The overall new car market growth of 6.0% YTD is broadly in line with expectations. While it is encouraging that the first half of 2024 breached the one million car registrations benchmark, nevertheless the market is still down 20.7% on the same period of 2019.

Within the market, there has been a lot more turmoil than the overall growth figure would suggest, writes David Francis.

Retail sales fell by 12.0% YTD, which is unsurprising given the low levels of consumer confidence. Currently consumer confidence is -12, (i.e. the number of people who are pessimistic outnumber those who are optimistic by 12 percentage points).

The overall new car market growth of 6.0% YTD is broadly in line with expectations. While it is encouraging that the first half of 2024 breached the one million car registrations benchmark, nevertheless the market is still down 20.7% on the same period of 2019.

Within the market, there has been a lot more turmoil than the overall growth figure would suggest, writes David Francis.

Retail sales fell by 12.0% YTD, which is unsurprising given the low levels of consumer confidence. Currently consumer confidence is -12, (i.e. the number of people who are pessimistic outnumber those who are optimistic by 12 percentage points).

It will be interesting to see if confidence improves with the new government.

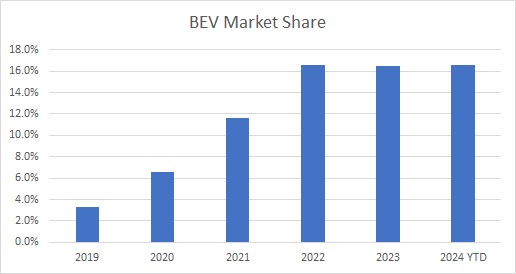

Something else the new government will be watching is the proportion of sales taken by BEVs. In the first half of the year, it crept up from 16.1% to 16.6%, which is still miles away from the government’s mandate of 22% for 2024.

It seems pretty clear that private buyers are currently about as interested as swapping petrol for BEV as a child is interested in swapping chocolate for sprouts. BEV retail sales fell by 10.8% YTD, with the BEV share of overall retail sales struggling to reach 10%.

It seems pretty clear that private buyers are currently about as interested as swapping petrol for BEV as a child is interested in swapping chocolate for sprouts. BEV retail sales fell by 10.8% YTD, with the BEV share of overall retail sales struggling to reach 10%.

It should be noted that car companies do not necessarily have to hit exactly 22% this year. They can “borrow” BEV sales from future years – effectively promising to sell more BEVs in 2025 or 2026. However, this is like an overdraft – it carries interest, and will be a nightmare if the car companies don’t overperform in the following two years.

Manufacturers can also buy credits from companies selling more than the target proportion of BEVs (for example, Tesla is currently earning £2.7 billion a year globally from regulatory credits).

It will deeply ironic if UK manufacturers have to buy BEV credits from Chinese BEV manufacturers (effectively handing over cash to China), just as European governments are planning tariffs on Chinese BEVs to protect European car companies.

If they are going to avoid fines of £15,000, or big payments to competitors, most car companies do need to get close to that 22% target this year – something which is looking very difficult for most of them. The other solution would be to do what car companies hate most: deliberately throttle back (excuse the pun) the sales of petrol models, in order to maintain their BEV share.

Car bosses would be absolutely furious with the British Government if that happens – it is no coincidence that that Stellantis has publicly threatened to close Luton and Ellesmere Port if government policy does not change

While the BEV mandate is hardly the only unexploded timebomb faced by the new government, it is something they are going to have to address. They are extremely keen to increase investment from global car companies, and making the UK a less profitable place to sell cars will not help achieve that goal.

