Interest in brand new cars remains strong even though retail registrations may be softening, according to Auto Trader which has recorded a 28.5% year-on-year (YoY) increase in visits to its new car platform in June.

This is a significant rise from the 22% and 21% growth recorded in May and April, respectively, and marks the largest YoY increase in over two years.

This demand is driven by a combination of increased choice and improving affordability, as brands respond to new regulatory targets, growing competition, increased production, and stalling retail sales.

Interest in brand new cars remains strong even though retail registrations may be softening, according to Auto Trader which has recorded a 28.5% year-on-year (YoY) increase in visits to its new car platform in June.

This is a significant rise from the 22% and 21% growth recorded in May and April, respectively, and marks the largest YoY increase in over two years.

This demand is driven by a combination of increased choice and improving affordability, as brands respond to new regulatory targets, growing competition, increased production, and stalling retail sales.

As more brands and retailers release more cars, Auto Trader said it is seeing a significant increase in the volume of new cars advertised on its platform. In May, the volume grew 8% compared to April, and in the first two weeks of June alone, new car stock levels on Auto Trader have risen over 21% versus January.

While baseline RRPs continue to rise, car buyers are benefitting from a reduction in overall prices, with over half (53%) of all new car models advertised on Auto Trader showing a gradual price reduction over the past 12 months.

Since June last year, average discounts have risen from 6.4% to 8.8%, with nearly eight in ten new cars now offering some level of discount. Moreover, seven in ten new cars have finance offers applied.

BYD scores winning goal at Euros

Tracking broader long-term trends in the new car market, Auto Trader’s data, also shows immediate market trends such as the impact of Chinese manufacturer BYD sponsorship of the 2024 Euros.

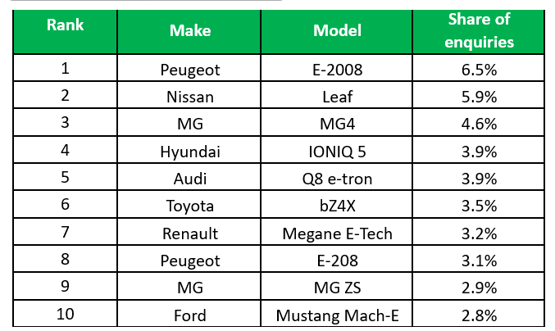

During the opening weekend, the all-electric Chinese brand saw a 69% rise in advert views of its new models on Auto Trader compared to the previous week. As of June 21, views have softened slightly but remain over 53% higher than before the tournament began. The Seal is now the second most viewed new EV model, just behind Hyundai’s IONIQ 5.

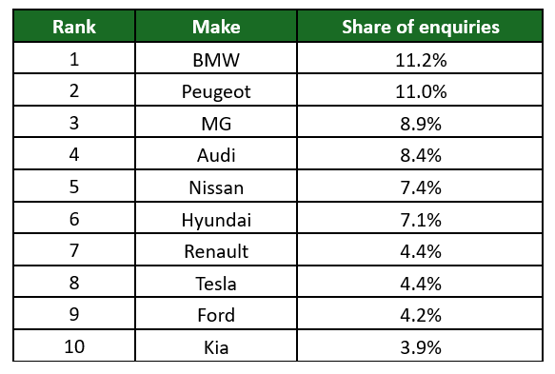

It noted that ahead of the tournament, BYD had already risen to the fifth most popular new electric brand, accounting for a 5.6% share of all new EV advert views. Since the tournament began on the 14th, BYD has risen to 2nd place, behind BMW but ahead of Tesla in 4th.

BYD is currently converting a smaller share of leads (2.9%) although with three weeks of the tournament left and a dedicated brand store on Auto Trader, it said the conversion rate gap is likely to close quickly as awareness builds.

BMW is June’s most in-demand marque

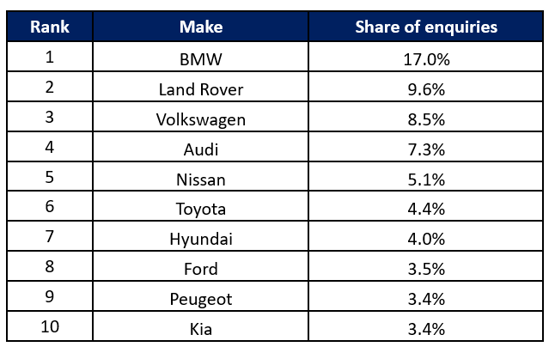

BYD is gaining traction but still has a long way to go to surpass the current most in-demand electric marque. So far this month, BMW is the UK’s hottest new car brand for both electric and all fuel types combined. Based solely on its EV range, BMW accounted for an 11.2% share of all new electric car enquiries in June. When considering all fuel types, BMW accounts for 17% of all new car enquiries sent to retailers on Auto Trader, far ahead of Land Rover in second place with a 9.6% share.

Golf takes the top spot

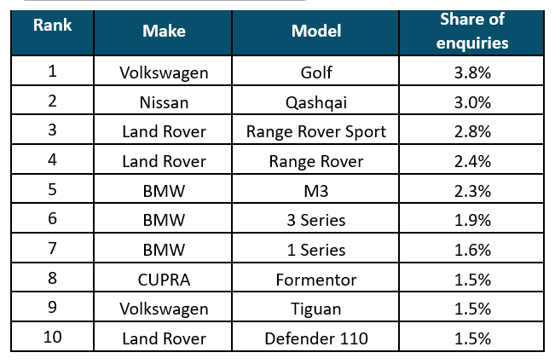

At a model level, there’s been a change. After three months as the UK’s most in-demand new car (based on all fuel types), the Defender 110 recorded the largest drop in lead share in June (down 2.5%), causing the SUV to slip from 1st to 10th place. It has been replaced by the equally iconic Golf, which in May was the third most popular new car on Auto Trader.

Commenting on the data, Auto Trader’s new car performance director, Bex Kennett, said: “The new car market continues to see flatlining retail sales, but contrary to what the headline figures may suggest, consumer interest in new cars remains robust. What we’re seeing on our platform is more retailers and brands looking to convert that interest into leads by offering more choice, better deals, and investing more in their digital showrooms.

“Looking ahead, we can expect the market to respond positively to recent economic green shoots, with consumer confidence rising in the wake of falling inflation and anticipation of further tax cuts. There may be some disruption over the coming weeks with the General Election and the Euros, albeit clearly not for BYD, but any impact on car behaviour will be short-lived.”

Most in demand new car MODELS on Auto Trader in June[2] ranked by enquiries/leads – all fuel types

Most in demand new car BRANDS on Auto Trader in June ranked by enquiries/leads – all fuel types

Most in demand new car electric models on Auto Trader in June ranked by enquiries/leads

Most in demand new car brands (electric only on Auto Trader in June ranked by enquiries/leads

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.