Consumer interest in electric vehicles (EV) grew by 126% in Q3 of 2019 according to data compiled for a Europe wide ‘EV Index’ to determine various markets’ progress in the adoption of alternative fuel vehicles (AFV).

The car buying data analyst aimed to determine what barriers lay between car buyers and zero emissions transport with its new study as it looked for answers to the question of why the high levels of interest had so far translated to an EV Market share of just 3% of new car sales, according to Society of Motor Manufacturers and Traders (SMMT) data.

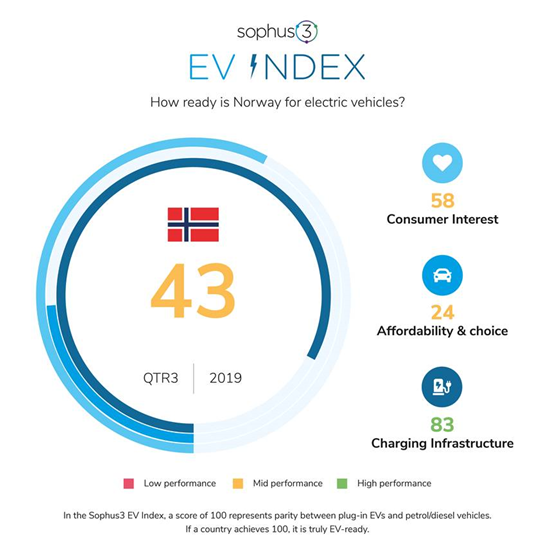

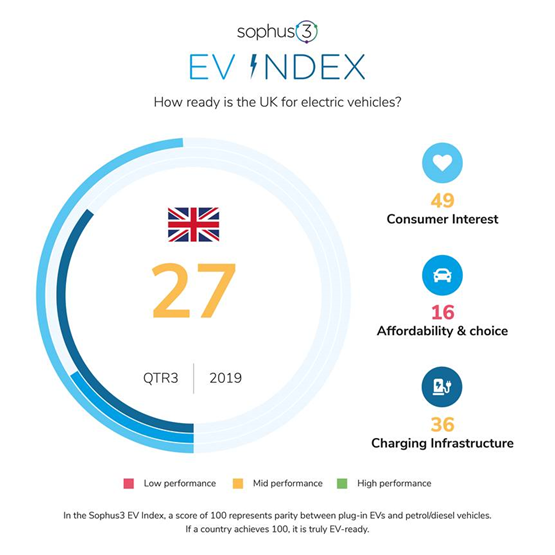

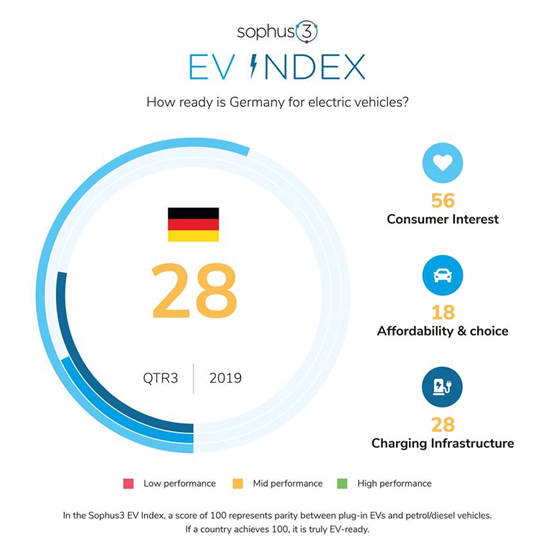

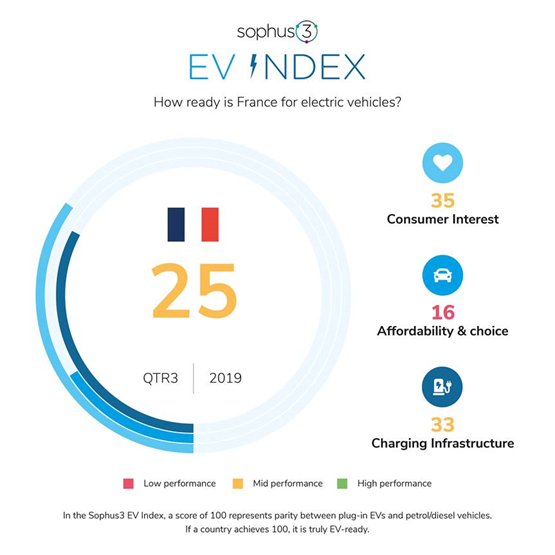

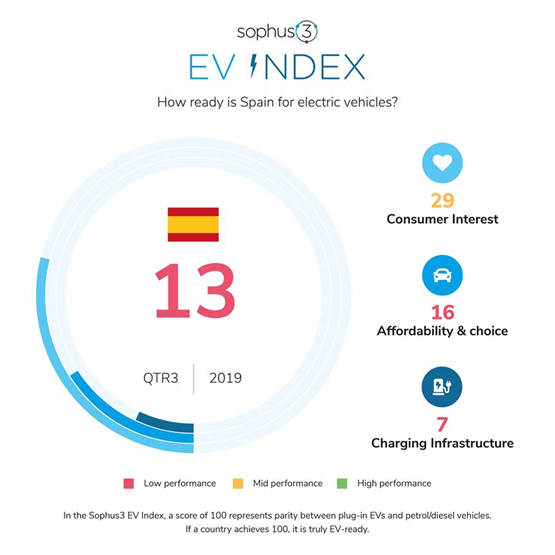

Sophus3’s EV Index awards scores for each country in the European Big 5 – UK, Germany, France, Italy and Spain – plus benchmark country Norway.

Each score is out of 100 and based on three core pillars: consumer interest, EV model availability, and charging infrastructure.

The three pillars give an overall Index score out of 100, with a score of 100 representing complete readiness across all pillars for a shift to EV.

When held against Norway, the world leader in EV adoption, the UK (27 points) and the rest of the European Big 5 are trailing far behind.

Sophus3 said in a statement: “Norway shows what it possible when conditions are right to promote the adoption of electric vehicles, scoring 15 points higher in the EV Index than the next highest country, Germany.”

Scott Gairns, Sophus3 managing director, said: “The fact is CO2 levels are actually increasing, as consumers shift to petrol cars after the diesel scare. EVs aren’t yet an attractive enough alternative.

“The EV Index is arriving at a crucial time, as right now all parties, especially the government, need to address the barriers in the way of the ‘Road to Zero’ ambitions.”

Sophus3 acknowledged that Government incentivisation was key to Norway’s success in making the switch from internal combustion engine vehicles to EVs.

In Norway taxes on petrol and diesel cars are punitive to the point that buying an EV is the cheaper option.

In Germany, the next highest scoring country with an EV Index score of 28, the government recently raised the financial contribution incentive for buying an EV from €4,000 to €6,000.

