Manufacturers are set to spend at least £2 billion on discounting electric vehicles (EV) this year in a desperate attempt to stimulate demand, according to the Society of Motor Manufacturers and Traders (SMMT).

September new car sales figure reveal that EV uptake among private buyers remains weak. Private battery electric vehicle (BEV) sales rose just 3.6%, translating to only 410 additional registrations, despite heavy discounting. The year-to-date figures show private BEV demand is down -6.3%.

Manufacturers are set to spend at least £2 billion on discounting electric vehicles (EV) this year in a desperate attempt to stimulate demand, according to the Society of Motor Manufacturers and Traders (SMMT).

September new car sales figure reveal that EV uptake among private buyers remains weak. Private battery electric vehicle (BEV) sales rose just 3.6%, translating to only 410 additional registrations, despite heavy discounting. The year-to-date figures show private BEV demand is down -6.3%.

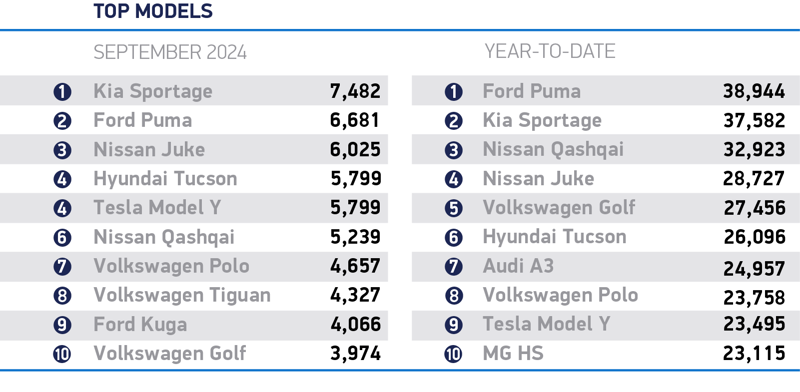

Even so, the EV market did hit a new high. BEV registrations increased by 24.4%, with over 56,000 units sold in September, achieving a market share of 20.5%.

Even so, the EV market did hit a new high. BEV registrations increased by 24.4%, with over 56,000 units sold in September, achieving a market share of 20.5%.

According to the SMMT, the £2 billion it estimates is spent on supporting EV sales threatens the viability of the sector at a time when car makers are facing rising production costs, expensive raw materials and low consumer confidence in the UK’s charging infrastructure.

That figure is based on average discount reported by Auto Trader on BEVs in September of 12.1% as proportion of average retail price of a new BEV (£49,600, based on JATO data) multiplied by SMMT’s full year BEV market outlook of 364,000 units - although this does not include finance offers or incentives given to large fleets.

Mike Hawes, SMMT chief executive, said: “September’s record EV performance is good news, but look under the bonnet and there are serious concerns as the market is not growing quickly enough to meet mandated targets.

“Despite manufacturers spending billions on both product and market support – support that the industry cannot sustain indefinitely – market weakness is putting environmental ambitions at risk and jeopardising future investment.”

