An 8.7% decline in new car registrations across Europe during August has been attributed to the rush to sell vehicle not compliant with the incoming WLTP a year earlier.

In its latest market commentary, Jato Dynamics said that car registrations in the region totalled 1,070,276 units last month as the market registered an “expected” decline.

It stated that the year-on year-drop could be explained by the introduction of WLTP in September 2018, which “saw many carmakers and consumers push through their purchases (self-registrations and private registrations respectively) in order to get rid of the units that were not homologated or not making use of special discounts”.

Jato said that the shift had been even more apparent when compared to the previous year, as registrations in 2018 increased by 30% compared to August 2017.

Felipe Munoz, JATO’s global analyst, said that the single-digit decrease had been “better than expected”, however.

Felipe Munoz, JATO’s global analyst, said that the single-digit decrease had been “better than expected”, however.

He said: “Last month was the second highest August of the last 10 years. In fact, the volume last month was 19% higher than in August 2017 and was the only time (excluding August 2018) that total volume exceeded one million units for the month.”

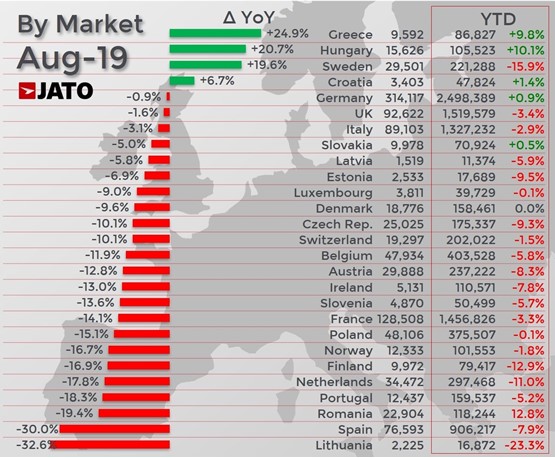

Just four out of 27 European nations posted a increase in registrations compared to August 2017 last month, according to Jato (Sweden, Norway, Ireland and Switzerland), with the UK’s 1.6% decline, reported by the Society of Motor Manufacturers and Traders (SMMT) earlier this month proving to be the second smallest decline.

Segment performance

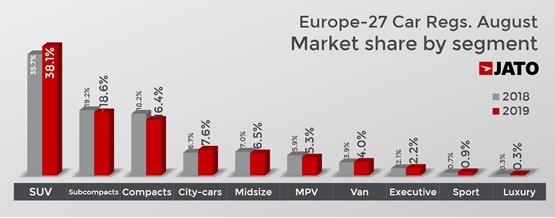

Jato’s insight into the strength of different car model segments revealed that although SUVs continue to lead the market their volumes declined by 3% to 407,700 units last month.

The only two segments to register a positive result were city cars (up 3%) and sports cars ( up 15%).

However, Jato said that the balance was relatively positive when compared to August 2017, when SUV volume totaled 266,000 units and had a market share of 30%, compared to 38% during August.

MPVs, midsize cars, executive cars and compact cars were the only segments to lose ground compared to August 2017.

According to Jato, the strong results for SUVs were mostly boosted by three models: the Dacia Duster; Volkswagen T-Roc; and the Volkswagen T-Cross.

Fuelling sales appeal

Fuelling sales appeal

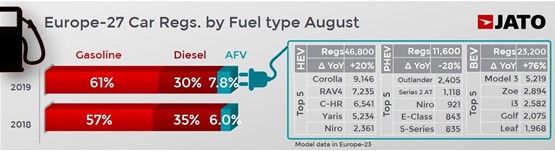

Diesel’s rapid decline continued during August with a 23% decline in sales volume for the fuel type compared to the same month last year, and 16% compared to August 2017.

Diesel’s market share has fell to 30% last month, from 42% two years ago.

Electrified vehicles (BEV, PHEV and HEV) continued to gain traction, with their market share jumping from 5.6% in August 2017 to 6% in August 2018 and 7.8% last month.

A total of 83,700 electrified cars were registered in August 2019.

Hybrids counted for 56%, with Mercedes outselling Lexus and becoming the second largest brand by registrations volume.

Registrations of fully electric vehicles (EVs) totalled 23,200 units, up by 76% on August 2018, and 143% on August 2017 as Tesla’s Model 3 emerged as the top-selling BEV of the month.

Munoz said: “It’s clear that the diesel crisis is not going to stop anytime soon. We’re used to seeing registration peaks for Tesla in Europe at the end of each quarter.

Munoz said: “It’s clear that the diesel crisis is not going to stop anytime soon. We’re used to seeing registration peaks for Tesla in Europe at the end of each quarter.

“However, August showed an unusual result as there was a peak a month earlier. This indicates that the demand is stabilizing at very strong levels.”

But he added: “While EVs are becoming increasingly popular, their high prices remain their biggest limitation for consumers.”

Model of success

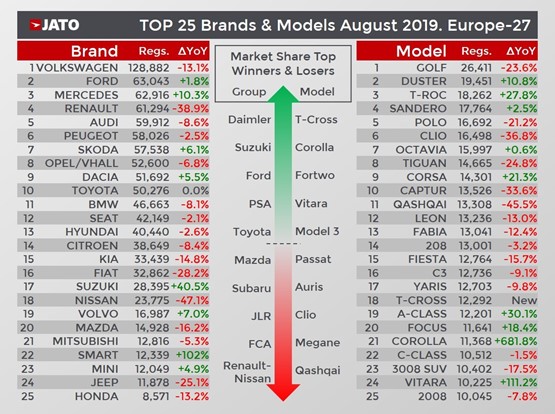

The model ranking shows clear winners for the month. The recently launched Volkswagen T-Cross was the top market share winner hitting the top 20 in 18th.

The Suzuki Jimny, Peugeot 508, Chevrolet Camaro, Peugeot Rifter, Smart Fortwo, Mercedes G-Class, Suzuki S-Cross, Ford S-Max, Suzuki Vitara and Volkswagen T6 all posted very high increases.

Notable highlights among the latest launches include 3,401 units registered of the Seat Tarraco; 4,737 units of the Citroen C5 Aircross, 5,258 units of the Tesla Model 3, 4,884 units of the Skoda Scala and 1,664 units of the Kia Proceed.

Login to comment

Comments

No comments have been made yet.