The UK’s car manufacturing sector saw its productivity choked by COVID-19 triggered staff absences and the global shortage of semiconductor microchips in June.

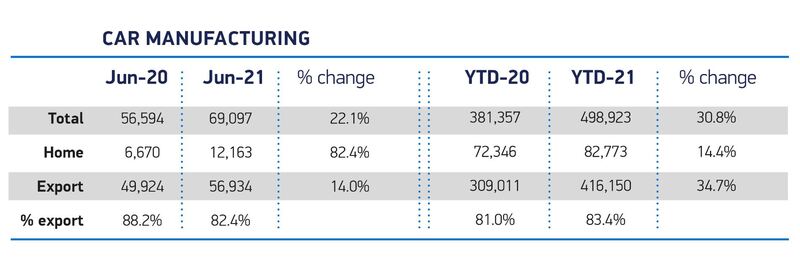

The Society of Motor Manufacturers and Traders’ (SMMT) monthly production data showed that just 69,097 cars roll off production lines last month.

Barring the heavily COVID-impacted June 2020 period, the result was sector’s output volume since 1953, the SMMT said.

It means that UK factories have produced a total of 498,923 cars down in the first half of the year – h down 38.4% on the five-year average for the period.

SMMT chief executive, Mike Hawes, insisted that the UK’s car manufacturing sector “has the capability to recover” from its current onslaught of challenges.

SMMT chief executive, Mike Hawes, insisted that the UK’s car manufacturing sector “has the capability to recover” from its current onslaught of challenges.

Commenting in a week that will also see Honda’s 36-year tenure as a UK car manufacturer end with closure of its Swindon plant this week, Hawes said: “While the UK automotive industry continues to suffer the effects of the global pandemic, with first half year production down significantly and a tough few months looming, the sector has the capability to recover."

Hawes added: “The latest investments into new models and battery production show a bright future is within reach, yet the industry still faces headwinds most notably from global semiconductor shortages and staff absenteeism as a result of staff being ‘pinged’.

“Businesses have ensured their facilities are COVID secure but urgent action is needed, such as bringing forward the 16 August target date for exempting fully vaccinated adults from self-isolation and introducing a 'test to release' scheme to support those employees not yet fully vaccinated.

“Businesses have ensured their facilities are COVID secure but urgent action is needed, such as bringing forward the 16 August target date for exempting fully vaccinated adults from self-isolation and introducing a 'test to release' scheme to support those employees not yet fully vaccinated.

“Operating conditions are still challenging, however, highlighting the need for specific actions to help competitiveness, such as creating a Build Back Better Fund and the alleviation of high energy costs, to get the sector back on track and towards the volumes that make UK facilities viable.”

The SMMT said today that its latest forecasts suggest that the global chip shortage could negatively impact planned UK production volumes by up to 100,000 units this year.

The industry body said that the current situation for UK manufacturers remains difficult, with the supply uncertainty “expected to last into 2022”.

It pointed to recent pledges of significant long-term investment in UK automotive – including Nissan in Sunderland, Stellantis at Ellesmere Port and Lotus Cars in Norfolk – as cause for positivity, but said that “much more such investment is needed if the British vehicle manufacturing sector is to remain in step with its overseas rivals”.

The SMMT recently set-out a series of steps needed to attract such commitments and assure the sector’s long-term competitiveness in its ‘Full Throttle: Driving UK Automotive Competitiveness’ report.

Among its recommendations are the establishment by government of a ‘Build Back Better Fund’ for the manufacturing sector, the construction of gigafactories with 60 GWh of capacity and the installation of 2.3 million public charge points by 2030.

Login to comment

Comments

No comments have been made yet.