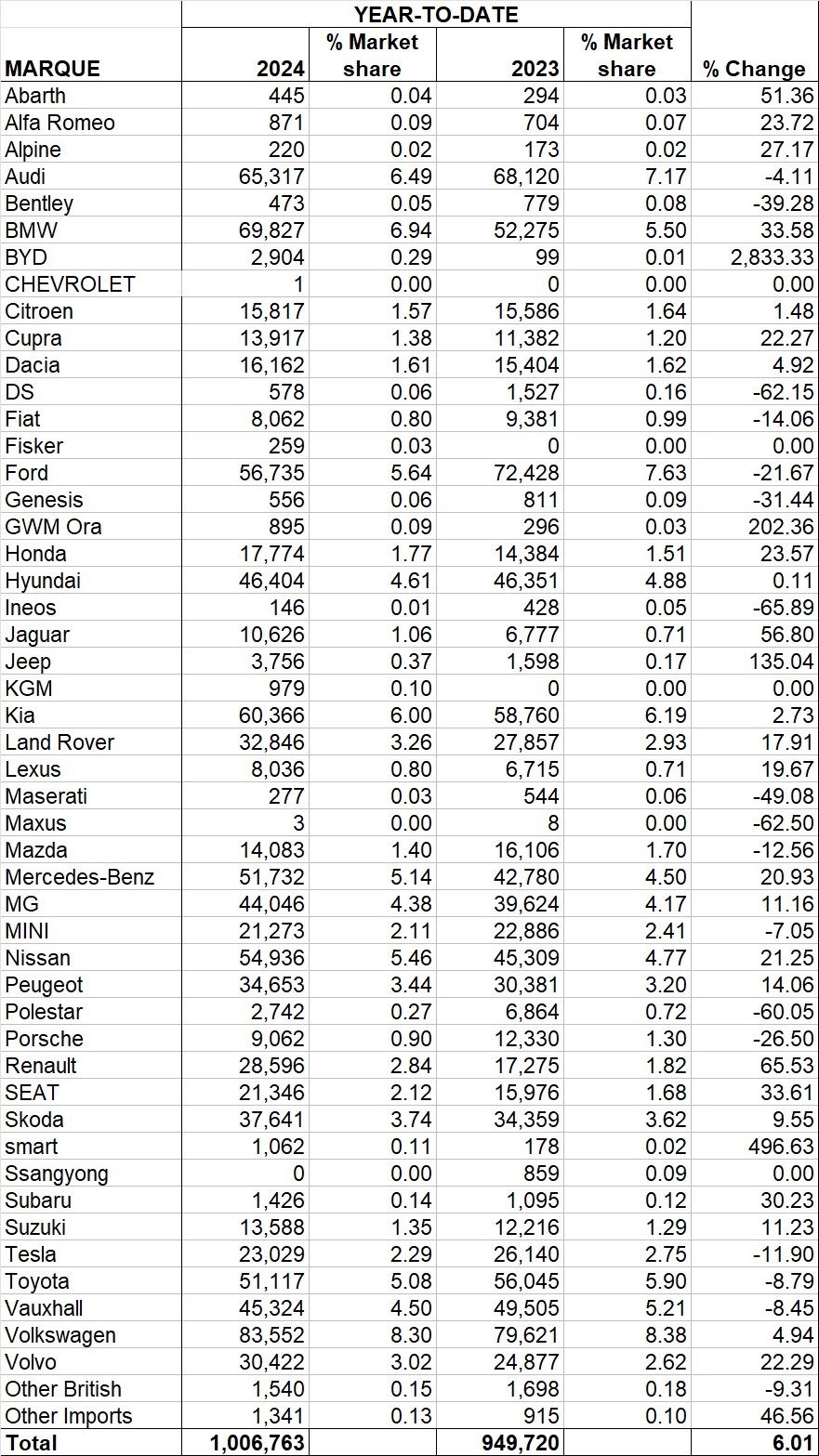

Meanwhile, back at the manufacturer level, it would be fair to say that “British” marques are struggling to take back control. The top three places are taken by German brands, with Kia in fourth and Ford in fifth place.

Meanwhile, back at the manufacturer level, it would be fair to say that “British” marques are struggling to take back control. The top three places are taken by German brands, with Kia in fourth and Ford in fifth place.

Ford managed to stay in first place in the UK from 1977 to 2020, but only managed to hold on to second place for two years. The new VW-based Explorer and Capri might help a bit, but then the Focus is being dropped next year.

The new electric models face a mountain to climb if Ford is going to get back to a podium position.

The other traditional British brand, Vauxhall, is only just managing to stay in the Top 10. The Corsa is doing well, as the leading supermini hatchback, but that means far less than it did 10 years ago.

The Mokka has fallen to fifth place in the much more important supermini crossover category.

Amongst, the mid-table brands (those with between 1% and 4%), the biggest increase has come from Renault. Its sales are up 66.5% YTD thanks to better sales of the Clio and Captur, but historically Renault sales have been as volatile as a Parisian taxi driver, so it is too early to say if a structural improvement is underway.

The one part of the Renault group that has been surprisingly stable is Dacia, with a market share of 1.6%.

That is not terrible, but it is way off what the company achieves in the rest of Europe: Dacia has an overall European market share of 4.6%, while the Dacia Sendero is Europe’s best-selling model YTD.

Amongst the smaller brands, the two most notable performances came from Polestar and DS – but not in a good way. UK Polestar registrations fell by 60.0% YTD (and by 27.6% globally).

Amongst the smaller brands, the two most notable performances came from Polestar and DS – but not in a good way. UK Polestar registrations fell by 60.0% YTD (and by 27.6% globally).

When Volvo said earlier this year that it had handed responsibility for Polestar to Geely, Volvo’s shares shot up by 30% on the announcement. That suggests investors are deeply sceptical about Polestar’s future. Meanwhile, DS sales are down by 62% to just 578 units YTD – once you strip out demonstrators, management cars etc, that does not leave many actual DS customers.

At a segment level, the market is continuing to consolidate around the C-segment (what we used to call the Focus segment, but should now call the Qashqai or Sportage segment).

It is taking a record 39.0% market share, of which 58% are crossovers. It is taking some sales from the B-segment (30.3%), which in turn is taking share from the badly-wounded A-segment (down to just 2.7%).

Looking forward, there is little sign of much overall growth. The SMMT is predicting 2024 registrations of 1.98 million, rising to 2.05 million in 2025.

More significantly, it has reduced its 2024 BEV forecast from 21% to 19.8%.

The big question is how that target will be reached – after all, almost any single target can be reached if you choose to ignore the consequences. It will be fascinating to see how the industry boosts its BEV share in the second half of the year – and how much collateral damage will be inflicted.

Login to continue reading

Or register with AM-online to keep up to date with the latest UK automotive retail industry news and insight.

Login to comment

Comments

No comments have been made yet.