A new whitepaper report published by Capgemini has determined that an agency model for franchised car retail, vehicle subscriptions and monetised customer data are now core elements of a sustainable automotive sector.

Following-up from the consultancy’s recent Agency Sales Model report, Capgemini’s new publication aims to advise car manufacturers on how best to cater for the future of mobility, sustainable manufacturing and how consumers and retail transactions should be approached in future.

Entitled ‘Finding a new balance in the automotive industry: Driving responsible innovation and transformation for the next decade’, the report acknowledges that the COVID-19 coronavirus pandemic has shifted many of the industry’s previous goalposts.

Access to a car has gained value during the crisis, it said, with 59% of younger consumers (below the age of 35) now considering buying a car, up from 35% in April 2020, in what it described as “a reversal of their historical preference to avoid vehicle ownership”.

Although OEMs are moving away from fully autonomous solutions, Capgemini said that subscription models now presented an alternative ownership model that was gaining traction.

Citing what it referred to as “small-scale programs such as Access by BMW or Porsche Passport”, the report said that vehicle subscription programs could account for nearly 10% of all new vehicle sales in the US and Europe by 2030.

The trend is part of a shift away from what had been seen as the automotive industry’s ‘megatrends’, “connected, autonomous, shared, electric” vehicles (CASE), towards “sustainability, customer centricity, and intelligent industry”.

The agency model in car retail will be a core component of the change, according to Capgemini.

The agency model in car retail will be a core component of the change, according to Capgemini.

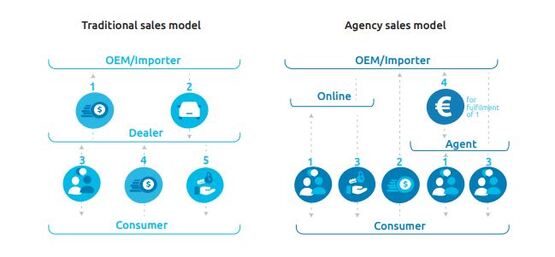

The concept – explored in-depth at AM Live Virtual’s interview with Marshall Motor Holdings Chief executive, Daksh Gupta, and dealer sustainability webinar with ICDP managing director, Steve Young – will see dealers act as an agent rather than a contractual partner.

They will specialise in the activities that require physical interaction, such as coordinating and executing test drives and handling service appointments, the agent plays a decisive role by managing the customer experience.

A recent AM magazine feature explored Capgemini's claims that a wholesale shift to an agency model for franchised car retailers to leverage a 4% increase in revenues in the long-term.

Capgemini’s ‘Agency Sales Model: Accelerating the Future of Automotive Sales’ report concluded that a shift away from a traditional franchised car retail model would not only drive OEMs’ direct customer relationships, but would bring “financial benefits on all sides”.

In its latest report Capgemini said that OEMs must move to leverage the aftersales opportunity presented by the connected car, while monetise consumer data, under such an agreement.

It said: “OEMs need to make sure they offer valuable services to customers, integrate third-party services, and monetize the data gathered.

“The high potential of secure and trusted vehicle data is reflected in global revenue predictions for 2030 ranging between $80bn and $800bn.”

Ultimately, though, Capgemini suggested that OEMs’ biggest challenge was now establishing a position – and then remaining relevant – in “a mobility ecosystem that also includes providers of public transportation, together with mobility enablers such as infrastructure and utility providers, and local and national governments”.

The automotive sector’s last 10 months of accelerated change due to COVID-19 does look set to abate any time soon, it suggested.

You can access the full Capgemini ‘Finding a new balance in the automotive industry: Driving responsible innovation and transformation for the next decade’ report by clicking here.

Login to comment

Comments

No comments have been made yet.