As Inchcape awaits the completion of its Inchcape Retail UK dealer group sale to Group 1 Automotive UK for £346 million, it has revealed a half-year financial performance showing growth in its overseas vehicle distribution and wholesale business.

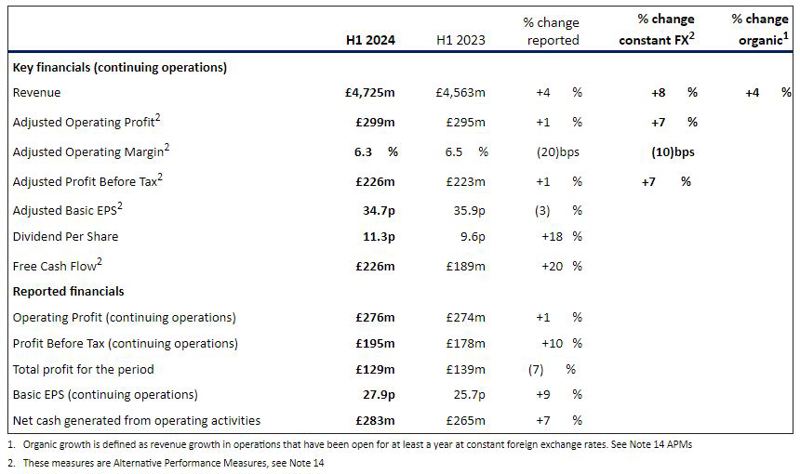

The group demonstrated strong financial performance in the first half of 2024, with significant revenue growth and robust margins. Group revenue increased to £4.7 billion, marking a 4% year-on-year rise, driven by organic growth and acquisitions.

Adjusted operating profit reached £299 million, a 7% rise in constant currency, though currency impacts reduced the reported growth to 1%.

Reported profit before tax was £195m.

Inventory reduced to £2bn due to efficiency improvements and the treatment of Inchcape Retail UK inventory as a discontinued operation. Net interest payments rose to £64m.

The sale of the dealerships, which is expected to complete during before the end of September, will leave Inchcape as a pureplay operator in automotive distribution.

In future Inchcape will further focus on growing its distribution business in small to medium-sized, more complex markets, which are higher growth with low motorisation rates, and it said it has secured more exclusive contracts with OEMs, including Ford in Estonia, JAC Trucks in Colombia and Changan in the Caribbean, as well as with a new partner, Forland, in Ecuador.

Inchcape also continued to develop its proprietary digital and data analytics capabilities, designed to drive superior performance for Inchcape and its OEM partners, and it continued to expand the breadth of coverage of its core artificial intelligence (AI) solutions in new vehicles, aftersales service and parts, including a system providing AI-based quotations for repair services.

It sees opportunities ahead in a range of value-added services, whether relatively high margin OEM-certified parts through a digital parts platform across the APAC region, and strategic partnerships on finance and insurance with key finance houses locally, and battery-related services relating to new energy vehicles, including EVs.

Inchcape's group chief executive Duncan Tait said automotive distribution "is capital light, highly cash generative, higher margin and higher returns" than running retail dealerships.

Inchcape's group chief executive Duncan Tait said automotive distribution "is capital light, highly cash generative, higher margin and higher returns" than running retail dealerships.

Reflecting the group's strong financial position, Inchcape has announced an increased share buyback programme of £150m.

Tait said: "Inchcape delivered a resilient performance in H1 2024, with a strengthening balance sheet, reflecting our scaled and diversified growth portfolio. We delivered strong organic revenue and profit growth, with further high levels of cash generation and returns.

"Our success in winning new distribution contracts continued during the first half, with four contracts awarded in the period. These contracts, along with our investment in acquisitions, will continue to support the business as we grow in existing markets by building market share, expand into new markets and develop our OEM partner portfolio to drive growth.

"With our global market leadership position and our differentiated digital and data capabilities to support our OEM partners, our distribution platform is well positioned for the future. To that end, we reiterate our growth expectations for FY 2024 and remain confident about the medium to long-term outlook for the group."

Login to comment

Comments

No comments have been made yet.