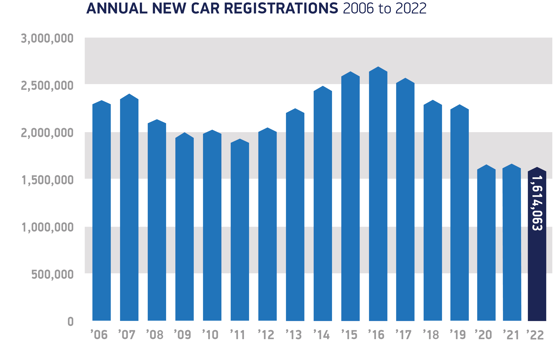

The UK automotive sector remains “adrift of its pre-pandemic performance” after an acceleration in December new car registrations failed to arrest a full-year decline – ending 2022 down 2% at 1.61 million units.

Data published by the Society of Motor Manufacturers and Traders (SMMT) today (January 5) revealed that electric vehicles (EV) delivered a record market share of 32.9% as registrations grew 18% year-on-year to 128,000 units last month.

It was the UK's fifth consecutive month of year-on-year new car registrations growth.

But the sector remained around 700,000 units down on pre-COVID levels, with the SMMT forecasting growth to around 1.8m this year despite ongoing car manufacturing issues and uncertainty about the UK Government’s plans for an EV mandate to drive the adoption of zero-emissions transport.

But the sector remained around 700,000 units down on pre-COVID levels, with the SMMT forecasting growth to around 1.8m this year despite ongoing car manufacturing issues and uncertainty about the UK Government’s plans for an EV mandate to drive the adoption of zero-emissions transport.

SMMT chief executive Mike Hawes said: “The automotive market remains adrift of its pre-pandemic performance but could well buck wider economic trends by delivering significant growth in 2023.

“To secure that growth – which is increasingly zero emission growth – government must help all drivers go electric and compel others to invest more rapidly in nationwide charging infrastructure.

“Manufacturers’ innovation and commitment have helped EVs become the second most popular car type.

“However, for a nation aiming for electric mobility leadership, that must be matched with policies and investment that remove consumer uncertainty over switching, not least over where drivers can charge their vehicles.”

Among the headlines that emerged from the 2023 new car registrations figures was news that a British-built car – the Nissan Qashqai – had become the UK’s best-selling car for the first time in 24 years.

Kia, meanwhile, delivered on its aim of reaching 100,000 registrations, a goal shared with AM at the launch of the Kia Sportage in February last year.

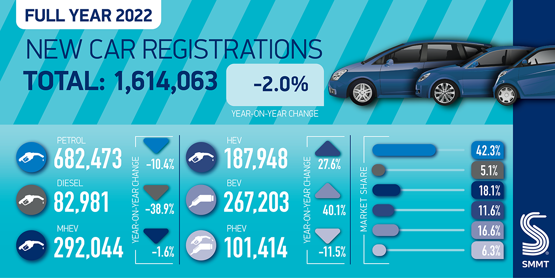

EVs comprised 16.6% of all 2022 registrations, surpassing diesel for the first time to become the second most popular powertrain after petrol.

Plug-in hybrids (PHEVs) delivered a 6.3% decline, however, as hybrid electric vehicles (HEVs) grew to 11.6% market share.

Plug-in hybrids (PHEVs) delivered a 6.3% decline, however, as hybrid electric vehicles (HEVs) grew to 11.6% market share.

The SMMT said that, as a result, average new car CO2 fell 6.9% to 111.4g/km in 2022 – the lowest in history.

It added that delivering the scale and speed of market transition required to meet climate change targets will “require action to enthuse more private buyers to go electric”, criticising plans to introduce VED on EVs from 2025.

While private buyers accounted for more than half of all registrations in 2022, fleets and business buyers accounted for two thirds (66.7%) of all EV registrations.

Despite reclaiming its position as Europe’s second largest new car market by volume in 2022, the UK was 13th overall by plug-in market share at the end of Q3, lagging behind markets including Norway (78.3%), the Netherlands (28.7%) and Germany (23.5%).

Commenting on 2022’s registrations, and the outlook for EV sales in 2023, What Car? editorial director Jim Holder said: “Electric vehicle sales became the success story for the industry last year, outperforming diesel for the first time ever.

“The challenge for 2023 is maintaining that growth as the energy and cost of living crisis continues.

“What Car?’s own research has shown rising energy prices have put off a third of potential buyers from choosing electric, and with manufacturers investing heavily into more electric models, they cannot be left alone to help consumers make the switch.”

National Franchised Dealers Association (NFDA) chief executive Sue Robinson described 2022 as "an irregular year for new car registrations" with the market impacted by wide ranging factors from supply constraints, driven by continued lockdowns and the war in Ukraine, along with the cost-of-living crisis.

National Franchised Dealers Association (NFDA) chief executive Sue Robinson described 2022 as "an irregular year for new car registrations" with the market impacted by wide ranging factors from supply constraints, driven by continued lockdowns and the war in Ukraine, along with the cost-of-living crisis.

She added: “Looking ahead, NFDA and its members remain cautiously optimistic. Franchised dealers are well placed to enable the UK’s transition to electric vehicles through schemes such as Electric Vehicle Approved (EVA), which are in place to ensure consumers receive the correct support in their switch to electric.

“In addition, personal transport remains a key driver of UK new vehicle sales, consumers still regard cars a necessity for both personal mobility needs and travelling to work. We look forward to 2023 as our members continue to help consumers find the right vehicle for their needs.”

Login to comment

Comments

No comments have been made yet.