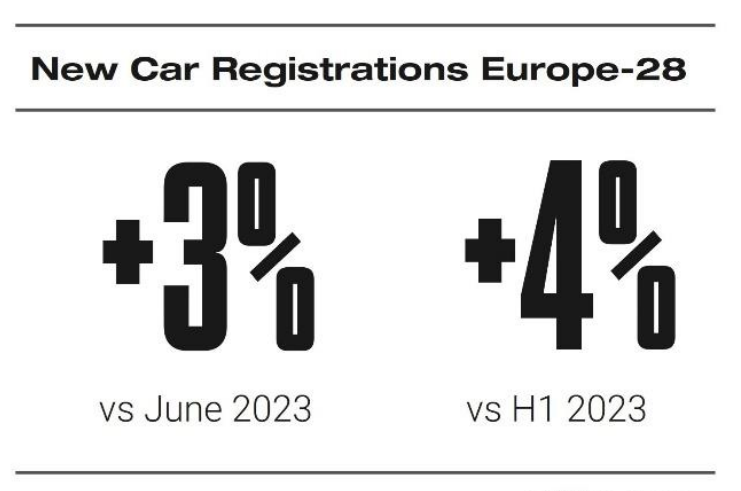

Despite positive overall results for new car registrations in the first half of 2024, there are worrying signs of slowing growth, according to JATO Dynamics first-half analysis of new passenger car registrations in 28 European countries

Registrations increased by just 4.4% from January to June, rising from 6,559,213 units in H1 2023 to 6,847,842 units in H1 2024.

Felipe Munoz, global analyst at JATO Dynamics, said: “Europe's growth is becoming more moderate and remains far from pre-pandemic levels. This is due to a more complex operating environment, including stricter emissions regulations, rising vehicle prices, and challenges in electric vehicle (EV) adoption.

Despite positive overall results for new car registrations in the first half of 2024, there are worrying signs of slowing growth, according to JATO Dynamics first-half analysis of new passenger car registrations in 28 European countries

Registrations increased by just 4.4% from January to June, rising from 6,559,213 units in H1 2023 to 6,847,842 units in H1 2024.

Felipe Munoz, global analyst at JATO Dynamics, said: “Europe's growth is becoming more moderate and remains far from pre-pandemic levels. This is due to a more complex operating environment, including stricter emissions regulations, rising vehicle prices, and challenges in electric vehicle (EV) adoption.

“Since the semiconductor shortage, EVs have been the main growth driver. It is crucial for the industry to address uncertainties in the EV market, such as the impact of EU tariffs on imported electric cars from China on vehicle affordability.”

Growth in Chinese EVs

In the first half of 2024, registrations of electric cars from Chinese brands totalled 70,000 units, marking a 26% increase compared to H1 2023. Their market share for BEVs also increased from 5.97% to 7.37%. This was the third largest increase in market share among all car groups, following Volvo-Polestar (+2.9 points) and BMW Group (+2.2 points).

Munoz, commenting, said: “EU tariffs on BEV imports from China target models that accounted for 17% of BEV registrations in Europe during H1 2024, excluding potential units imported by Tesla.

“Notably, the Volvo EX30 and the MG4, both made in China, were among the top registered electric cars in Europe during this period. Without the competitive prices from China, consumers could face higher prices, potentially reducing demand in the coming months.”

BMW and Chinese OEMs Leading Charge

In H1 2024, the European BEV market was led by the Volkswagen Group with 178,000 units, although this represented a 14% decrease from H1 2023. The brand saw a 24% drop, while Porsche experienced a 55% decline. Despite updates to the Volkswagen ID.3 and ID.4, their age (nearly 5 and 4 years old, respectively) has made it challenging to attract new customers.

In contrast, BMW Group and Chinese OEMs saw significant growth in the first half of 2024. BMW Group's market share increased to nearly 10%, up from 7.5% in H1 2023, driven by strong sales of models like the BMW iX1, i4, i5, iX2, and Mini Countryman. BMW registered more electric cars than the Volkswagen brand during this period.

Geely Group, which owns Volvo, Polestar, and Lotus, increased its BEV registrations by 52% compared to H1 2023, surpassing Hyundai-Kia, Mercedes, and Renault Group. BYD saw registrations of 17,000 electric cars, 14,000 more than in H1 2023, allowing it to outsell brands like Nissan, Smart, Toyota, Polestar, and others.

Xpeng, Great Wall Motors, Zeekr, Hongqi, and Voyah also reported significant increases in their BEV registrations.

Munoz said: “The intense domestic competition in China drives their extraordinary progress. However, market saturation, oversupply, and price wars mean overseas expansion is critical for growth.”

Tesla's Deceleration

Tesla, after years of continuous growth, is showing signs of slowing. Registrations in Europe fell from 185,200 units in H1 2023 to 161,600 units in H1 2024.

Munoz explained: “Tesla's limited product line, increasing competition from other brands, and the diminishing impact of price cuts due to more competitively priced Chinese vehicles are contributing factors.”

While the Tesla Model Y and Model 3 continued to lead the European BEV rankings, the Model Y fell from the top position to the 8th overall, and its deepest drop was from first to 73rd. The facelifted Model 3 saw a 37% increase, but its growth might be constrained by European consumers' modest appetite for sedans.

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.