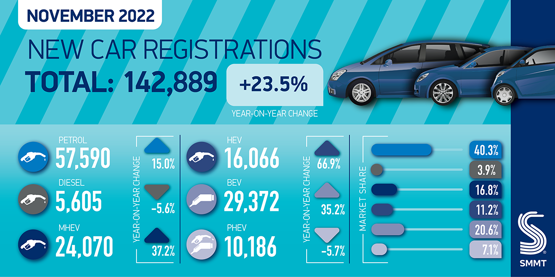

The Society of Motor Manufacturers and Traders (SMMT) said that new car registrations were being energised by electric vehicle (EV) uptake as November delivered 23.5% year-on-year growth.

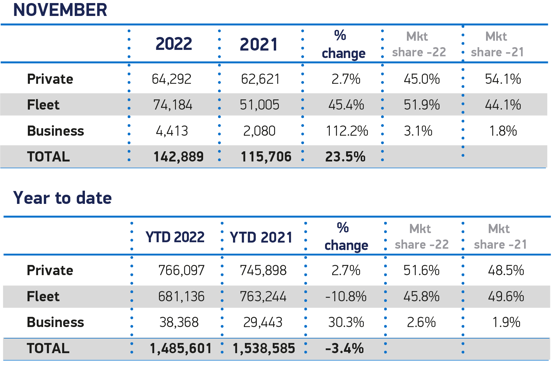

Registrations reached 142,889 units – the highest November total since 2019 – as the sector marked a fourth consecutive month of new car registrations increases.

Plug-in vehicles accounted for 27.7% new registrations (39,558 units) as fully electric vehicles (EVs) took a 20.5% share to register their largest monthly share of the new car market in 2022, the SMMT reported.

Plug-in hybrid (PHEVs) registrations fell 5.8%, making up 7.1% of the market as hybrids rose by 66.9% to 11.3% of the market.

Plug-in hybrid (PHEVs) registrations fell 5.8%, making up 7.1% of the market as hybrids rose by 66.9% to 11.3% of the market.

However, despite November’s growth, the market remained 8.8% below 2019 levels and the SMMT said that global and domestic economic challenges mean that the market “will remain below pre-pandemic levels”.

Chief executive Mike Hawes said: “Recovery for Britain’s new car market is back within our grasp, energised by electrified vehicles and the sector’s resilience in the face of supply and economic challenges.

“As the sector looks to ensure that growth is sustainable for the long term, urgent measures are required – not least a fair approach to driving EV adoption that recognises these vehicles remain more expensive, and measures to compel investment in a charging network that is built ahead of need.

“By doing so we can encourage consumer appetite across the country and accelerate the UK’s journey to net zero.”

The SMMT’s optimism comes as the UK continued to battle double-figure inflation and the prospect of a long-running recession, however, as the affordability of EVs continued to be questioned.

What Car? editorial director Jim Holder urged caution. He said: “It is of major concern that the cost-of-living crisis is now looming over the industry and prompting buyers to delay or cancel buying decisions. At a time when the industry needs to invest huge sums in R&D these contractions are a major concern.

“As energy prices continue to rise this year and next, it will remain to be seen if EV demand slows down, as previous research by What Car? found rising electricity prices result in buyers shunning away from EVs due to higher charging costs.”

“As energy prices continue to rise this year and next, it will remain to be seen if EV demand slows down, as previous research by What Car? found rising electricity prices result in buyers shunning away from EVs due to higher charging costs.”

Manu Varghese, from EY’s UK and Ireland advanced manufacturing and mobility team, said: “A generation of automotive leaders who have never dealt with such an acute and sustained crisis are now forced to plan for different scenarios and navigate the business through several years of turmoil.

"However, automotive dealers, suppliers and OEMs can soften the impact from this winter of discontent by ensuring the right portfolio, competitive pricing and focusing on efficiency."

Large fleet registrations drove the bulk of the volume growth, with volumes up 45.4% on last year, as demand from private buyers grew by a more modest 2.7%. Business registrations more than doubled, meanwhile, up 112.2%, but remain a small fraction of the overall market.

Commenting on November’s registrations figures this morning (December 5), National Franchised Dealers Association (NFDA) chief executive Sue Robinson said: “New car sales rising again demonstrates that consumer demand remains robust and our members are focused on helping customers find the right vehicle for them against long lead times and supply constraints.

“Through our Electric Vehicle Approved (EVA) scheme, we are also helping dealers to advise customers on the transition to EV, a trend that will continue through the remainder of the decade.”

Login to comment

Comments

No comments have been made yet.