The used car market has entered the second half of the year with a following wind, sustained by improving consumer confidence and favourable market conditions, according to Auto Trader’s latest Retail Price Index.

These factors are not only driving the speed of sales but also increasing overall sales and stabilising retail prices.

Even so, finding profitable cars is becoming more challenging, forcing retailers to adapt to significant disruption of their traditional stock profiles.

According to the latest data from Auto Trader, the average price of a used car in June was £16,410, reflecting a modest month-on-month decrease of just -0.5%, which aligns with seasonal trends.

Since the beginning of the year, the market has seen robust consumer demand, showing no signs of slowing down.

In June, demand on Auto Trader, measured by advert views and search activity, rose by 12.4% year-on-year, marking the highest rate of demand growth in 15 months.

Further highlighting this demand, Auto Trader recorded 80.8 million cross-platform visits in June, a 10% increase from June 2023 and a significant 21% rise from 2022.

Moreover, used cars are selling in just 29 days on average, three days faster than the same period last year.

This demand is translating into increased transactions, with retail sales data indicating an 8% rise in used car transactions compared to June 2023, building on an already robust 6% year-on-year increase in May.

Market confidence is buoyed by a positive economic outlook, with rising consumer confidence driven by optimism about the economy.

The latest inflation figures have fallen to their lowest level in nearly three years, and the GFK Consumer Confidence Index improved for the third consecutive month in June.

Auto Trader’s consumer research found that 50% of in-market car buyers felt more confident in their ability to afford a new car compared to last year, and 89% were at least as confident as they were 12 months ago.

The growing consumer demand is coupled with a recent drop in supply. While the supply of used cars improved towards the end of last year, it has slowed over the last quarter, with a 4.2% year-on-year decline in June, the largest drop since May 2023.

Cars aged below five years are particularly affected, with those aged 1-3 years and 3-5 years recording drops of 20.6% and 16.7% year-on-year, respectively. Conversely, the supply of 'nearly new' cars (those aged below 12 months) is up 42% year-on-year, due to normalised production levels.

This imbalance between rising demand and falling supply is creating a robust used car market. Auto Trader’s Market Health metric, which assesses potential market profitability, rose to 15% in June, up from 11% in May, marking the highest rate of growth since April 2023.

For stock aged 3-5 years, the metric is up 43% year-on-year, underscoring the nuanced dynamics of the used car market.

Richard Walker, Auto Trader’s data & insights director, commented: “As we enter the second half of the year, our data shows that the fundamentals of the used car market remain solid; consumer demand is robust, and cars are selling at pace.

“This, combined with the softening in supply, means retail prices continue to stabilise. Although this balance of market dynamics is working to return retail prices to seasonal norms, it’s also affecting retailers’ traditional stock profiles and making the job of finding profitable cars more challenging. Using insights over instincts to power your forecourt strategy is more important than ever.”

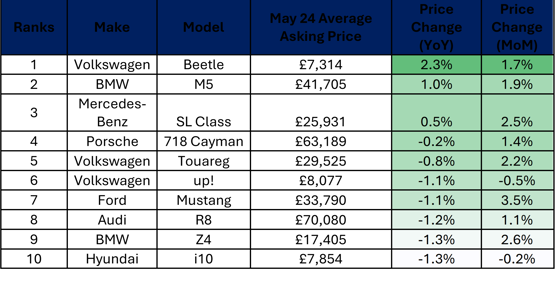

Top 10 used car price growth (all fuel types) | June 2024 vs June 2023 like-for-like

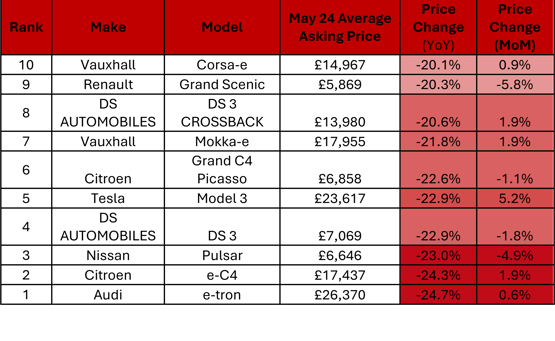

Top 10 used car price contraction (all fuel types) | June 2024 vs June 2023 like-for-like

Login to comment

Comments

No comments have been made yet.