Business secretary Jonathan Reynolds confirmed last night at the SMMT's annual dinner that a fast track consultation will be launched on the Zero Emission Vehicle (ZEV) mandate that could change the way car manufacturers are fined for missing targets.

Reynolds said the Government is still committed to the the 2030 phase out date for petrol and diesel vehicles, but there is a clear need for more support around the fines system that can see manufacturers fined £15,000 for each vehicle sold outside the target.

There is already a credits system in place to avoid fines, but the result of the consultation may result in further changes here.

A credit-based system already exists whereby manufacturers can bank credits if they overperform on their targets. These can be used to bolster performance in future years, when the targets become stricter, or can be sold to other brands that are underperforming.

The Government had previously ruled out weakening electric vehicle (EV) production targets for car and van makers despite mounting pressure from the industry.

The Department for Transport (DfT) has been holding crunch talks with car manufacturers over the last few weeks about the challenges they're facing with ramping up electric vehicle sales, with retail demand still proving to be a sticking point.

Automotive retailers have also called for a relaxation of the ZEV, citing fears over steep sales targets and high fines. Dealers have also shared concerns that the ZEV mandate is creating a false EV market for the retail sector.

Industry commentators are concerned that this DfT fast track consultation will in fact lead to a relaxation of ZEV mandate targets, which requires 22% of all UK new car sales to be battery electric vehicles (BEV) this year, with targets ramping up to 28% next year and then up towards 100% over the next several years.

Representatives from Tesla, Nissan, Ford, Volkswagen Group, Stellantis, BMW and Toyota, as well as trade bodies, the Society of Motor Manufacturers and Traders (SMMT), the British Vehicle Rental and Leasing Association (BVRLA) and ChargeUK, met with the transport secretary, Louise Haigh, and business and trade secretary, Jonathan Reynolds, for the roundtable talks last week.

Nisssan has called for changes to how the ZEV mandate targets are applied, while Stellantis has gone as far as blaming the ZEV mandate for the closure of its Luton plant and putting 1,100 jobs at risk.

Backsliding risks uncertainty

Vicky Read, ChargeUK chief executive (pictured), is hoping that the consultation will actually bring “much needed clarity” to the speculation around the ZEV mandate.

Vicky Read, ChargeUK chief executive (pictured), is hoping that the consultation will actually bring “much needed clarity” to the speculation around the ZEV mandate.

She said: “Government could not have been clearer last week in its meeting with the automotive and charging industries that there would be no tinkering with the percentages of electric cars that

must be sold ahead of 2030.

“Any backsliding on that risks inducing the uncertainty that all sides agreed is the very enemy of the EV transition.”

Read believes the billions of pounds of investment in the EV charging infrastructure roll out will end up being put at risk should the ZEV mandate be redrawn.

She adds: “This would be particularly foolish given the charging industry is busy deploying the infrastructure that is essential for the automotive sector to sell EVs and for the UK to meet its net zero goals.”

Dominic Phinn, head of transport at Climate Group, said that policymakers need to ask themselves a simple question: are they prepared to risk the progress the UK has made in moving towards a cleaner, more sustainable transport system?

Phinn says: "Any changes to this world-leading legislation will seed uncertainty among businesses – threatening investments, business cases and the clear and confident path so many companies across the country have put themselves on.

"There is absolutely no need for a relaxation. Contrary to intense lobbying from a small number of carmakers over recent weeks and months, demand for EVs is strong and growing.

"While sales of petrol and diesel cars are stalling, EV sales now account for 18% of the global market.

"The country’s leading companies need both the volume and the variety of models the ZEV Mandate guarantees, as do British drivers who deserve their next car to be electric.”

Colin Walker, head of transport at the Energy & Climate Intelligence Unit, believes that the flexibilities that are already built into the mandate, including credit for low-emitting petrol cars, mean that manufacturers like BMW, Mercedes, Toyota and Hyundai are on course to meet, or even exceed their obligations in 2024.

Walker says: "The question for those who are struggling has to be, if others can do it why can’t you?

“The reality is that the mandate, conceived and implemented by the previous Government is working, manufacturers are competing to hit targets, driving down prices for consumers.

"As prices come down, sales are going up – 14% higher in 2024 so far than they were at this stage in 2023.

“If it were weakened, prices could well be higher for drivers, and this in turn could slow the growth of the second-hand EV market, leaving millions of households stuck driving dirtier and more expensive petrol and diesel cars for longer.

“It would create regulatory uncertainty, with investors already warning it could delay charging infrastructure projects and undermine the transition to building the EVs that our major export markets increasingly demand.

