New research from automotive performance marketing agency UpShift highlights the significant rise of Chinese electric vehicle (EV) manufacturers in the UK’s search habits.

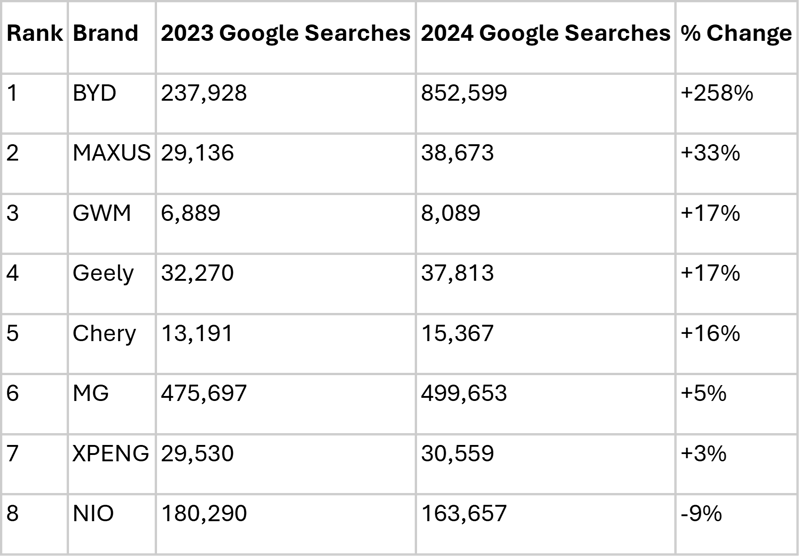

Brands like BYD have experienced substantial growth, with a 258% increase in search volume and 191% growth in Google Trends, indicating a shift in consumer interest toward Chinese-manufactured EVs. Other brands such as Maxus (vans) and Great Wall Motors (GWM) also show positive growth.

While Chinese EVs have generated significant interest, the demand for Chinese hybrids does not correlate with growth in search data, likely due to limited awareness and exposure among consumers. Despite MG’s strong presence and leadership in the hybrid segment, its search growth is surprisingly low when compared to other Chinese brands.

Ian McIntosh, CEO of UpShift, offers insights on the importance of tracking search trends in the evolving EV market: “The surge in search interest for Chinese EV brands signals a major transformation in the automotive market. Legacy manufacturers can no longer rely on past momentum, as consumer focus is rapidly shifting toward new players who are resonating with their needs. This data highlights the importance of tracking and adapting to search behaviours.”

The search volume data shows strong growth for Chinese EV brands like Maxus (33%), GWM and Geely (17%), and Chery (16%), with BYD leading at a 258% increase.

The search volume data shows strong growth for Chinese EV brands like Maxus (33%), GWM and Geely (17%), and Chery (16%), with BYD leading at a 258% increase.

This growth reflects the expanding presence of Chinese automakers, gaining traction due to competitive pricing and innovative EV offerings that appeal to consumers and businesses. MG, with a 5% increase in search volume, shows steady interest in its EV models, maintaining its position in the market.

MG dominates search interest for hybrid vehicles, with the MG3 Hybrid leading at 5,000 monthly searches. Alternatively, Chinese hybrid models entering the market lag significantly behind established players like MG, which received 499,653 searches in 2024, suggesting a gap in consumer familiarity or preference for hybrids from newer entrants.

Uplift said the dominance of MG in this space is somewhat unexpected, given the broader rise of Chinese EV manufacturers, but it reflects MG’s longstanding presence and established reputation in the hybrid market. This suggests that while Chinese EVs are rapidly gaining traction, their hybrid offerings still face hurdles in competing with more established names.

EV brands like Polestar grew by 21% in search volume, reaching 1,051,056 searches, despite a 49% drop in online visibility, showing solid interest in its EVs. Tesla, though still dominant, had only a 2% increase in branded search volume, reaching 3,566,657 last year, alongside a sharp 98% drop in visibility.

McIntosh said: “Businesses that embrace these changes will remain competitive and seize opportunities to lead the way or at least dominate online visibility. For dealerships and manufacturers alike, staying proactive in understanding these shifts is no longer optional, it’s essential for long-term success.”

Login to comment

Comments

No comments have been made yet.