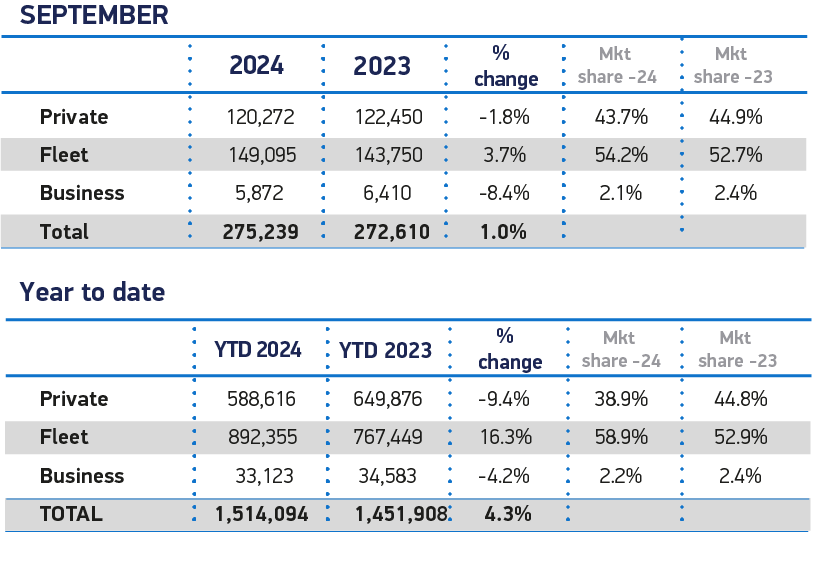

Reporting an overall 1.0% rise in September, with 275,239 new vehicles registered, the SMMT points out that while this uptick marks the best September since 2020, it remains nearly 20% below pre-Covid levels.

Fleet sales drove the growth, surging by 3.7% to account for over half of the market, but private consumer demand fell by -1.8%. More alarmingly, business sales plummeted by -8.4%, reflecting deep-rooted economic uncertainty across the sector.

Fleet sales drove the growth, surging by 3.7% to account for over half of the market, but private consumer demand fell by -1.8%. More alarmingly, business sales plummeted by -8.4%, reflecting deep-rooted economic uncertainty across the sector.

To salvage the transition to electric, SMMT and major manufacturers are calling on the government to take bold action.

Their proposals include halving VAT on new EVs, scrapping the upcoming ‘expensive car’ tax for zero-emission vehicles (ZEVs), and matching VAT on public charging with the home charging rate. They also advocate for stronger business incentives, including maintaining the Benefit in Kind scheme and the Plug-in Van Grant.

Without urgent government intervention, they warn that the EV revolution risks stalling, jeopardising both the UK’s environmental goals and the long-term sustainability of the industry.

“While we appreciate the pressures on the public purse, the Chancellor must use the forthcoming Budget to introduce bold measures on consumer support and infrastructure to get the transition back on track, and with it the economic growth and environmental benefits we all crave,” said Hawes.

Ian Plummer, commercial director at Auto Trader, commenting on today’s SMMT figures, said: “Electric vehicle sales surged in September to claim a 20%-plus share of the market, in the key plate-change month for the industry, but it still won’t be enough for many manufacturers to hit sales targets under the Zero Emissions Vehicle mandate.

“Record discounts are driving the interest as brands and retailers do all they can to stimulate sales, showing once again just how sensitive the market is to financial incentives, and the importance of overcoming the current EV cost barrier.

“These efforts are also reflected in the strongest interest in new EVs on our platform for more than two years, a good sign that the remaining months of 2024 should also see strong new EV sales. That said, there’s still much to do to drive further levels of interest and actual sales - and discounts can only last so long.”

Philip Nothard, insight director, Cox Automotive, added: "The 2024 figures are essentially set, but the focus shifts to the potential challenges in 2025. The market may face further disruption if current dynamics persist, including heavy reliance on discounts and weak private EV demand. Structural changes and more substantial incentives will be crucial to ensure sustainable growth moving forward."

Philip Nothard, insight director, Cox Automotive, added: "The 2024 figures are essentially set, but the focus shifts to the potential challenges in 2025. The market may face further disruption if current dynamics persist, including heavy reliance on discounts and weak private EV demand. Structural changes and more substantial incentives will be crucial to ensure sustainable growth moving forward."

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), commenting, said: “The upcoming Autumn Budget, set for the end of the month, will be the first under a Labour government since 2010, providing a vital opportunity to outline its vision for the future of the sector. NFDA submitted its Budget proposal to the Chancellor last month with growth, restimulation and clarity being key themes. This included measures such as harmonising VAT between public and domestic charging to 5% to incentivise consumers to electric."

She added that NFDA conducted a flash survey of members this week in which 94% of respondents cited they were either ‘extremely pessimistic’ or ‘pessimistic’ that the government is hearing the issues the automotive industry is facing.

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.