"Slowing this transition could have dire consequences, with a recent report by CBI Economics estimating that economic output could fall by as much as 73%, with over 400,000 jobs being lost."

Only three car brands set to meet full ZEV mandate targets this year

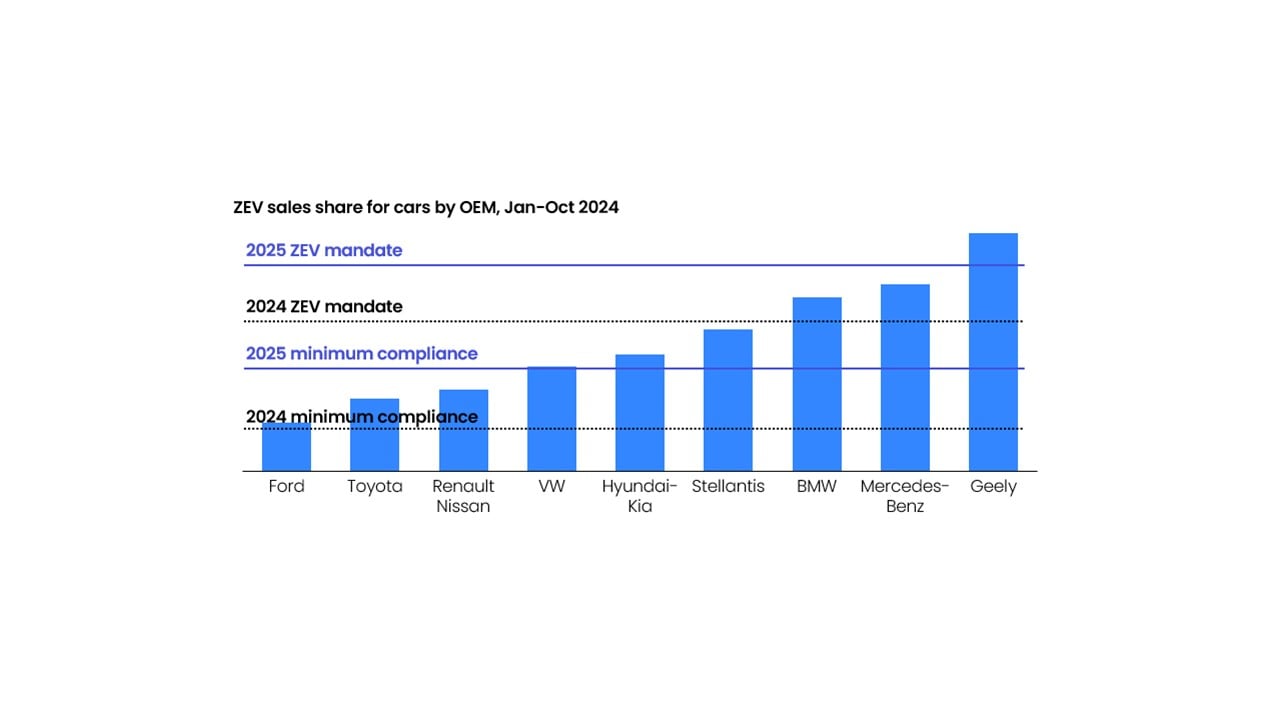

Rho Motion, the EV research-house, is predicting that only three traditional car manufacturers are due to meet the UK’s full 2024 ZEV car mandate.

While most major manufacturers should attain the 2024 minimum compliance level (6% of sales), only BMW, Mercedes and Geely are expected to meet the full 2024 ZEV mandate for cars (22%).

George Whitcombe, Research Analyst at Rho Motion, says: “While we can be buoyed by today’s news that we expect most UK manufacturers to reach the minimum compliance level of EV sales, it’s not without concern for future years.

"European sales figures for the year have been lower than expected as manufacturers struggle to compete with traditional petrol and diesel cars on price.

"If the UK mandate is to be successfully met in the future, manufacturers and consumers need further incentives to go electric.”

According to Rho Motion’s sales figures up until October and projected numbers for the remaining two months, major car manufacturers like Toyota and Ford, are expected to meet the 2024 minimum compliance level for cars but fall short of the full 2024 ZEV mandate which could lead to financial penalties.

However, the current framework is designed with some flexibility which allows manufacturers to trade ZEV credits among themselves as well as either borrow from or credit their sales against future targets.

The news comes as Ford announced 800 job cuts in the UK and Jaguar’s latest rebrand is met with a mixed reception. Global EV sales hit their second consecutive month of record figures in October with two out of three purchases happening in China.

Login to comment

Comments

No comments have been made yet.