Discounting risks undermining the ability of companies to invest in next generation technologies and cannot be sustained indefinitely, according to the Society of Motor Manufacturers and Traders (SMMT).

Its May new car figures reveal that with a choice of more than 100 EV models now available, accompanied by a raft of compelling offers, manufacturers are under pressure to meet new targets which require 22% of new vehicles sold this year by each brand must be zero emission.

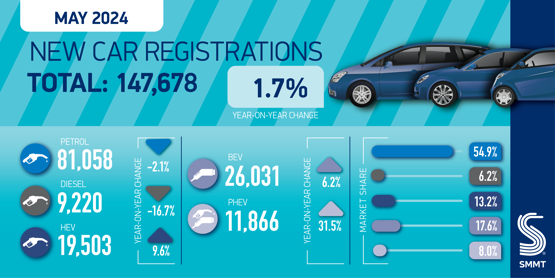

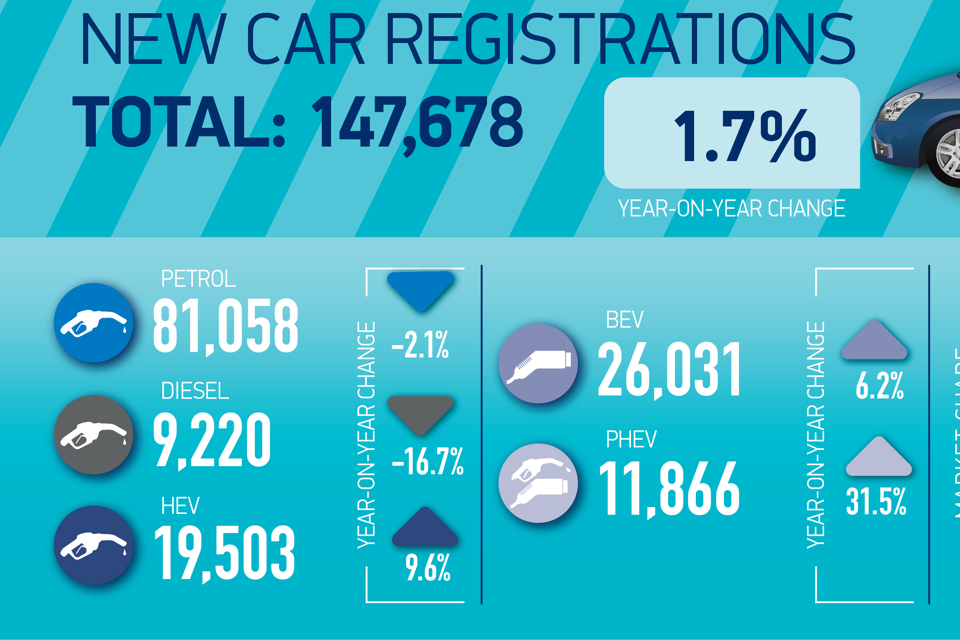

Even so, while battery electric vehicle (BEV) registrations outperformed the market, rising 6.2% to claim a 17.6% market share, up from 16.9% in the same month last year, uptake is still driven by the fleet sector, where volumes rose 10.7%.

Importantly, private retail BEV uptake, fell by 2.0% (just 98 registrations short of May last year).

The SMMT said that while certain private buyers can access some of the benefits enjoyed by business buyers through salary sacrifice schemes, providing universal access to incentives would dramatically increase BEV uptake and accelerate the decarbonisation of road transport.

It advocates for a temporarily halving of VAT on new BEV purchases, combined with a cut in the VAT levied on public charging from 20% to 5% – in line with domestic use – which would drive up demand, potentially adding a quarter of a million EVs over the next three years.

Mike Hawes, SMMT chief executive, said, “As Britain prepares for next month’s general election, the new car market continues to hold steady as large fleets sustain growth, offsetting weakened private retail demand.

“Consumers enjoy a plethora of new electric models and some very attractive offers, but manufacturers can’t sustain this scale of support on their own indefinitely. Their success so far should be a signpost for the next government that a faster and fairer transition requires carrots, not just sticks.”

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), added: “The new electric vehicle market has also seen another month of moderate growth. As has been the trend throughout 2024, fleet continues to be the main driver for new car registrations. A key focus for the next government will be a need to incentivise private demand.

Despite this, the UK new car market marked its 22nd consecutive month of growth as registrations rose 1.7% in May. With 147,678 units reaching the road, it was the best May market performance since 2021, although it remains down some -19.6% on 2019.

Fleets and businesses continued to fuel market growth, up 14.0% and 9.5% respectively, narrowly offsetting a -12.9% decline in private retail uptake.

While deliveries of both petrol and diesel cars fell, demand for electrified vehicles rose, with plug-in hybrids (PHEVs) recording the highest growth of all powertrains, up 31.5% to reach an 8.0% market share, and hybrids (HEVs) rising 9.6%, maintaining their status as the third most popular fuel type after petrol and battery electric at 13.2% of the market.

Ian Plummer, commercial director of Auto Trader, said that a dearth of affordable new car models means less choice for consumers, despite fleet buyers underpinning the market.

“Rising new car prices since 2019 mean that even volume brands are suffering as the middle market is hollowed out. The share of new models for sale below £20,000 in the past five years has dropped from 17% to just 4%, underlining the pressure on affordability.

“The high prices are pushing many more buyers into the used market, where demand is up 9% this quarter on 2023. But they also leave the UK market vulnerable to more affordable competition, for example from Chinese electric vehicles.”

NFDA's Robinson, here, said: “Whilst the new car market has shown remarkable resilience this year, there remains a lot to think about for the political parties during this build up to the General Election."

Login to comment

Comments

No comments have been made yet.