The Financial Conduct Authority has shifted its expectations of finance firms and dealers from the old "treating customers fairly" principle to now an adage of "put their customers' needs first".

The shift comes as the FCA today launched a new Consumer Duty "which will fundamentally improve how firms serve customers" as the financial watchdog continues a transformation to become "a more assertive and data-led regulator".

The Consumer Duty is made up of an overarching principle and new rules firms will have to follow.

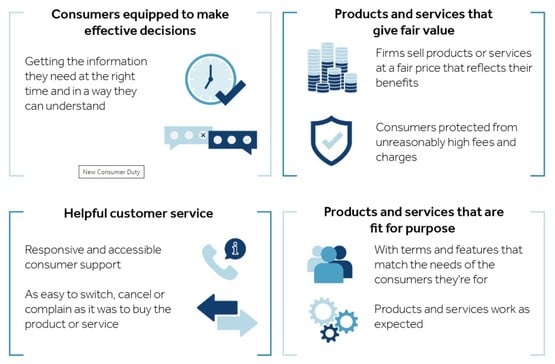

The FCA said it will mean that consumers should receive communications they can understand, products and services that meet their needs and offer fair value, and they get the customer support they need, when they need it.

It also wants to ensure products and services are sold at a fair price that reflects their value.

Financial product providers will be expected to make it as easy to switch or cancel products as it was to take them out in the first place, amid a 'Consumer Principle' that "a firm must act to deliver good outcomes for retail customers".

Sheldon Mills (pictured), executive director of consumers and competition at the FCA, said: “The current economic climate means it’s more important than ever that consumers are able to make good financial decisions.

"The financial services industry needs to give people the support and information they need and put their customers first.

"The financial services industry needs to give people the support and information they need and put their customers first.

“The Consumer Duty will lead to a major shift in financial services and will promote competition and growth based on high standards.

"As the duty raises the bar for the firms we regulate, it will prevent some harm from happening and will make it easier for us to act quickly and assertively when we spot new problems.”

Regulated firms, which include captive and independent finance houses plus car dealers which offer motor finance to consumers, are being given 12 months to implement the new rules for all new and existing products and services currently on sale.

In 24 months the rules will apply to closed book products, that are no longer on sale, to ensure fairer conditions for consumers still paying for these products.

In response, Fiona Hoyle, director of consumer and mortgage finance at the Finance & Leasing Association said: “The consumer credit industry fully supports the underlying principle of the Consumer Duty - that consumers receive clear information about products and services that meet their needs and offer fair value, and that customer support is there when needed.

In response, Fiona Hoyle, director of consumer and mortgage finance at the Finance & Leasing Association said: “The consumer credit industry fully supports the underlying principle of the Consumer Duty - that consumers receive clear information about products and services that meet their needs and offer fair value, and that customer support is there when needed.

“However, today’s announcement thrusts the full responsibility for achieving this objective onto lenders, when in actual fact the real problem is the outdated and opaque, but nonetheless prescribed, information required to be sent to customers by the Consumer Credit Act (CCA)."

She said it is imperative that HM Treasury’s previous agreement to reform the Consumer Credit Act (CCA) is taken forward at pace.

“While we welcome the extension of the implementation deadline for the new Consumer Duty rules, it remains a mammoth task for firms to complete the required work within this timeframe.”

Login to comment

Comments

No comments have been made yet.