The new Prime Minister will put jobs and economic growth at risk unless fast, focussed action is taken to mitigate against soaring costs in the manufacturing sector, the Society of Motor Manufacturers and Traders (SMMT) has said.

SMMT chief executive Mike Hawes urged urgent action from the new PM as he warned of the threat of growing economic headwinds despite a third consecutive rise in car manufacturing volumes in the UK during July.

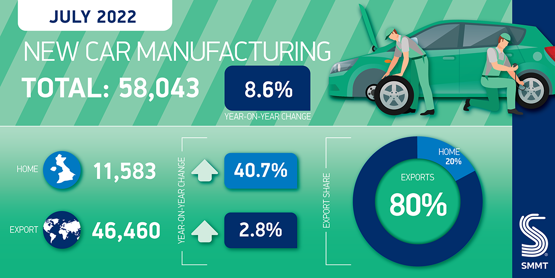

Output rose 8.6% year-on-year to 58,043 units, but remained just 4,605 units ahead of a period which proved to be the sector’s worst performing July since 1956.

Year-to-date, volumes remain 16.5% down (at 461,174) and a sizeable 46.4% below pre-pandemic levels, the SMMT said.

“A third consecutive month of growth for UK car production is, of course, welcome and gives some hope that the supply chain issues blighting the sector may finally be starting to ease,” Hawes said.

“A third consecutive month of growth for UK car production is, of course, welcome and gives some hope that the supply chain issues blighting the sector may finally be starting to ease,” Hawes said.

“But other challenges remain, not least energy costs which are increasing at alarming rates. If we are to attract much needed investment to drive the production of zero emission vehicles, urgent action is needed to mitigate these costs to make the UK more competitive for manufacturing.

“This must be a priority for the next Prime Minister else we will fall further behind our global rivals, risking jobs and economic growth.”

Richard Peberdy, UK head of automotive at KPMG, also called for help from the new Prime Minister as rising energy prices pushed up production costs and the cost-of-living crisis threatened the consumer demand which has driven the automotive sector since the COVID-19 pandemic.

“Rising energy, supply, and labour costs are driving up the cost of car production at a time when many consumers are applying the brakes to their spending plans,” said Peberdy.

“Owing to ongoing supply issues, demand still outweighs supply, but this isn't a save-all for the challenges that the sector faces.

“UK car manufacturers will be looking to the new Prime Minister and government to support the competitiveness of the industry over the coming months, particularly as it looks to seize electric vehicle market share globally.”

SMMT data showed that production for the UK market grew by 40.7% to 11,583 units with exports, which account for one-in-10 cars produced by UK factories, up by a more modest 2.8%.

SMMT data showed that production for the UK market grew by 40.7% to 11,583 units with exports, which account for one-in-10 cars produced by UK factories, up by a more modest 2.8%.

Orders from China and Japan drove the export growth, rising 54% and 40.1%, as exports to the EU and US declined 7.3% and 22.8%.

Almost a third (29.9%) of cars produced in July were electric vehicles (EV), plug-in hybrids (PHEV) or hybrid electric (HEV) amounting to 17,356 units, with BEV volumes up 65.9%.

Lisa Watson, director of sales at Close Brothers Motor Finance, said: “Though the outlook is beginning to look more positive as production levels rise for the third month in a row and the industry shows signs of recovery, persistent issues will continue to cause turbulence in the coming months.

“The ongoing conflict in Ukraine means the well-documented semiconductor shortage is continuing to cause headaches, although the backlog appears to be easing and delivery times are coming down as a result. Renault and Stellantis are expecting to return to normal production following their summer break, which is welcome news for retailers and customers of the brands.

“Other issues, however, such as the Felixstowe strikes, are throwing new hurdles in front of manufacturers. Those relying on the port to ship parts and components in and out of the UK are likely to have their production lines affected.

“As demand may begin to cool due to the soaring cost of living, it is important that dealers continue to use all available market insights and data to ensure their forecourts are well stocked to meet consumer trends.”

Login to comment

Comments

No comments have been made yet.