Commenting on the UK government’s approach, Sophus3 said: “The need for incentivisation was further reflected by the UK government’s decision to scrap the grant for Plug-in Hybrid Electric Vehicles (PHEVs) in October 2018, which prompted a steep decline in sales of PHEVs.

“Year-to-date sales of PHEVs in the UK are down 27% as of October 2019, whilst sales of pure plug-ins, which still receive the subsidy, are up 125%.”

In all five of the big European markets, the demand for SUVs, arguably the antithesis of EVs, shows no signs of slowing, as demonstrated by the most recent European car registrations analysis from Jato Dynamics.

Sophus3’s unique data revealed that across the Big 5, 46% of online consumer interest is in the SUV segment, as measured by webpage visits. The next biggest is hatchback, with just 16%.

It described this trend as “disastrous” in terms of ambitions to curtail road transport’s CO2 emissions.

The International Energy Agency (IEA) warned recently: “If consumers’ appetite for SUVs continues to grow at a similar pace seen in the last decade, SUVs would add nearly two million barrels a day in global oil demand by 2040, offsetting the savings from nearly 150 million electric cars.”

Sophus3’s EV Index looked at the proportion of electric models on offer from manufacturers compared to ICE cars in a bid to examine manufacturer readiness to supply EVs to market.

It also analysed the pricing of the two types of vehicle to calculate the premium that an EV buyer currently pays, and how that may be changing over time.

The study also looked at each country’s charging network, an area in which the UK scored 36 out of 100. This placed it second only to Norway’s 83.

Nissan recently published a statement which claimed that the emergence of 1,000 more electric vehicle (EV) charge point locations than filling station forecourts in the UK is “a tipping point” in the shift to alternative fuel vehicles (AFVs).

But Gairns said there is still work to be done. He said: “When cars became mainstream in the 1960s, taxpayers provided the billions needed to build the road infrastructure to make them usable.

“Electrification needs a similar level of ambition from European governments to match the online interest from car buyers.”

EV Index's ratings of Europe's 'Big 5' and Norway:

Login to comment

Comments

No comments have been made yet.